Today, I discuss this recent market dip and what it means for cannabis investors.

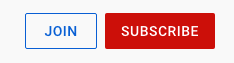

September has been a rough month for the stock market, as you can see in the chart below:

In the first 13 trading days of the month, the S&P 500 fell 3.7% amid investor worries about the delta variant of COVID-19, inflation and the potential default of Chinese construction giant Evergrande.

The market showed some life after Monday’s horrific sell-off, but the dip had a profound impact on the cannabis market as well.

Before that, news that House lawmakers wanted to roll parts of the SAFE Banking Act — the bill allowing easier access to capital for cannabis companies — into the National Defense Authorization Act (according to Marijuana Moment) boosted pot stocks.

Then they followed the rest of the market down.

Sell-Off = More Investment in Pot Stocks

While some investors will view the market correction as a window for cannabis investors to sell off for gains they realized earlier this year, it opens the door for additional investment in cannabis stocks.

Here’s why.

Amid the longest bull market in recent history, stocks (cannabis included) raced to sky-high valuations.

I analyzed three valuation metrics:

- Price-to-book — the comparison of a company’s market cap to its book value.

- Forward price-to-earnings (P/E) — dividing the current share price by the estimated future earnings per share.

- TEV/EBITDA — dividing the total enterprise value of a company by its earnings before interest, taxes, depreciation and amortization.

Cannabis Company Valuations, May to Today

I looked at three public cannabis companies in the U.S. from May 1, 2021, to September 20, 2021:

- GrowGeneration Corp. (Nasdaq: GRWG).

- Tilray Inc. (Nasdaq: TLRY).

- Hydrofarm Holdings Group Inc. (Nasdaq: HYFM).

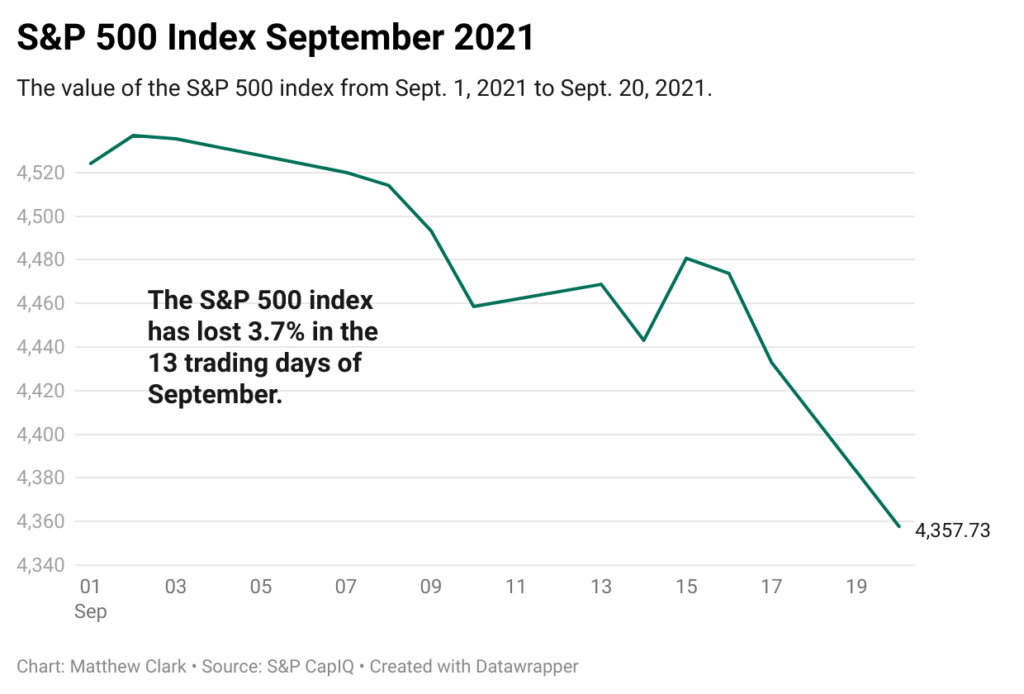

All three companies started the period with strong price-to-book metrics, as you can see in the chart above.

