It’s been a month and a week since President Trump announced his plan for sweeping tariffs in the White House Rose Garden.

You’ll be forgiven if you view his announcement of a 90-day pause of those tariffs, made one week later, on April 9th, as the true “Liberation Day.”

At least, that’s how the stock market has taken it …

Consider that the S&P 500 spiraled more than 12% lower between the close on April 2nd and April 8th.

It has since rallied nearly 14% during the first month of the 90-day pause.

In two words, “policy uncertainty” is keeping every investor and investment manager on edge.

Will Trump blink first?

Will Xi Jinping?

Everyone’s waiting for the next shoe to drop, without knowing what it’ll be or how it’ll affect financial markets in the U.S. and abroad.

Realize, uncertainty is a fact of life and the markets.

Sure, we may be living through a period of heightened uncertainty. But as investors, we’re continually required to make the best decisions we can, with whatever information we have, while knowing we can’t have it all … and that there is no such thing as a certain future.

Every Thursday is “New Bulls” day here at What My System Says Today …

We run a simple screen to determine which stocks have recently earned a “bullish” rating of 60 or higher, after having previously been below that mark for four consecutive weeks.

These stocks may be rated 60 currently … or 99 … but they have each improved their standing in my Green Zone Power Rating system over the past month, and thus are worth a closer look.

Today’s screen should be particularly interesting, given that it covers the four-week period since Trump announced a 90-day pause on the tariffs he threatened to enact one week before.

Given the importance of this four-week period, we’ve also run a “New Bears” screen. This captures any stock that is now rated “bearish” (40 or below), after previously being above that threshold over the prior four weeks.

Let’s get to it …

25 “New Bulls” to Put on Your Watchlist

As mentioned, here’s what my “New Bulls” screen looks for:

- The stock must currently rate 60 or higher (that is, “Bullish” or “Strong Bullish”),

- The stock must have been rated less than 60 for each of the last four weeks.

In short, these are stocks that have been rated “Neutral” or worse … but now are rated “Bullish” or better.

I’ve limited our screen to only the S&P 500 index. Here are the 25 stocks that made the list this week:

Paid-up members of my Green Zone Fortunes newsletter have full access to my rating system on the Money & Markets website – click here to join us.

Above you’ll see three variable of note:

- The one-month change in each stock’s Green Zone Power Rating,

- The price return of each stock since the close of April 8th, and

- The percentage each stock is below its 52-week high.

On average, these “New Bulls” have gained 8.4% since the April 9th “pause” announcement, though they remain an average of 10.4% below their 52-week highs.

I can’t make sweeping conclusions about this list of stocks, other than to say that their Green Zone Power Rating is now “bullish” or better.

Before adding any of these stocks to our portfolio, we’d most certainly want to examine their overall Green Zone rating, as well as their individual factor ratings.

For instance, Monster Beverage (MNST) looks strong as it’s only 1% below its 52-week high, and I can tell you it now has an overall Green Zone rating of 62. But to truly know what we’d be buying if we bought shares of MNST … we’d also want to know the stock’s momentum, volatility, value, quality and growth ratings.

Likewise, you might conclude that buying shares of Humana (HUM) is a good idea now that the stock has pulled back 37% from its highs …

But to truly feel confident buying the stock, we’d want to know the stock’s value and quality ratings, at the very least.

Again, you can gain full access to my Green Zone Power Rating system, across thousands of stocks, with an entry-level membership to my flagship Green Zone Fortunes newsletter.

Now, let’s move on to this week’s “New Bears” report …

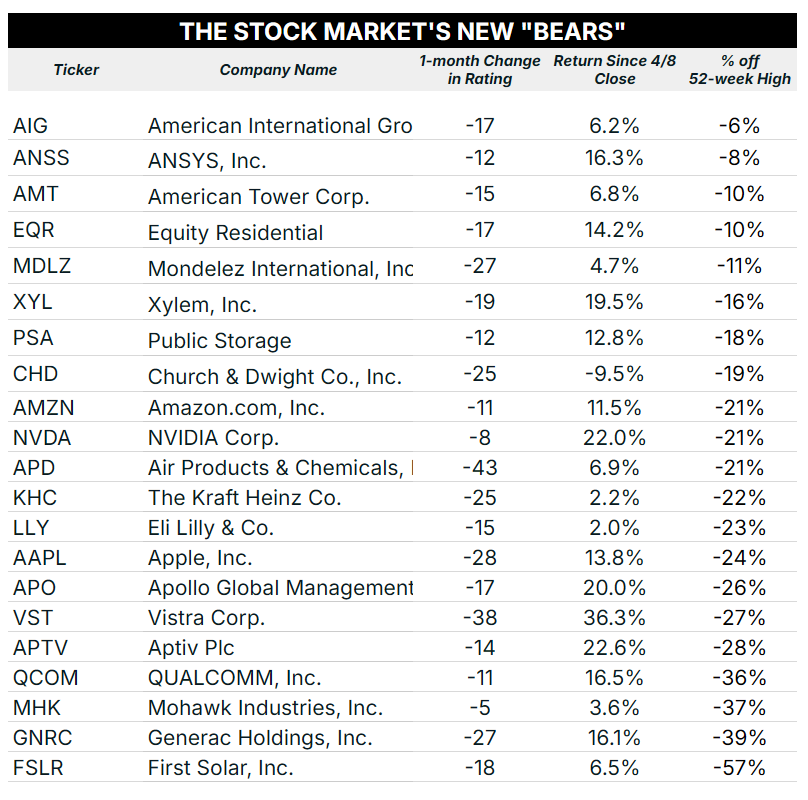

“New Bears” a Whopping 23% Off Their Highs

This “New Bears” screen looks for:

- The stock must currently rate 40 or lower (that is, “Bearish” or “High Risk”),

- The stock must have been rated greater than 40 for each of the last four weeks.

In short, these are stocks that have been rated “bullish” or better … but now are rated “bearish” or worse.

Again, I’ve limited our screen to only the S&P 500 index. Here are the 22 stocks that made the list this week:

Of note, these “New Bears” are now an average of 22.8% off their 52-week highs, which is more than double the average drawdown we saw from the “New Bulls” list.

They have gained an average of 11.6% since the April 9th “pause” announcement, but they clearly still have far more ground to cover ahead if they’re going to get back up to their previous highs … and now my system has them all rated “bearish” or “high risk.”

Caution is warranted!

Until next time…

To good profits,

Editor, What My System Says Today