Keeping up with everything going on in financial markets and the economy is tough these days. That’s where “The 5” from Money & Markets Daily comes in…

Let’s start your week off right!

NVDA Rocketed Up 17% Last Week

The first weekend in August brought us a sharp downturn in stocks across the board. Even though the pullback was already over by lunchtime on Monday, investors were clearly rattled.

After seeing the S&P 500 gain 12% in just seven months (nearly twice the historical average), many on Wall Street believed we might be in for a pullback — or worse, a whole new bear market. But stocks had other plans.

Over the last week, we witnessed a rapid “V-shaped” recovery for the major indexes. Nvidia Corp. (Nasdaq: NVDA) alone logged a jaw-dropping 17% gain. That’s no mean feat for a company with a $3 trillion market capitalization.

But it’s also worth noting that NVDA has substantially outperformed its “Magnificent Seven” counterparts, suggesting a possible consolidation in the ongoing AI trend.

We’ll have to see how the rest of the week plays out after this morning’s sleepy start.

This Week Is Jampacked

The Democratic National Convention is kicking off today in Chicago. Democrats hope to ride the recent momentum behind Vice President Kamala Harris before her impending nomination on Thursday.

President Joe Biden will kick things off tonight before a jampacked schedule featuring speeches from past presidents and other dignitaries on the left side of the aisle.

We’re still bracing for Stone Cold Steve Austin’s surprise endorsement…

The convention should reveal more about Harris’ policy plans, but it likely won’t move markets too much … yet.

For an event that will have a larger impact now, we have to go about 20 hours west of the convention to Jackson Hole, Wyoming.

Federal Reserve Chair Jerome Powell, along with a laundry list of central bankers, policymakers and economists, is meeting this week to discuss broad economic policy.

But we’re all worried about one thing: interest rates.

With a September rate cut all but guaranteed, investors now want to know how low the Fed will go.

Powell’s Friday speech should provide some clues there. We’ll have a response in next week’s edition of “The 5.”

A 7-Eleven on Every Corner?

Mergers and acquisitions dropped off after reaching a 2021 high.

However, forecasts suggest a 20% growth in M&A activity in 2024 and 2025.

While big headlines around M&A deals surround well-known companies gobbling up lesser-known businesses, one potential deal has made big headlines… at least in Japan.

The Canadian operator of Circle K truck stops and gas stations submitted a deal to buy the Japanese owner of 7-Eleven stores globally.

Alimentiation Couch-Tard Inc. (OTC: ANCTF) — with around 14,000 service stations — has proposed a buyout of Japanese-based Seven & I Holdings Co. (OTC: SNVDY) — a company with nearly 85,000 stores globally.

The potential merger would create the world’s largest operator with nearly 100,000 convenience stores around the world — including around 22,000 stores in North America. It would also be the largest foreign takeover of a Japanese company.

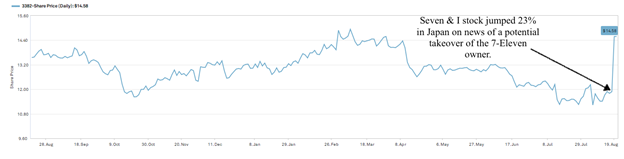

While the offer was considered “friendly” and “non-binding,” traders in Japan went nuts when the news was announced:

Seven & I Holdings Moved Up 23% on Monday

Seven & I Holdings Co. stock on the Nikkei cruised 23% higher to near its 52-week high on news of the potential deal.

It’s important to note that while Couch Tard has fewer stores, it does have a larger market cap than its Japanese target. Couch Tard has a market cap of $58.5 billion compared to Seven & I’s $38.5 billion.

While details of the offer have not been made available yet, this merger may not come to fruition unless there is a significant cash attachment to the deal.

Subway’s Five-Dollar $6.99 Footlongs

Last week, corporate leadership from the fast food chain Subway called for an emergency meeting with franchisees amid plummeting sales.

To address the issue, Subway is “going back to basics” with a host of new bargain value meals centered around a $6.99 footlong sandwich.

Subway’s new promotion hearkens back to the legendary “Five Dollar Footlong” promotion, which took America by storm while forcing franchisees to wrestle with frustratingly tight margins.

Subway’s decision also reflects the larger challenges faced by restaurants across America in 2024. With rising prices, consumers are eating out less and less often.

We can expect to see continued restaurant closures, downsizing and special offers as the industry adapts to meet the market.

Do YOU own a Subway franchise or other restaurant? Have you noticed crowds dwindling as prices rise? We’re curious to know what restaurateurs are seeing out there in the real world, and we know you’re a very entrepreneurial crowd.

Send us your insights at Feedback@MoneyandMarkets.com.

And speaking of that…

What You’re Seeing on the Recession Front

With last week’s strong market recovery and economic reports showing a robust U.S. economy, a recession seems unlikely any time soon.

We wanted to know if you were seeing any signs throughout your own daily experiences. Thank you to all who submitted an email to our poll last week. (Responses may be edited slightly for clarity, and we’ll keep responses anonymous, as always.)

Let’s start with C.L. in Tennessee:

Living in a 450-home resort community pretty much insulates me from the vagaries of the economy. The only out-moves I see are very old folks moving to assisted living or to be closer to their kids. New refugees from New York, Illinois and California replace them pretty quickly. Still lots of new home building here, and most are sold even before completion.

Thank you for the email, C.L.! It seems like you’re seeing almost the opposite of what Editor-at-Large Matt Collins is experiencing in his community.

M.O. kept it simple with their response after we asked, are you seeing signs of a recession in your neighborhood?

No.

Thank you for the short and sweet answer, M.O. Nothing wrong with that!

If you want to chime in with your own experiences, feel free to email us at Feedback@MoneyandMarkets.com.

Before wrapping up this edition of “The 5,” we wanted to feature one last email about the Olympics from one of our international readers. Kenneth L. wrote in from Australia:

Parochial, to be sure, but Australians do get the Olympics at the low cost of watching interrupting ads, but otherwise costless, unless you count lost sleep. They can be watched online through Channel 9 On-Demand services, too.

Thank you, Kenneth! I think plenty of people in the U.S. would be happy to watch the world’s games on an ad-supported stream. Maybe in 2028…

That’s a wrap for “The 5.” Have a great week!

— Money & Markets Team