It seems analysts and politicians always find something new to argue about.

This time, it’s the recession definition.

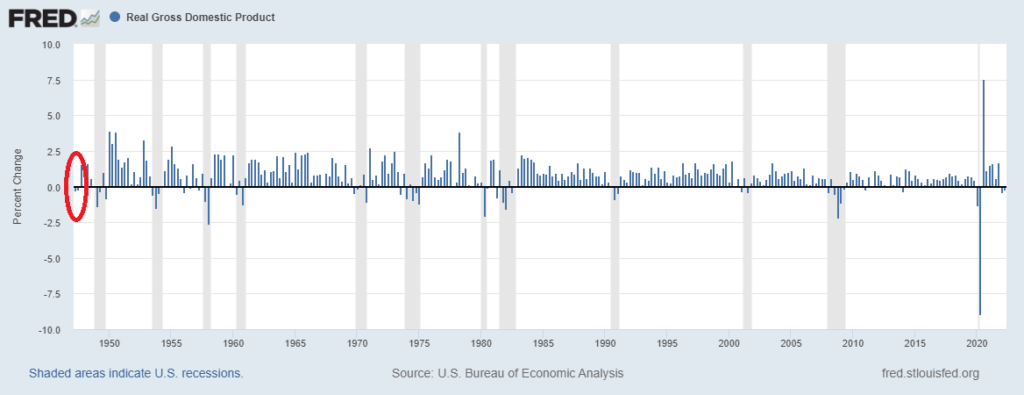

The informal recession definition has always been two consecutive quarters of contraction in gross domestic product (GDP).

Now that we’ve had two such quarters, many analysts say we’re in a recession.

Economists and policymakers in the White House disagree.

They are highlighting strong employment data as proof we aren’t in recession.

The Fed’s Recession Argument

Federal Reserve Chair Jerome Powell made a different argument.

He noted that because data is often revised, we shouldn’t put much faith in the current numbers.

Using the Fed’s data, a revision has never changed two negative quarters to ultimately show growth.

And Powell’s comments are horrifying even if we put aside the recession question for a moment.

The Fed changes interest rates and sets policies based on its data.

If the numbers aren’t reliable, the central bank should wait before acting.

But if the Fed waits, as we now know, inflation spirals out of control.

Powell should focus on improving the data instead of scoring political points.

Recession Definition Debate

Both sides have a strong case.

Many recessions since 1947 have started with two down quarters in GDP.

Consecutive GDP Contraction ≠ Recession

Source: Federal Reserve.

The most interesting part of the chart is at the extreme left.

In 1947, there were two consecutive quarters with GDP declining, and there wasn’t a recession.

It’s possible to have two down quarters without a recession.

That’s why some agencies use a more detailed recession definition.

The National Bureau of Economic Research looks at data on real personal income, employment, real personal consumption expenditures, wholesale-retail sales adjusted for price changes and industrial production.

Bottom line: Based on these indicators, there is no clear answer as to whether or not we are in a recession.

But we are most likely heading into recession, and the worst economic pain lies ahead.

Michael Carr is the editor of True Options Masters, One Trade, Precision Profits and Market Leaders. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.