The energy bull market is ongoing, but certain stocks are better buys than others. What does our system say about Enbridge stock (NYSE: ENB)?

Enbridge Inc. is a Canadian energy transportation company with over 65 years of experience in the industry.

It operates the world’s longest crude oil and liquids pipeline system which delivers crude oil from Canada to the United States.

With its extensive network, Enbridge has become a leader in both North American and global energy markets.

In this blog post, we will provide an overview of Enbridge’s business and its outlook for 2023. And then we’ll run Enbridge stock through our proprietary Stock Power Ratings system to see how it looks.

Overview of Enbridge’s Business

Enbridge is one of the largest publicly-traded companies in Canada and is involved in three major areas of activity:

- Natural gas distribution, transmission and storage.

- Crude oil transmission.

- And renewable energy generation.

Its pipelines transport more than 3 million barrels per day (bpd) of crude oil and natural gas liquids. Enbridge also owns or has interests in nearly 8,000 megawatts (MW) worth of renewable energy assets located across North America.

The company’s core infrastructure includes more than 11,000 miles of active pipelines connecting some of the most important production regions in Canada and the U.S.

Additionally, it operates 31 regulated storage facilities with a total capacity of over 1 billion cubic feet. This allows it to store natural gas for customers ahead of peak demand periods when prices tend to be at their highest.

Outlook for 2023

Enbridge plans to spend $18 billion on capital projects between 2020 and 2024 as part of its five-year strategic plan.

These investments are expected to generate $2 billion in annual earnings before interest and taxes by 2024, with dividend growth averaging 10% per year during that time frame.

The company expects these investments will add significant value to shareholders over the next few years as they look to expand their operations across North America while also providing reliable energy delivery services to customers.

Enbridge also expects strong growth from its renewable energy assets as it looks to capitalize on increasing demand for clean electricity sources such as solar, wind and hydropower.

The company currently owns or has interests in nearly 8,000 MW worth of renewable energy assets located across North America which are expected to generate an estimated $1 billion in combined earnings by 2030.

But does that mean Enbridge stock will outperform in 2023? Let’s see what Stock Power Ratings says.

Enbridge Stock Power Ratings

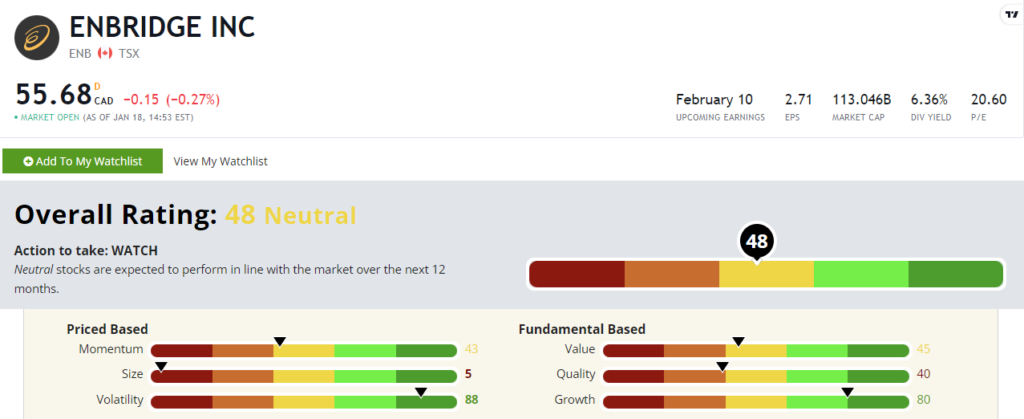

Enbridge stock rates a “Neutral” 48 out of 100. That means our system expects the stock to perform in line with the broader market over the next 12 months.

Explaining some of the stock’s factor ratings.

Enbridge boasted strong revenue growth for 2021. Annual revenue increased more than 28% from 2020 to hit $37.5 billion. Numbers for the full 2022 year should come out later this year, but those numbers explain ENB’s growth rating of 80 out of 100.

But investors have bid this stock up a bit. ENB’s current price-to-earnings ratio is north of 20, while the broader energy sector are at 10.8. That’s part of the reason Enbridge stock scores a 45 on our value factor.

And ENB is one energy stock that didn’t outperform over the last year. It actually lost 1.6% over the last 12 months, which explains its 43 out of 100 on our momentum factor.

Bottom Line: Enbridge stock is set to perform in step with the broader market, according to Stock Power Ratings.

Note: If you want to know more about the renewable energy mega trend…

My colleague Adam O’Dell’s “Infinite Energy” presentation highlights the largest untapped energy source in the world.

This source is worth trillions of dollars and makes massive oil fields look tiny in comparison.

We’re still in the early stages, but this breakthrough is set to turn the global energy market on its head.

Make sure to watch his presentation for more information about this revolutionary new renewable tech (and the one company behind it all).