You might think it’s a good idea to buy shares of Netflix stock amid the COVID-19 pandemic lockdown, but you’ve missed that train by now and it would actually work against you in the immediate future.

Millions of Americans are sheltering in place, working from home and generally staying inside to help curb the spread of the novel coronavirus.

As a result, several companies have been able to capitalize on that by pushing their services to help people deal with being locked inside with little to do.

One of those companies is Netflix Inc. (Nasdaq: NFLX). The television streaming giant has been able to take advantage of more Americans binge-watching its massive collection movies, TV shows and original programming.

In its Q1 2020 earnings report, the company said it gained 15.8 million subscribers — more than doubling Wall Street expectations.

All of that may seem like overwhelming triggers to buy Netflix stock, but that would be a big mistake.

Netflix Stock Performance

To say the coronavirus pandemic has been good to Netflix would be a gross understatement.

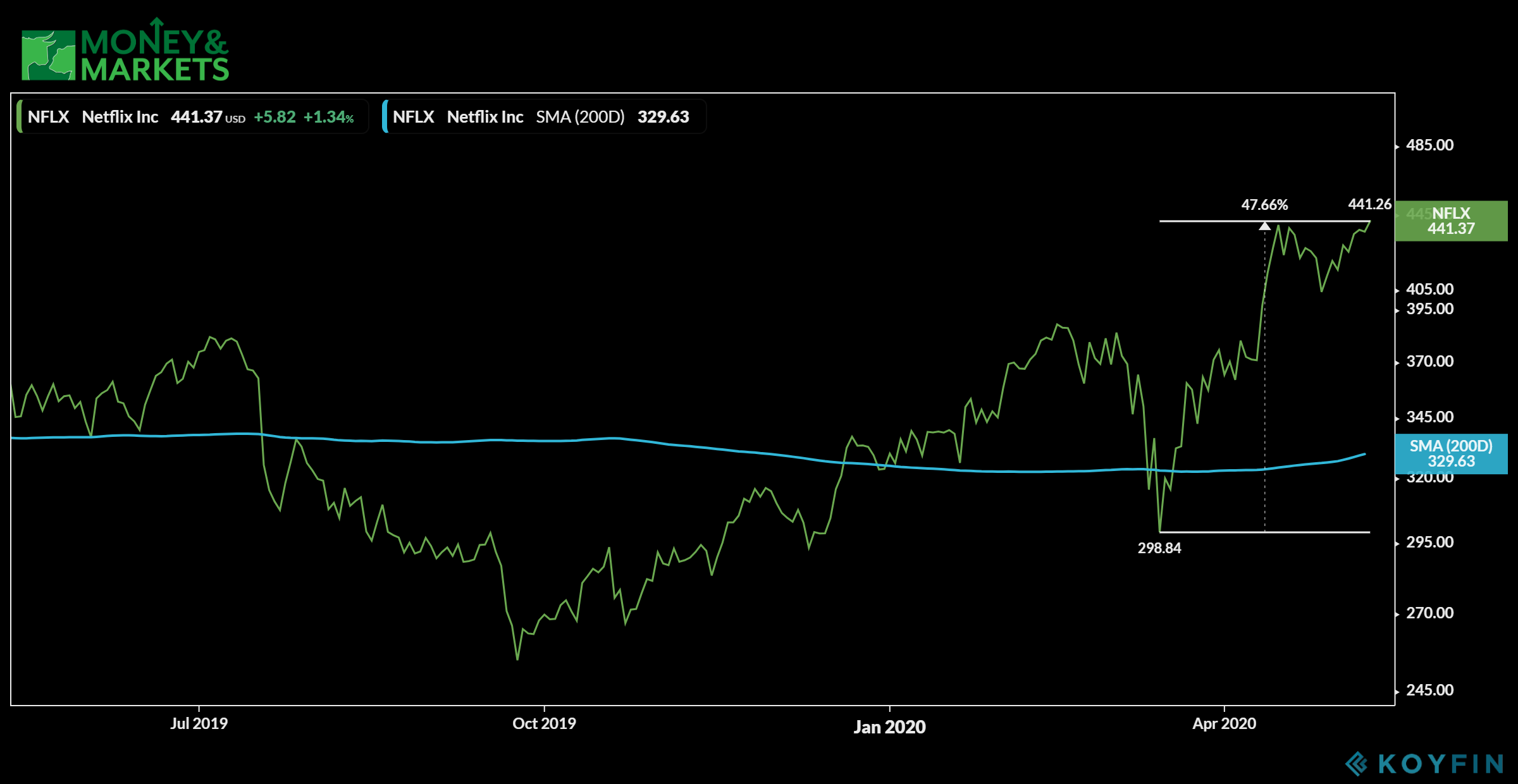

The jump in the number of subscribers has been a nice boost for shareholders as Netflix stock has risen nearly 48% after bottoming with the broader stock market crash in March.

If you look at the chart above, you can see that Netflix stock has weaved below and above its 200-day moving average. It’s currently more than $110 above that average — trading at around $441 per share.

The test of the moving average came in March when investors poured into Netflix and started to push the stock up significantly.

Since then, it has continued its upward trajectory.

So Why Isn’t Netflix Stock a Buy?

First, the fact that it is so far above its 200-day moving average should give potential investors a little pause.

Also, consider that Netflix stock is currently trading with a price-to-earnings ratio of 89.5. That’s high, especially considering the company doesn’t even pay a dividend.

It also has a price-to-book ratio of 23.1, further illustrating how Netflix stock is extremely overvalued.

Then you have to take a look at the space Netflix currently dominates.

“The pandemic boosted Netflix’s first-quarter earnings, which it reported on April 21. And it still boasts the largest subscriber count of any streaming service,” Banyan Hill Publishing’s John Ross said. “But competition is heating up. In addition to Hulu, Amazon Prime and Apple TV+, Disney+ is hitting its stride with exclusive rights to Star Wars and the Marvel Cinematic Universe.”

With unemployment reaching record levels, millions of consumers are going to start trimming back expenses — including Netflix subscriptions.

“And when the economy begins to open back up, will Netflix be able to bring on new accounts when people have less time to watch — at a pace that investors can justify buying an overvalued stock?” Ross, the Editor of Apex Profit Alert, said.

So while Netflix seems to be on top of its game now, don’t look for it to stay there. You can hold your current stock, but it might be a good time to sell at least a portion and take some profits before the stock falls.

If you don’t own Netflix stock, it’s probably best to stay away for the time being.

When the fundamentals paint a better picture, Netflix may be a better buy but, for now, that’s not the case.

Editor’s note: Want to learn how to profit from stock market volatility and grow your money 10 times over with just two simple investments? Sign up for The 10X Switch, a free webinar with Money & Markets Chief Investment Strategist Adam O’Dell on Thursday, May 14, at 8 p.m. EDT. You’ll also receive a free copy of Adam’s report, “The Simplest Investing Strategy Ever,” just for registering. Sign up here and reserve your spot!