Economists in the government often revise the data they use. This makes sense. Economic changes necessitate it.

For example, we no longer need data on the number of horse-drawn carriages in New York City. But the number of cars crossing bridges to enter the city is an important economic indicator.

Of course, not all changes will be that logical. Economists often change inflation indexes. Some of the changes are due to technology. Other changes are due to quality adjustments or consumer behavior. Economists can always explain the need for the changes.

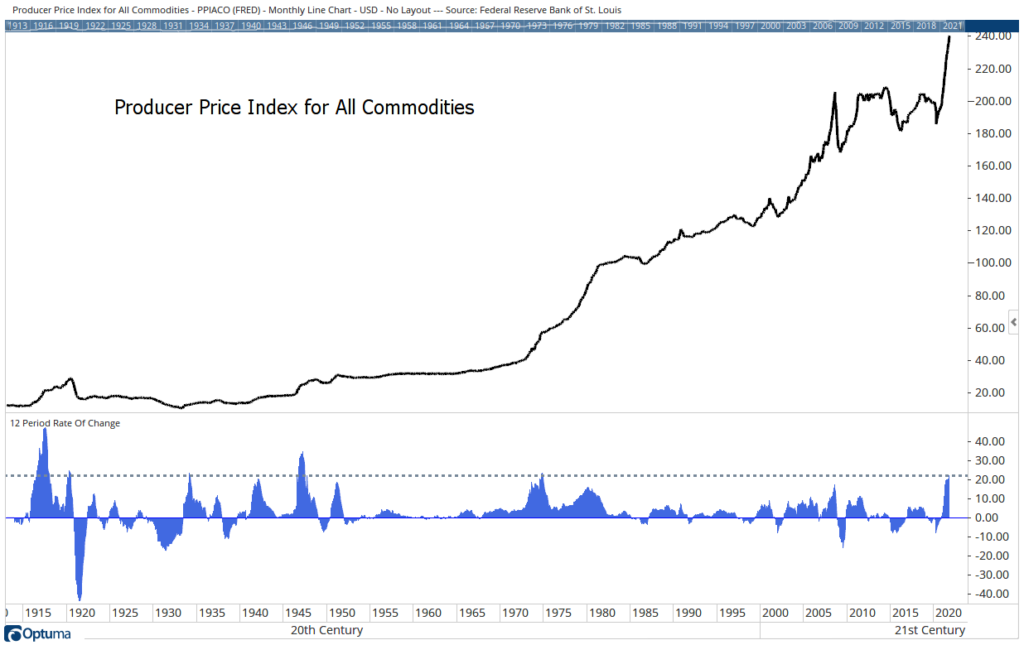

But when reviewing the state of the economy, it’s helpful to look at the longest data series available. For inflation, we can consider the Producer Price Index for all commodities, a data series that extends back to January 1914.

The most recent report shows this index is up 22.2% in the past 12 months. That’s much higher than the 8.6% jump in the Producer Price Index that was reported. That number is the Producer Price Index by Commodity: Final Demand. The history of that series only extends to November 2011.

Pandemic Inflation Mirrors That of Wartime

Using the commodities index, the chart below shows inflation is at levels previously seen in wartime.

Source: Optuma.

Inflation has only been this high two other times since 1914 — during the two world wars.

The wars destroyed the industrial bases of major economies. After the wars, combatants needed to rebuild. As rebuilding continued, new supplies of commodities entered the market, and higher supply led to lower prices.

Wartime inflation and a subsequent decline in prices had been the natural cycle of inflation for centuries.

Now, prices rose as the government declared war on the coronavirus. But there is no obvious way to create new supplies of goods as there was after war destroyed property around the world.

This time is different, and there is no clear solution to inflation.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.