Best-selling author, professor and technology industry pundit Scott Galloway analyzed WeWork’s S-1 filing as the company prepares for its initial public offering, and he had some … interesting things to say.

Galloway, who has started nine firms himself, penned a blog on his site called “WeWTF,” where he lambasted the company’s upcoming IPO and anyone considering buying in, and basically called it a cult Jim Jones himself would be proud of.

From the company’s prospectus: “We dedicate this to the power of We — greater than any one of us, but inside each of us.”

Of course, Galloway scoffed and said it’s easy to enter into a consensual hallucination like buying into WeWork’s IPO while stock markets are volatile, “and it’s easy to wallpaper over the shortcomings of the business with a bull market’s halcyon: cheap capital.”

Galloway then goes on to poke a bit of fun at WeWork’s stated mission “to elevate the world’s consciousness,” which sounds like something out of the 1960s.

Galloway contends WeWork isn’t so much a real estate firm renting desks as it’s a “space as a service” firm.

“I know, use the word ‘technology’ over and over, despite having little R&D and computers and stuff, and voilà … we’re Salesforce,” Galloway wrote.

“Today I froze water and used this technology to reconfigure the environment encapsulating my Zacapa and Coke. So, I’m Bill Gates. Better yet, today I began calling my wife Gisele, which I’m pretty sure means I’m the starting QB for the Pats.”

Galloway also said the company’s metrics are completely invented and pulled out of thin air.

GAAP accounting standards got you down? No problema at WeWTF. We has begun reporting “Community-based EBITDA,” profitability before the BITDA, but is also taking out expenses, including real-estate, that comprise the bulk of cost required to deliver the service. A more honest description of the metric would be “EBEE, Earnings Before Everything Else.” As someone who follows stocks and goes on TV to pretend I have any idea which direction a given stock is going, I’d like to suggest a few metrics to provide insight into We:

- EBG, Earnings Before Gluten

- EBBG, Earnings Before the Big Dawg (tennis balls, pig’s ears, etc.)

- EBEPW, Earnings Before Equal Pay for Women

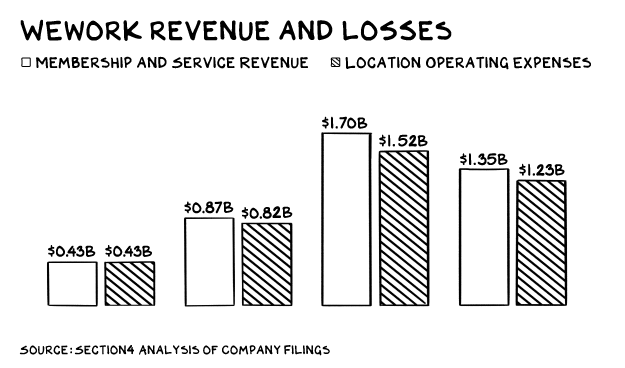

Galloway noted some major red flags by WeWork, including the fact that CEO Adam Neumann has sold more than $700 million in stocks, which is “700 million red flags that spell words on the field of a football field at halftime: “Get me the hell out of this stock, but YOU should buy some,” he wrote before illustrating how awful the company’s gross margins are (see graph below). Neumann also has several family members working in the business who make “less than $200,000.”

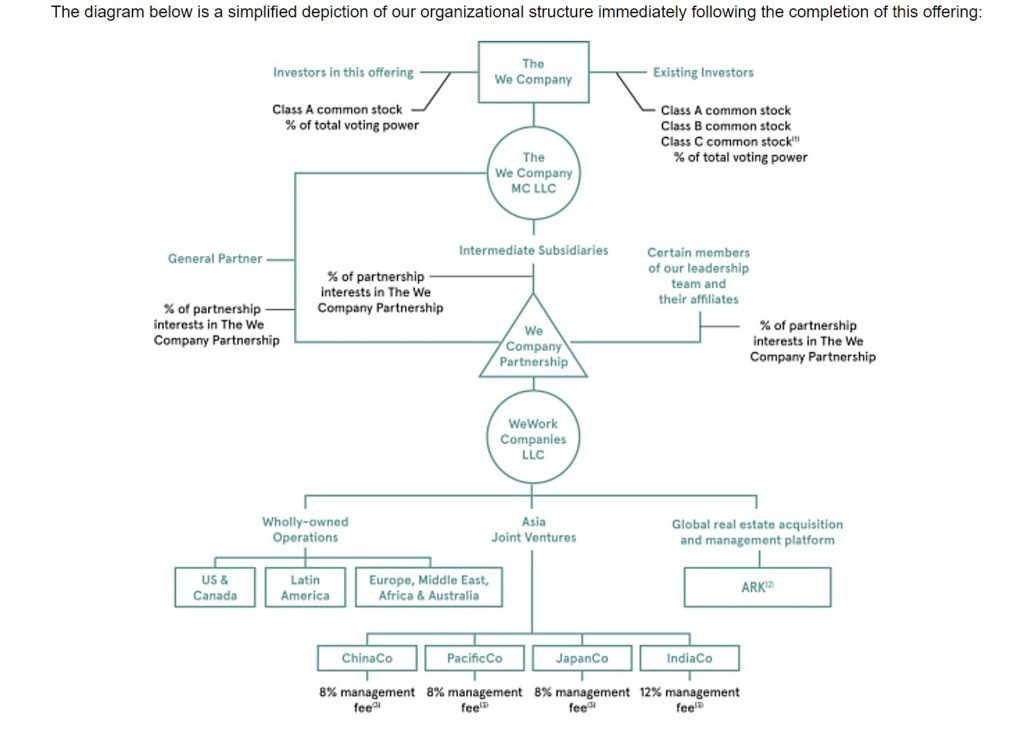

Galloway also points out that Neumann owns 10 buildings, several of which leased to WeWork at quite the handsome profit while also owning the right to the “We” trademark, which of course the firm decided to buy from Neumann for $5.9 million. Yes, you read that right, Neumann paid himself $5.9 million for the rights to the trademark he already owned — red flag, Galloway said.

Valuation

Galloway says the company’s valuation is “Insane. Seriously loco.”

“The last round $47 billion ‘valuation’ is an illusion. SoftBank invested at this valuation with a ‘pref,’ meaning their money is the first money out, limiting the downside,” he wrote. “The suckers, idiots, CNBC viewers, great Americans, and people trying to feel young again who buy on the first trade — or after — don’t have this downside protection. Similar to the DJIA, last-round private valuations are harmful metrics that create the illusion of prosperity. The bankers (JPM and Goldman) stand to register $122 million in fees flinging feces at retail investors visiting the unicorn zoo. Any equity analyst who endorses this stock above a $10 billion valuation is lying, stupid, or both.”

Click here to read Galloway’s blog, which also was posted in full on Business Insider.

Money and Markets contributor Bill Bonner also has written an interesting piece we published on July 11 that questions whether WeWork is a company, or a scam. Spoiler alert: Bonner said it’s a scam and the blame falls on the Federal Reserve.