An event happened last Wednesday on Wall Street when a robot rang the closing bell for the first time ever.

It may not seem like a big event, and you likely missed it while checking your portfolio amid the market decline. But this ceremonial presentation by privately-held Universal Robots was a nod to a rapidly growing industry.

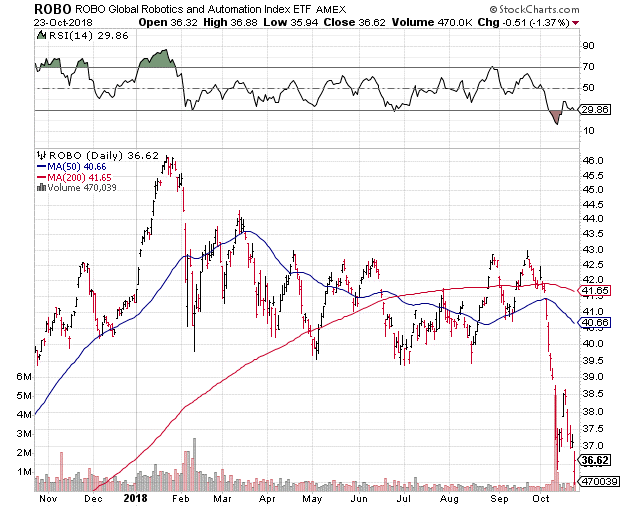

For the NYSE, the bell ringing was a celebration of the five-year anniversary of the ROBO Global Robotics & Automation ETF (NYSE: ROBO).

ROBO allows investors access to many foreign robotics companies not listed on the NYSE, including top holdings Yaskawa Electric Corp. and OMRON Corporation.

But a cloud overhung the celebration. ROBO shares were in a nose dive alongside the rest of the market and had been since the start of October.

As you can see from the chart, ROBO actually entered bear-market territory back in June when the ETF dipped below its 200-day simple moving average. There was a brief recovery attempt in September, but a double-top formation at $43 led to October’s sharp reversal and continuation of the downtrend.

It’s important to note that most of ROBO’s biggest holdings are foreign companies. Revenue and sales for many of these are negatively impacted by tariffs and a rising U.S. dollar.

But there are several homegrown U.S. robotics companies that should be on your radar (if not already in your portfolio) for when the selling pressure finally blows over.

The first is iRobot Corporation (Nasdaq: IRBT). iRobot makes the Roomba line of home cleaning robots. It may seem like a mundane use for robotic technology, but home integration is the future of this market. What’s more, iRobot is a market leader in this space, and has received world-wide adoption of both its vacuum sweeper bots and its automated moping bots.

Of note, iRobot reported quarterly earnings just last night. The company beat third-quarter earnings expectations and raised its full year guidance. However, iRobot said that China tariffs would hurt margins.

IRBT stock is off sharply following the report due to tariff concerns. However, with the company still averaging quarterly revenue growth just shy of 20 percent, long-term investors should see this decline as a buying opportunity.

The second opportunity lies with Intuitive Surgical Inc. (Nasdaq: ISRG). Intuitive’s robots are nearly the polar opposite of iRobot; the company makes surgical robots for medical procedures too precise for human hands.

But this robotics niche also is growing rapidly. Medical procedures have become increasingly advanced, and Intuitive Surgical’s expertise in the field is helping to vastly improve patient survivability, recovery and costs.

In a nod to the company’s market strength, Intuitive’s recent third-quarter earnings report also topped Wall Street’s expectations. What’s more, Intuitive’s revenue growth has averaged better than 18 percent a quarter in the past year. Like IRBT, ISRG also is a stock that long-term investors will want to pick up at a discount in the current market.