However, all three dropped fast — Tilray (green) in July, GrowGeneration (blue) and Hydrofarm (red) in mid-August.

GrowGeneration’s high ratio of 8.29 in July fell 48.3% to just 4.28 as of September 20.

Hydrofarm’s high of 9.85 in May dropped 68%, to 3.13 in September.

Tilray’s high ratio of 5.72 in July now trades at 1.12 — an 80.4% decline.

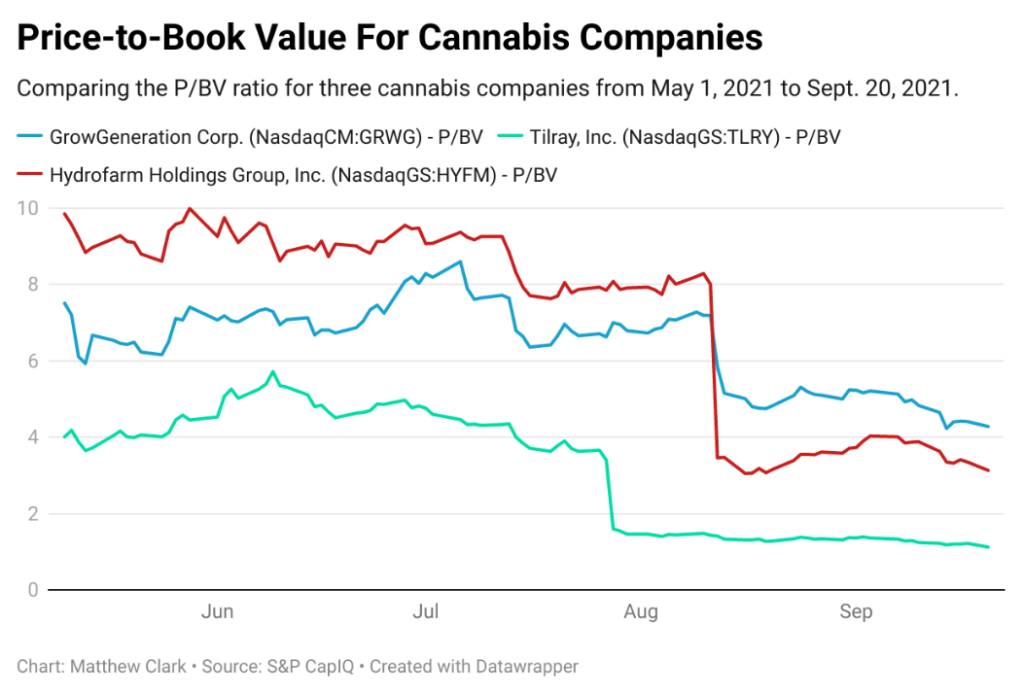

Now, we can look at forward price-to-earnings.

Note: I took Tilray out of this comparison and the next because we don’t have enough data for forward calculations since it acquired cannabis company Aphria.

As you can see in the chart above, Hydrofarm (red) opened the period trading with a 125.21 forward P/E ratio. That fell 74%, to 33.03.

GrowGeneration (blue) reached a high ratio of 88.94 in July but now trades at a forward P/E ratio of 47.45 — a drop of almost 47%.

