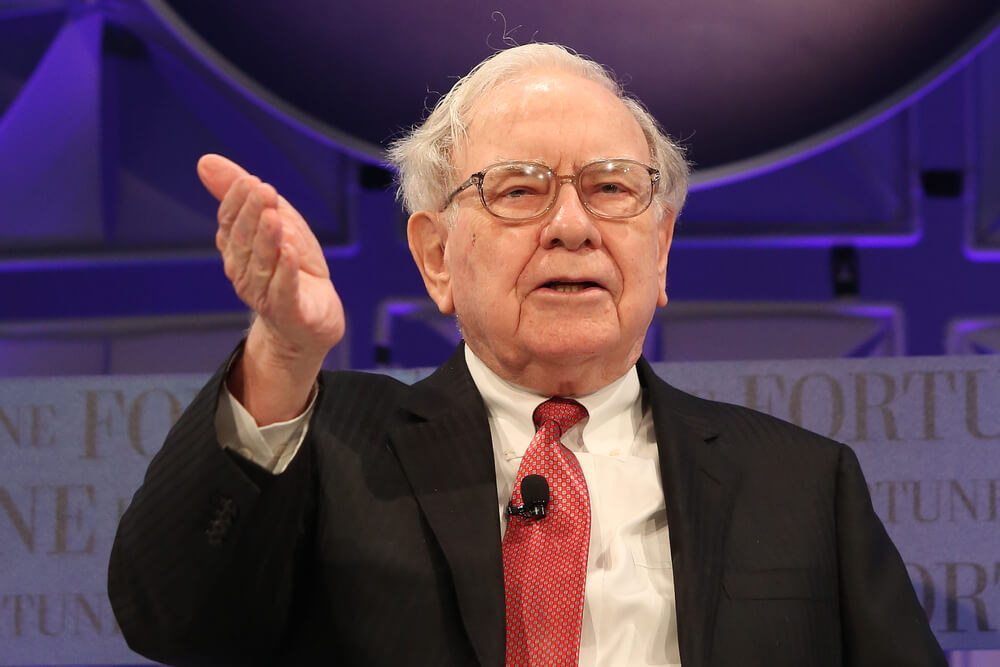

Leave it to Warren Buffett to keep us all guessing.

Earlier in August, the Oracle of Omaha shocked us all by initiating a new position in large-cap miner Barrick Gold Corp. (NYSE: GOLD). Now, he’s doing it again by making investments in Japan.

Buffett’s company, Berkshire Hathaway Inc. (NYSE: BRK.B), just invested about $6 billion in five Japanese conglomerates:

- Itochu Corp.

- Marubeni Corp.

- Mitsubishi Corp.

- Mitsui & Co.

- And Sumitomo Corp.

Berkshire now owns more than 5% of each of these companies, making it a major shareholder.

Now, $6 billion is a drop in the bucket for Buffett. At the end of June, Berkshire Hathaway had $146 billion in cash on hand. But taken collectively, the five Japanese companies would be tied with Wells Fargo as Buffett’s seventh-largest position. And a 5% ownership interest means Buffett is making a commitment to hold for a while.

Buffett has been mum about his reasons for loading up on Japanese companies. And we don’t know if Buffett or one of his lieutenants executed the trade. But we can speculate.

Why Is Warren Buffett Investing in Japan?

All About Value

To start, this is not Buffett’s first foray overseas. Buffett is one of American capitalism’s biggest cheerleaders. And he has repeatedly said that most investors should stick with U.S. equities. But Berkshire has invested in Chinese, Indian and Israeli stocks in the past.

Furthermore, while Berkshire’s portfolio includes American mega-caps like Apple, the Oracle thinks the American market is pricey. There’s a reason Berkshire is sitting on a $146 billion cash hoard.

So, with slim pickings at home, Buffett is nibbling overseas. The U.S. sports a cyclically-adjusted price-to-earnings ratio (CAPE) of 30, making it the most expensive major market in the world by a country mile. (The CAPE compares stock prices today to a 10-year average of earnings.)

Japan’s CAPE is much more modest, at 18. Buffett has never specifically said that he follows the CAPE, though his mentor Benjamin Graham used a similar metric.

Inflation Trade?

Again, Buffett has been quiet about his investment strategy of late. But we can draw some conclusions.

Buffett’s purchase of Barrick Gold suggests that the Oracle is at least a little worried about inflation or dollar devaluation on the horizon.

He also made a $4 billion purchase of Dominion Energy’s natural gas pipelines and storage assets earlier this summer. That suggests Buffett is tiling Berkshire’s portfolio to more inflation-sensitive sectors.

Perhaps the same thoughts are behind the Japanese purchases. In typical Japanese corporate style, the companies are conglomerates with a random assortment of businesses. But they all have major stakes in raw materials.

There is no dogma of Buffett infallibility. The Oracle has made plenty of mistakes over his career. And he’d be the first to tell you about them.

But Buffett is right more often than he is wrong. So if it looks like Berkshire Hathaway is positioning for inflation ahead, we’d be wise to do the same.

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.