Editor’s Note: As we barrel toward the close of 2024, we wanted to look back at Chad’s harrowing experience escaping Hurricane Helene. It led to an investing idea driven by our proprietary Green Zone Power Ratings system…

It felt like something out of a Hollywood blockbuster…

A caravan of slow-moving vehicles inching along mountain roads, surrounded by the devastation of a brutal hurricane.

The convoy crept along, skirting under downed trees and powerlines and over washed-out roads. It passed homemade signs advertising free water and warning of blocked roads.

Unfortunately, this wasn’t just another movie. It was a reality for myself, my wife and thousands of others who found themselves trapped in the aftermath of Hurricane Helene:

What was I thinking?

Of course, it all started as a quiet vacation … a chance for my wife and I to get away from the hectic excitement of our South Florida home.

We were eager to take in the Appalachian scenery and enjoy a nice, quiet week in the Blue Ridge Mountains, just outside of Brevard, North Carolina.

But Hurricane Helene had other plans.

After the storm left us virtually stranded without power, water or even cell service for over 24 hours, we decided to make our escape. Using a few downloaded maps and some advice from the locals, we got in our car to make an unsure descent from our mountain lodge.

In hindsight, ignoring official recommendations to stay in place and instead making this harrowing trek was a stupid decision. But survival instincts kicked in, and we were incredibly fortunate to have a place to go.

Now, a week later, I am so thankful that we made it home safely. And for better or worse, the experience offered a moment of reflection I hadn’t expected.

Namely…

It’s So Easy to Forget How Good We Have It

Like most South Florida residents, I’m no stranger to the occasional hurricane.

Losing power and water was rough, but that wasn’t new. We did have enough foresight to fill the few gallon jugs we had with water, and when the power went out, we stuck to hurricane toilet rules. (If it’s yellow … you know the rest.)

What really surprised me was losing cell phone service out in the remote Blue Ridge Mountains.

You don’t realize how much you rely on something until it’s gone.

My wife and I were never directly in danger, but we had no way to tell family and friends that we were safe. We also couldn’t receive updates on the storm or the state of the roads. We were feverishly scanning local radio stations, listening for any updates we could.

When we finally got a bar or two of 4G cell service in the small town of Hendersonville, it felt like Christmas. We quickly pulled over to contact relatives and plan our next move.

I realize this might sound like a fussy “first-world problem.”

But the feeling of isolation is something I’ll not soon forget. In the future, I plan to have multiple backups to ensure safe communication in case of emergency.

Additionally, we can’t help but wonder whether these outages might have a long-term cost for investors…

Massive Outages = Massive Losses?

Moody’s estimates that the storm may cost as much as $34 billion once all is said and done.

A great deal of this cost will come from needing to rebuild infrastructure. Fixing roads, clearing debris and erecting new power lines and cell phone towers.

And one of the area’s biggest cell providers is Verizon Communications Inc. (NYSE: VZ).

In the long run, I don’t think these massive outages the company has been dealing with all week will affect its stock price.

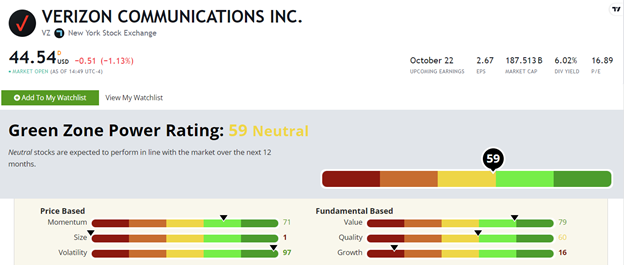

But let’s take a closer look at VZ’s Green Zone Power Ratings to make sure:

Verizon stock rates a “Neutral” 59 out of 100 in Green Zone Power Ratings. That means it should perform in line with the broader market over the next 12 months.

VZ rates best on Volatility (97), Value (79) and Momentum (71).

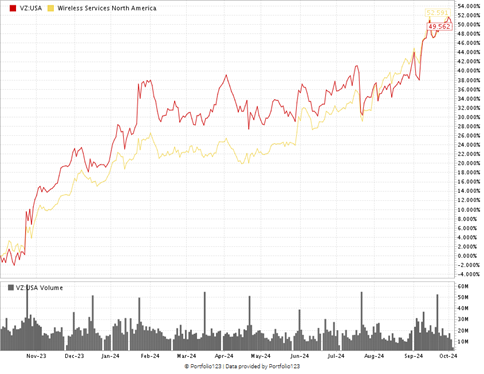

Looking at its price action, VZ is up 49% over the last 12 months, narrowly beating the S&P 500’s 36% gain.

That seemed solid until Chief Research Analyst Matt Clark pointed out that VZ was actually lagging behind its wireless services peers.

VZ Lags Its Subindustry Peers

What’s more, VZ’s steady performance over the last year is putting pressure on its valuations.

It currently trades with a price-to-earnings ratio of 17, compared to the industry average of 14.5. Its price-to-sales and price-to-book value are similarly higher than its peers.

Its Growth rating of 16 out of 100 is also problematic. The company’s one-year sales growth rate is -2.1%, and its earnings-per-share growth rate is -45.5%.

It also has a long history of declining EPS with a 5-year EPS growth rate of -6%.

While VZ stock has rallied alongside the S&P 500, Green Zone Power Ratings says this is one to watch for now.

To close, I want to say to keep the people affected by this disaster in your mind. And do whatever you can to help out.

We were lucky to leave, but I know most people affected didn’t have that luxury.

And on a happier note, this experience showed me the power of humanity and community.

From the random neighbor with a generator offering to print directions for our journey to the spray-painted cardboard sign on the side of the road that read “BIG HOLE.”

I’ll never forget those small acts of kindness.

(And yes, that hole in the road was BIG.)

Until next time,

Chad Stone

Managing Editor, Money & Markets