My wife and I have this project that has taken us years (and still isn’t done): cleaning out our garage.

The challenge isn’t doing it.

It’s figuring out what to do with all the stuff we want to get rid of.

Throwing it away seems wasteful.

Selling it online sounds time-consuming.

I suggested that we take it to a resell store.

It’s not a new idea, but it’s growing in popularity … especially when high inflation has everyone pinching pennies:

The chart above shows the value of the in-store and online resale market in the U.S.

Last year, it was worth $160.1 billion.

By 2030, the resale market’s value will hit $353.9 billion — a 121% increase!

Today’s Power Stock operates retail stores that buy, sell, trade and consign used merchandise: Winmark Corp. (Nasdaq: WINA).

WINA Stock Power Ratings in June 2022.

Winmark has 1,271 franchise stores in the U.S. and Canada, with 44 more on the way.

The stores’ very familiar names include: Play It Again Sports, Plato’s Closet, Music Go Round and Once Upon A Child.

Winmark stock scores a “Strong Bullish” 91 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

WINA Stock: Quality + Solid Price-Based Metrics

In my research on Winmark, I discovered two compelling items:

- In 2021, WINA reported revenue of $78.2 million — an 18.5% increase from 2020.

- The company increased its quarterly total revenue from first-quarter 2021 to first-quarter 2022 by 8.6% — setting the stage to beat 2021’s annual revenue.

WINA’s quality numbers will knock your socks off.

Its return on assets is 176%, while the apparel and accessory retail industry average is a paltry 7.5%.

What’s even better is its return on investment (ROI): WINA’s ROI is 576.3%. The industry average, on the other hand, is just 11.9%.

The company’s gross margin is 94.7%. Its operating margin is 65.5% — 14 times better than the industry average!

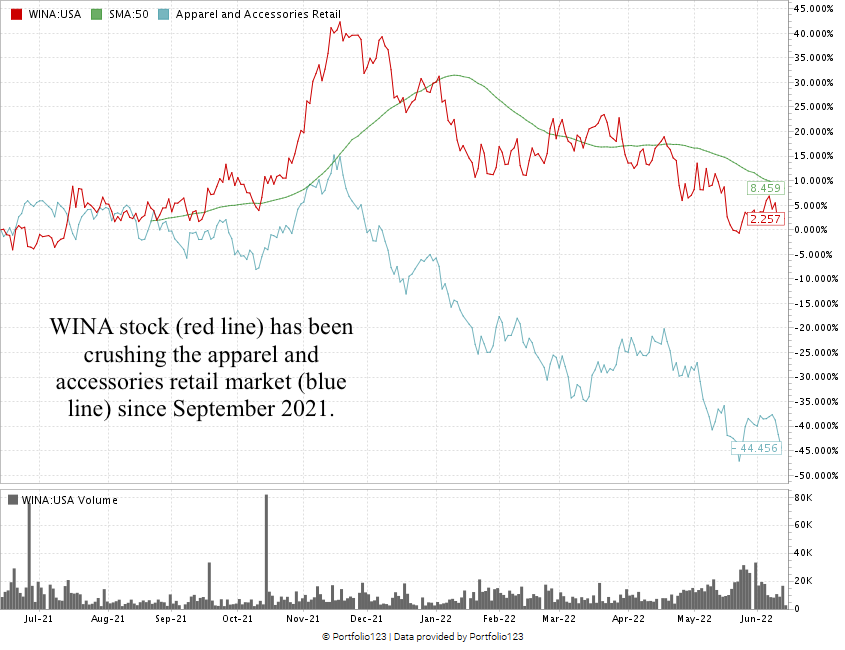

WINA stock jumped 42% from June to November 2021, as you can see in the chart above. Broader market headwinds pared those gains back, but the stock is still in the green.

It’s up 2.3% for the past 12 months and crushes the apparel and accessories retail industry, which is down 44.5% over the last 12 months.

Winmark Corp. stock scores a 91 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

With inflation high, people are looking to earn extra money. One smart idea is to sell old clothes, furniture and other items.

Acting as a middleman, Winmark Corp. makes it easier for folks to sell their goods.

It’s a strong contender for your portfolio.

Bonus: Shareholders earn a 5.3% dividend yield, meaning the company will pay you $10.30 per share, per year to own the stock.

Stay Tuned: Top Health Insurance Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on an excellent health insurer whose stock is a solid buy.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment or question about Stock Power Daily? Reach my team and me anytime at Feedback@MoneyandMarkets.com.