Silicon Valley Bank’s collapse last week hammered financial institutions large and small.

Since last Wednesday through Monday:

- The SPDR S&P Bank ETF (NYSE: KBE), an exchange-traded fund that holds larger U.S. banks, lost 20%.

- The SPDR S&P Regional Banking ETF (NYSE: KRE), a similar regional bank fund, fell 23%.

Many bank stocks posted a solid recovery on Tuesday after the government quelled bank-run fears. But this situation put the industry under the spotlight for all the wrong reasons.

And it’s created a significant headwind in the banking industry which means several bank stocks of all sizes are ones to avoid.

I started screening stocks through Stock Power Ratings, and one big name stuck out to me: Wells Fargo & Co. (NYSE: WFC).

Let’s see why…

When 1 Bank Fails, Pressure Mounts

SIVB’s collapse sent shockwaves throughout the banking industry and the broader market.

That was exacerbated by New York’s Signature Bank (Nasdaq: SBNY) fall on Sunday alongside the earlier liquidation of Silvergate Capital Corp. (NYSE: SI).

What makes SIVB’s fall unique is that it was the 16th-largest U.S. bank by asset, while SBNY and SI were more crypto-friendly banks … and not nearly as big.

While the Federal Reserve stepped in and announced all depositors in Silicon Valley Bank and Signature Bank would have their deposits protected, the damage to bank stocks was already done.

It’s left the financial sector fearful of a run on small and mid-sized banks. Not to mention continued inflationary pressures and lack of profitability due to the highest interest rate environment in 15 years.

And WFC is one of several bank stocks trending down.

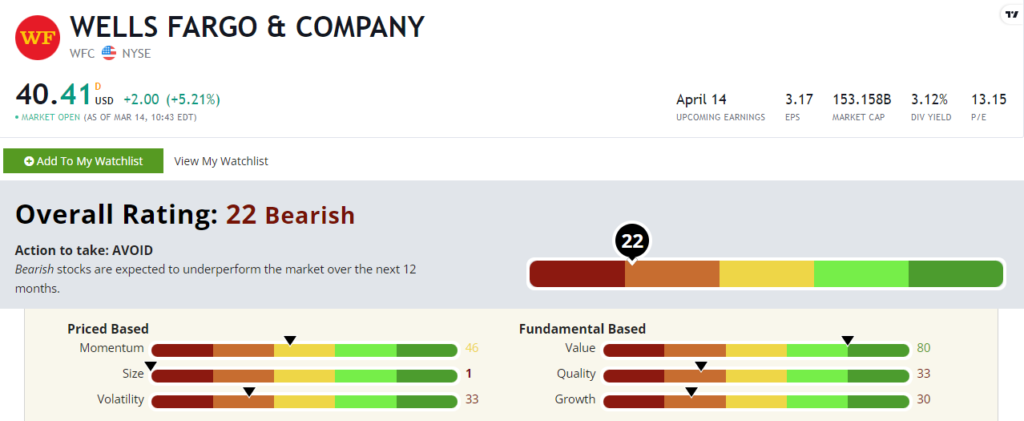

WFC stock scores a “Bearish” 22 out of 100 on our Stock Power Ratings system. We expect it to underperform the broader market over the next 12 months.

Wells Fargo Stock: Too Much Volatility, Weak Quality and Growth

Diving deeper into Wells Fargo’s finances tells me there are some issues with this massive bank:

- Its fourth-quarter revenue was $19.6 billion — that’s a 5.8% drop from the same quarter a year ago!

- The company reported a $3.3 billion loss in operations and saw its diluted earnings per share fall 51.4% from the same quarter a year ago.

While WFC scores in the green on our value factor (80), you can see why it slumps on growth (30).

Its quality is also in the red (33) with a return on assets of just 0.6% compared to the banking industry average of 1.1%. Its returns on equity and investments are also lower than the industry averages.

Wells Fargo stock has “value trap” written all over it.

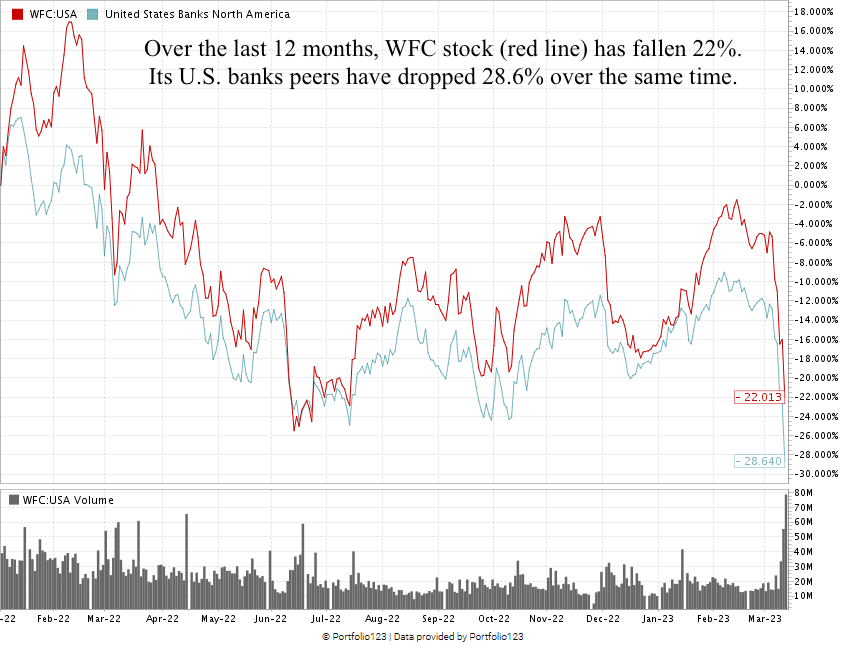

Another sign to avoid WFC is its lack of recent momentum … Wells Fargo stock is down 22% over the last 12 months:

Created in March 2023.

As I write, WFC stock has fallen 17% off its previous high set last month.

That includes a 13.6% decline since March 6.

WFC stock scores a terrible 22 overall on our proprietary Stock Power Ratings system.

That means we are “Bearish” on the stock and expect it to underperform the broader market.

Bottom line: The banking industry is in some serious trouble right now.

Three major banks have collapsed and investors worry more could be on the way. The government has addressed some of these fears, but there is too much uncertainty in this sector right now.

And if we don’t see another collapse, banks are struggling to make money for their investors due to high interest rates.

These are all reasons why WFC is a banking stock you want to avoid right now.

Stay Tuned: The Future of the EV Market

More electric vehicles (EVs) are hitting the road every year. You might be wondering if it’s time to start investing in these automakers.

I’ll explore the state of EVs tomorrow, and tell you if Stock Power Ratings says now is the time to buy in.

Until then…

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. I’d love to hear what you thought about my “Stock to Avoid” article today. Was it valuable? Would you like us to continue sharing high-risk stocks on occasion, so you know what to stay away from?

Would you prefer that we only share “Bullish” and “Strong Bullish” stocks?