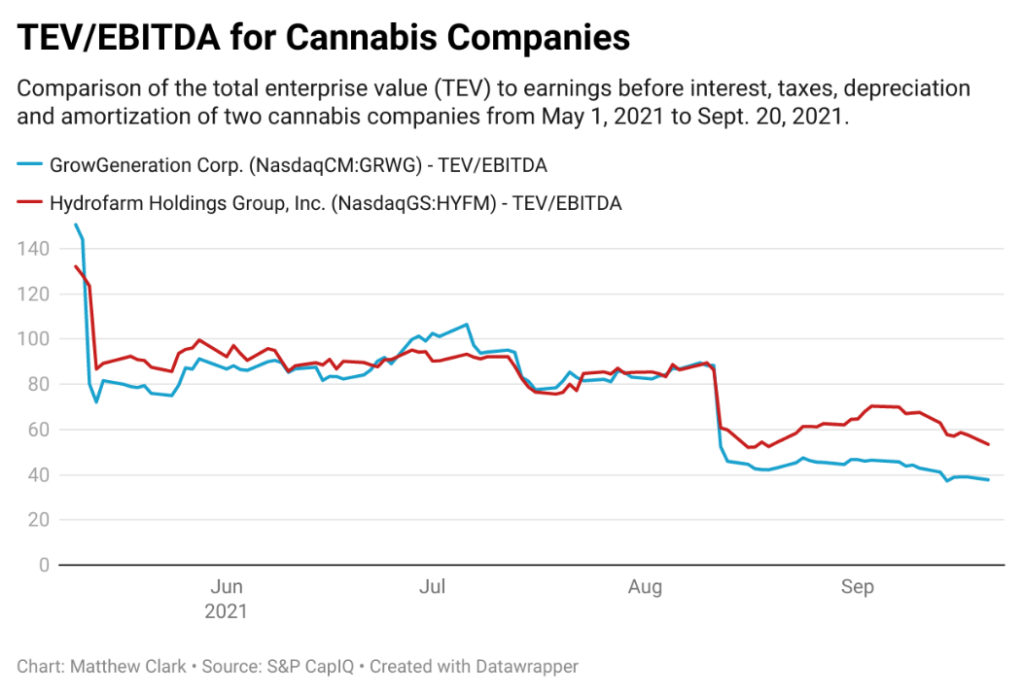

Finally, I examined the total enterprise value compared to EBITDA:

GrowGeneration (blue) started the period with a high TEV/EBITDA ratio of 150.52 in May. The stock is now trading at a ratio of 37.72 — a 75% decline from its period high.

Hydrofarm (red) started the period at a high ratio of 132.03. That TEV/EBITDA fell to 53.41 — a drop of 60%.

The Takeaway for Cannabis Investors

None of this suggests that cannabis stocks are undervalued right now.

However, these changes in valuation ratios tell me that cannabis stocks are becoming more valuable investments.

Also consider that the growth metrics for many cannabis companies point to future growth.

Aaron Grey, an analyst with Alliance Global Partners, projects GrowGeneration’s total revenues to increase by 35% in 2022.

Kevin Marek, an analyst with Deutsche Bank, provided guidance that Hydrofarm’s net sales would grow 45% to 50% for 2021. He suggested that year-over-year sales growth for the company would be 30% in 2022.

So, you have a decline in valuation metrics coupled with projected total revenue increases for the future.

The drop in share price suggests that investors still struggle with Congress’ inaction when it comes to significant cannabis reform.

However, this recent drop may provide good entry points into the cannabis market as the revenue projections suggest growth is on the horizon.

Remember, our strategy is to buy high and sell higher. I’d prefer to see a confirmed uptrend before jumping into the sector.

But, with prices falling, buying on that uptrend will offer solid value as well as the potential for strong profits in the cannabis market.

Now, I should mention our exclusive community on YouTube.

YouTube “Join” Feature

We offer members exclusive content, including:

- Interviews with cannabis insiders.

- Blog posts, stock analysis and company breakdowns.

- More content related to our Cannabis Watchlist.

- Monthly live chats with me, where we’ll discuss cannabis stocks, the cannabis sector and much more.

I even unveiled another tool you can use to help point you in the right direction for cannabis stock investments.

Just click “Join” on our YouTube page to find out what you can access by joining.

If you have a cannabis stock you’d like me to look at, email me at feedback@moneyandmarkets.com.

Where to Find Us

Coming up this week, we’ll have more on The Bull & The Bear podcast and our Money & Markets Week Ahead, so stay tuned.

Don’t forget to check out our Ask Adam Anything video series, where we ask any question to chief investment strategist Adam O’Dell, and our Investing With Charles series, in which our expert Charles Sizemore and I discuss the trends you write in to ask about.

Also, you can follow me on Twitter (@InvestWithMattC), where I’ll give you even more insights, not just in the cannabis market.

Remember, you can email my team and me at feedback@moneyandmarkets.com — or leave a comment on YouTube. We love to hear from you!

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.