The last five years have been wild but overall bullish for investors.

In 2018, the S&P 500 was lingering around 2,750 points.

By the following year, the market was in freefall as the world navigated shutdowns due to the COVID-19 pandemic.

Fast forward to today, and the S&P 500 has almost doubled since 2018 and is riding a new all-time high — above 5,100 points.

The momentum of the stock market is clearly bullish, and more investors are looking to ride the rally to even bigger gains.

But what's the best way to do that?

Today, I'm focused on momentum — one of the six factors of Adam O’Dell’s Green Zone Power Ratings system. I'll break down what this factor means in the stock market and run a momentum-based exchange-traded fund (ETF) through the system to see how it rates overall.

Momentum: Buy High, Sell Higher

We’ve all heard of buying the dip. This is when you buy a stock at its low point with hopes of significant returns when the stock rebounds.

The problem is you never really know when a stock hits that low point. It could trade at what you perceive as the low and then continue sinking from there.

That's why we focus on Adam’s Momentum Principle.

This means buying a stock that is already moving up with the idea that it will continue its momentum even higher.

Trading momentum is one of the best ways for investors to make money.

Here’s why:

- Momentum has a successful track record that stretches more than 200 years.

- Momentum provides stronger market-beating returns than all other strategies.

- Momentum works on all types of investments, not just stocks.

Those are the main reasons why momentum is a key component of Adam’s six-factor Green Zone Power Ratings system.

Without getting deep in the weeds, momentum uses three sub-factors:

- DMI— The Directional Movement Index, or DMI, shows the direction the price of a stock is moving.

- Up/Down Volume— This is a ratio that takes the stock’s trading volume on days when it’s up and divides it by the volume traded on days when it closes down.

- Trailing Returns— This shows how a stock performed on a historical basis. It looks back at a stock’s annualized return over a specific period of time.

These three sub-factors combine to give a stock an overall score on momentum.

But how do momentum stocks rate overall on Adam’s system?

Momentum ETF Shows Strength on Our System

To test how momentum stocks rate overall, I did what we at Money & Markets call an ETF X-ray.

I used the iShares MSCI USA Momentum Factor ETF (NYSE: MTUM), which tracks the performance of large- and mid-cap U.S. stocks with higher price momentum.

Taking all 127 stocks in the ETF, I get the average of the overall and six individual factors.

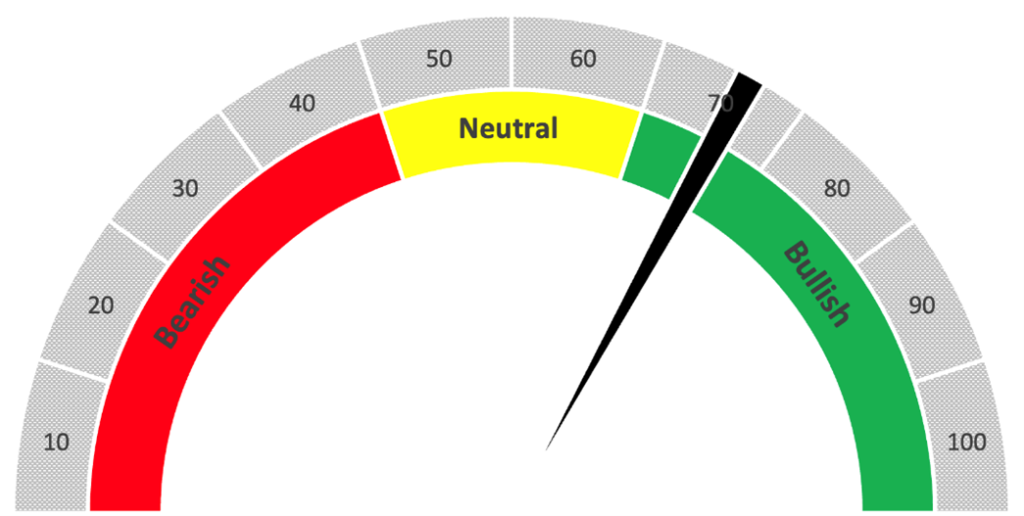

MTUM Earns 70 Overall

Overall, the stocks within MTUM earns an average “Bullish” 70 out of 100 on Adam’s Green Zone Power Ratings system. We expect stocks in this category to outperform the broader market by 2X over the next 12 months.

Conventional wisdom should tell you that MTUM is a good investment for your portfolio, but here’s something that should stand out to you: Of the 127 stocks in the ETF, 81 of them rated 70 or better.

That means single stocks are outperforming the ETF — not to mention the 46 stocks that rate lower than 70, potentially dragging the fund's performance down.

MTUM gives you good exposure to momentum stocks, but there’s a better way to capitalize on the factor.

Infinite Momentum Alert Finds the Best of the Best

ETFs get you into a specific industry, theme or individual investing factor, such as momentum.

But being more selective in the stock market gives you a greater opportunity at true market-crushing gains.

This is where Adam’s Infinite Momentum strategy comes into focus. It’s a purely systematic approach that finds the 10 highest-quality stocks with momentum that are trading at a fair value every four weeks to maximize your gains.

It’s a simple strategy that has already produced double-digit gains on multiple positions… in a matter of months.

Adam recently “refreshed” the Infinite Momentum Alert model portfolio, so now is the perfect time to get in.

Click here to see how you can join.

Until next time…

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets