Warren Buffett and Berkshire Hathaway turned some heads Friday after revealing the company was selling off a chunk of its stake in two major U.S. airlines, but is Buffett selling Delta stock a big deal?

“The obvious reason for the sale is Berkshire owned more than 10% of each company, a threshold Buffett said he didn’t want to go over.”

An April 3 filing from the Securities and Exchange Commission revealed Berkshire Hathaway Inc. (NYSE: BRK.B) had offloaded around 13 million shares of Delta Air Lines Inc. (NYSE: DAL), netting around $314 million in the sale that occurred Wednesday, April 1. Berkshire still owns 9% of outstanding Delta shares.

Berkshire also sold off 2.3 million shares of Southwest Airlines Co. (NYSE: LUV) for $74 million Thursday, April 2.

“To put this in context, the sale of Southwest reduced his position by 4%, leaving a stake of $1.5 billion, or 51 million shares,” Banyan Hill Publishing’s Charles Mizrahi said. “Buffett sold off around 18% of Delta, and still owns 59 million shares.”

These filings were required to be disclosed shortly after the sale because Berkshire held at least a 10% stake in each company, and it’s clear that Buffett still owns a massive amount of Delta and Southwest stock.

Why Is Buffett Selling Delta Stock?

Banyan Hill’s Charles Mizrahi

Mizrahi, Editor of Alpha Investor, which reveals mispriced opportunities and hidden gems in the markets, thinks having too large of a stake was part of the reason for Buffett selling Delta stock.

“The obvious reason for the sale is Berkshire owned more than 10% of each company, a threshold Buffett said he didn’t want to go over,” Mizrahi said. “He went over the 10% Delta position due to the company’s share buybacks.”

The sale comes just a couple of weeks after Buffett told Yahoo Finance it would not be selling off airline stocks despite the recent toll the COVID-19 pandemic has taken on the airline industry. And Berkshire actually increased its stake in Delta on Feb. 27.

“It’s possible that he is doing an about face, but highly unlikely,” Mizrahi said. “We’ll have to wait until the next quarterly filings to see if the Delta sale was anything more than house cleaning.”

Even so, it’s pretty clear that Delta and other airlines are struggling, as Bloomberg recently estimated that as much as two-thirds of the global population is staying home to help stop the spread of the novel coronavirus.

Delta CEO Ed Bastian revealed just how bad the company has been hit, saying the first quarter of 2020 “was unlike any quarter in Delta’s history” in an April 3 memo to employees. Here are some of the shocking numbers, per the memo:

- On March 28, Delta carried 38,000 customers, in comparison to a daily average of around 600,000 in late March in the previous year.

- Delta is burning $60 million in cash every day.

- A total of 115,000 flights were canceled in March, which accounted for approximately 80% of the total scheduled flights for the month.

The airline is expected to report Q1 earnings Wednesday, and the numbers will likely be rough. But like Mizrahi said, we’ll have to wait and see if Buffett selling Delta stock was anything more than shoring up his exposure to the company.

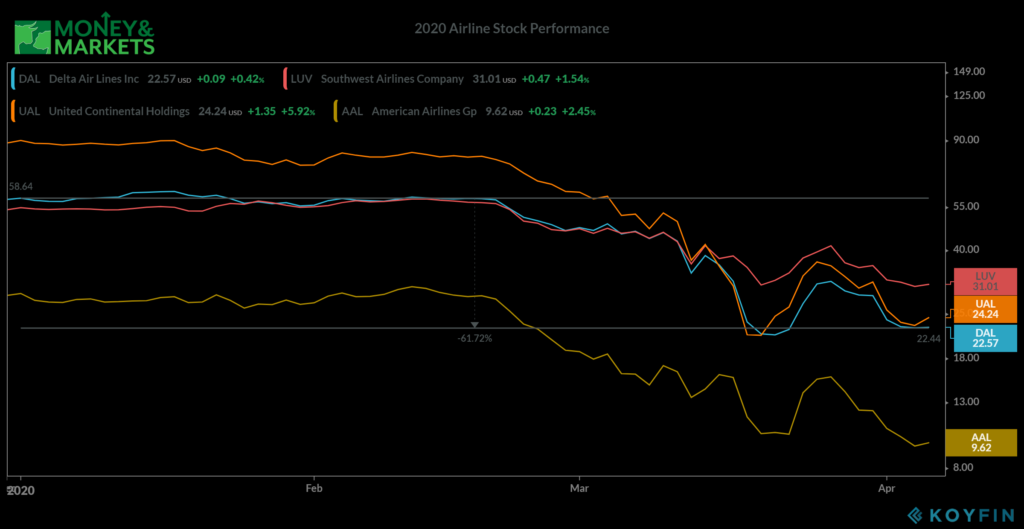

Delta’s stock value has plummeted over 60% since the beginning of the year, and it could get hammered even more as the company is projecting another $10 billion revenue hit in the second quarter, which is an 80% year-over-year decline, according to Yahoo Finance.

While the stock will most likely take another hit after the Q1 earnings drop, the long-term prospects for Delta and many of these other major airlines are still good.

Travel will likely return to normal once the impacts of the COVID-19 outbreak are in the past, so if you are looking for an investing opportunity, it may be best to wait this thing out a bit longer and look for a possible buying opportunity down the road.