One of my sons is an automotive technician for a local car dealership.

He does everything from engine work to oil changes.

Recently, he told me how they discard old oil from cars.

Instead of dumping oil into a drum, they vacuum it out into tanks for a different company to pick up.

It reduces spillage and makes it easier to dispose of hazardous used oil.

That led me to discover today’s Power Stock.

Using Chief Investment Strategist Adam O’Dell’s proprietary six-factor Stock Power Ratings system, I found a “Strong Bullish” company:

-

- It’s an environmental services and waste management business in the U.S.

- The stock is only 3% off its 52-week high and showing solid upward momentum.

- It rates a perfect 100 on our system.

Here’s why the waste management stock I’m sharing with you today will continue its strong performance in 2022 and beyond.

Waste Management Isn’t Just About Trash

When you think of waste management, the first thing that comes to mind is trash.

But the industry is so much more than that.

Waste management also deals with hazardous and industrial materials — which make up the largest share of the market by revenue:

Allied Market Research expects the industry to grow to $2.48 billion by 2030. That’s a 54% increase from 2020!

Bottom line: This industry’s growth is exploding … that means more profits for companies and smart investors.

HCCI Stock: Great Fundamentals and Strong Momentum

Trash collectors make up a small portion of the waste management sector.

The biggest share of the market comes from companies that clean up hazardous and industrial waste.

Heritage-Crystal Clean Inc. (Nasdaq: HCCI) specializes in cleaning both hazardous and non-hazardous waste in the U.S.

The Illinois-based company cleans up used oil, antifreeze and wastewater. It also sells recycled fuel oil and refines used oil into lubricants.

By focusing on this large part of the waste management sector, HCCI‘s revenue growth has been strong and steady:

In 2020, HCCI earned $406 million in total annual revenue.

By 2024, that number is expected to surge to $715.1 million — a 76.1% increase from 2020.

Now let’s look at this waste management stock’s recent performance:

HCCI Nears New 52-Week High

HCCI stock has enjoyed a profitable summer.

After hitting a 52-week low in June, the stock has rocketed up 45.3%. It’s now around 22% higher than it was a year ago.

HCCI is also only 3% off its 52-week high set in November. This is the “maximum momentum” we love to see in stocks.

Heritage-Crystal Clean Inc. Stock Rating

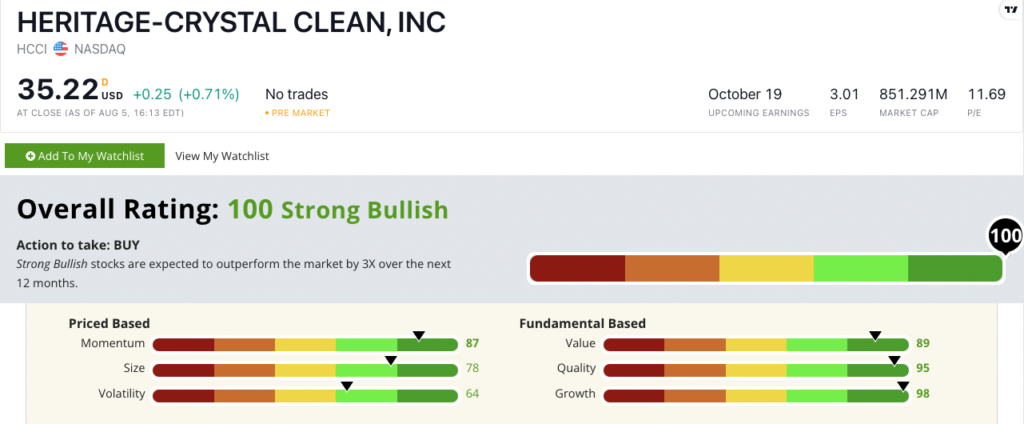

Using Adam’s six-factor Stock Power Ratings system, HCCI scores a 100 overall.

That means we’re “Strong Bullish” on this waste management stock and expect it to beat the broader market by at least three times over the next 12 months.

HCCI rates in the green on all of our six factors:

- Growth — Heritage has a one-year annual earnings-per-share growth rate of 408.3% and a sales growth rate of 27%. HCCI scores a 98 on growth.

- Quality — HCCI’s return on equity is 20.7%, compared to the waste management services industry average of negative 14.7%. It also has an operating margin of 16.4%, while its peers average negative 33.9%. HCCI scores a 95 on quality.

- Value — HCCI scores an 89 on value, with a price-to-earnings ratio of 11.7 compared to its sector peer average of 22.5. HCCI’s price-to-book value ratio is 2.2, while the waste management industry average is 5.6.

- Momentum — Since June 2022, HCCI’s stock price has risen 45.3%. It scores an 87 on momentum.

- Size — With a market cap of $851.3 million, Heritage-Crystal Clean scores a 78 on our size factor. When looking at two stocks with similar ratings on the other five factors, smaller stocks historically outperform their larger counterparts.

- Volatility — In the last 52 weeks, HCCI has rebounded off its 52-week low. It scores a 64 on volatility.

Bottom line: The global waste management industry will continue growing over the next several years.

Hazardous and industrial waste cleanup will be the biggest contributor during that expansion.

As an industry leader, HCCI is a great waste management stock to have in your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Stock Power Podcast, as well as the Marijuana Market Update. He’s also a certified Capital Markets and Securities Analyst through the Corporate Finance Institute. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.