Traders love tech stocks.

This isn’t new. Traders have always loved new technologies.

In the 1790s, they bid up prices of canal stocks in England.

The next century, railroads and telegraphs caught the attention of traders.

In the 20th century, bubbles in automobiles and radios preceded the bubbles in computers and the internet.

While we don’t look at canals or railroad lines as high tech today, they were in their day.

They required new tools to engineer and build.

Traders fought for shares as consumers marveled at the advances making life easier.

While tech has been a fascination for centuries, traders shouldn’t overlook non-tech stocks.

Don’t Ignore Non-Tech Stocks

Sometimes a company is nothing more than a different version of something that’s been around for decades.

This is easy to see with online retailers.

One example is Wayfair Inc. (NYSE: W), an online retailer of products for the home.

On its website this week, I saw there were sales on laundry baskets, couches, shoe-storage racks and many other items.

I noticed similar items on sale at Big Lots Inc. (NYSE: BIG), a non-tech company.

Parallels Between Wayfair Stock & Big Lots Stock

Big Lots offers items crowded into stores found in strip malls all across the country.

You never know what you’ll find at Big Lots, just like you never know what Wayfair will feature on its website.

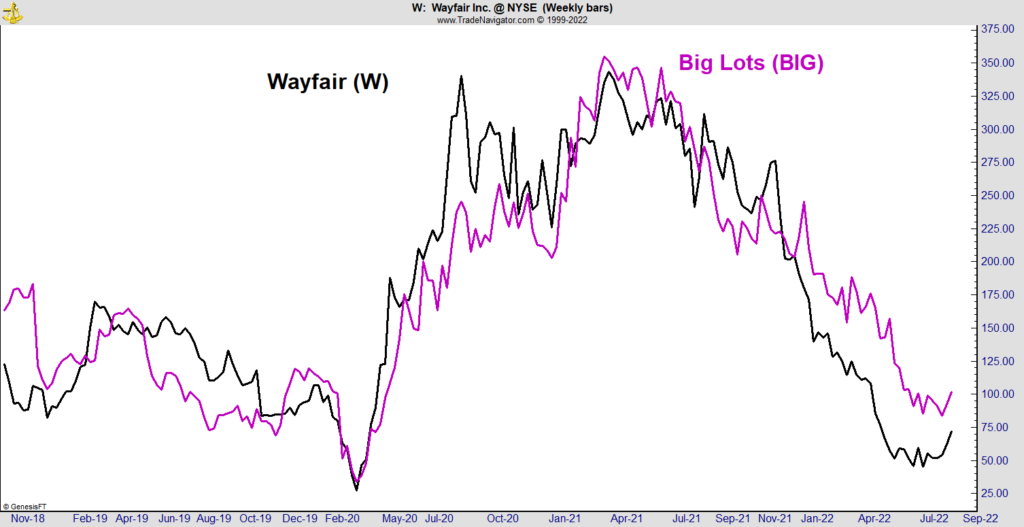

Like their business models, the two company’s stocks share a similarity. Wayfair is shown as the black line in the chart below. Big Lots is in purple.

Big Lots’ Uptrend Boosts Appeal for Non-Tech Stocks

The direction of the trends line up precisely.

In trading terms, Wayfair’s stock is just a more volatile version of Big Lots’ stock.

This is important to keep in mind.

When traders see excitement over new tech, they can always look for a less volatile option.

Bottom line: By trading options instead of the stocks, traders may be able to capture tech-like gains with the lower risk seen in brick-and-mortar stocks.

Click here to join True Options Masters.