One of my sons visited the dentist to fix a broken tooth last week.

He was shocked to learn it would cost more than $600 to treat.

He’s fortunate to have insurance coverage that brought that figure way down to $15.

Take a look at how much Americans spend on health care every year:

In 2021, we spent $3.5 trillion, according to the chart above. That number will increase 48.6% by 2028.

For perspective, health care spending per person was $10,679 in 2021. That will grow to $14,947 by 2028.

That emphasizes the need for quality health insurance to keep costs down.

Today’s Power Stock is Cigna Corp. (NYSE: CI), a large Connecticut-based provider of health insurance in the U.S.

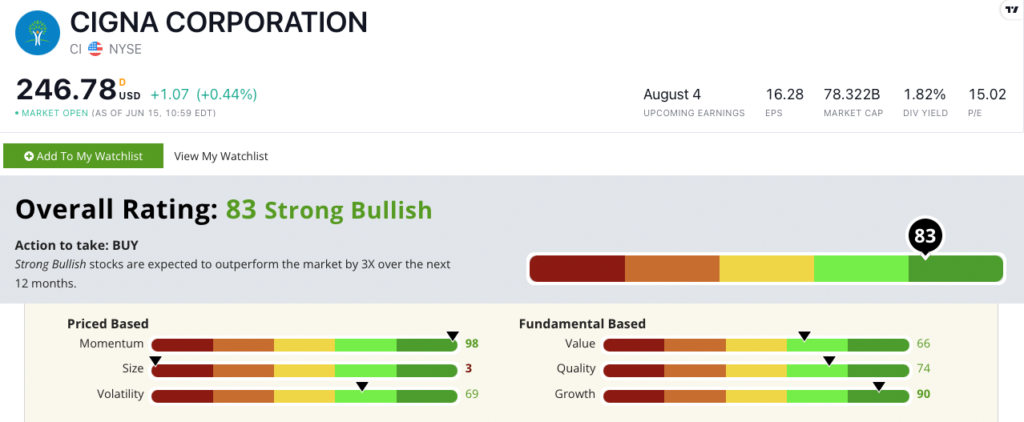

CI Stock Power Ratings in June 2022.

Cigna offers both private and public medical, pharmacy, behavioral health, dental and vision insurance.

Cigna stock scores a “Strong Bullish” 83 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

CI Stock: Market-Busting Momentum + Top Growth Potential

CI just posted a strong first quarter of 2022. Here are two highlights:

- Reported total revenue of $44 billion in first-quarter 2022 — up 10% from the same quarter a year ago.

- Added 698,000 new customers in the quarter, bringing its total medical customer base to 17.8 million.

Cigna stock has a ton of growth opportunity.

The company grew its earnings per share by 11.6% from first-quarter 2021 to first-quarter 2022. It increased its sales by 53.1% over the last three years.

Cigna’s quality is also strong.

In an industry that averages a negative 10% operating margin, CI registers 4.7%. Its returns on assets, equity and investment are all positive, while industry peers average negative.

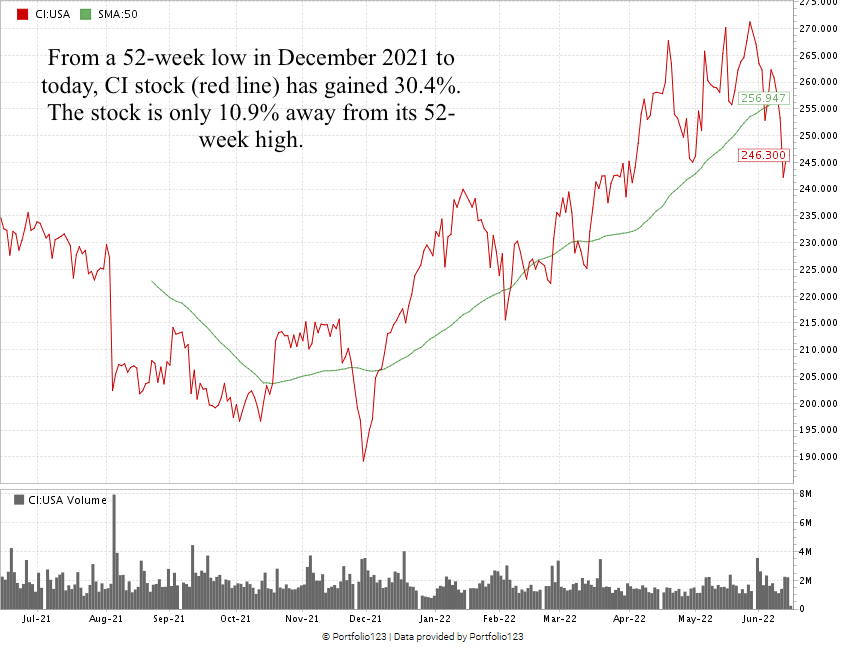

CI hit its 52-week low of $189.22 at the beginning of December 2021.

Since then, the stock has gained 30.4%, even in the midst of a broader market sell-off.

It’s now just 10.9% away from its 52-week high, which it reached in May 2022.

Cigna Corp. stock scores an 83 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

We all need health insurance, and the market is competitive.

By offering a wide range of private and public plans, CI has outstanding growth potential and is a smart bet for your portfolio.

Bonus: Cigna’s forward dividend yield of 1.8% means it pays shareholders $4.48 per share, per year.

Stay Tuned: Discount Retailer to Buy

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a discount retailer whose shares I think you’ll want to own.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Don’t forget to check out The Stock Power Podcast. Each week, I do a deep dive into one of our “Strong Bullish” Power Stocks and tell you why you should consider buying shares. Best of all? It’s separate from the five stocks a week I share with you in Stock Power Daily! Check out the latest podcast on our YouTube channel or your favorite podcast provider.