It was just a few weeks ago that Federal Reserve Chair Jerome Powell acknowledged that inflation could last for some time.

In an appearance at a European Central Bank event, he noted:

The current inflation spike is really a consequence of supply constraints meeting very strong demand. And that is all associated with the reopening of the economy, which is a process that will have a beginning, middle and an end. It’s very difficult to say how big the effects will be in the meantime or how long they last.

This was an initial step toward recognizing the reality consumers face when they go to stores and see higher and higher prices.

But Powell may soon have another temporary scapegoat for inflation. Winter is coming, as it does every year. And energy prices are soaring.

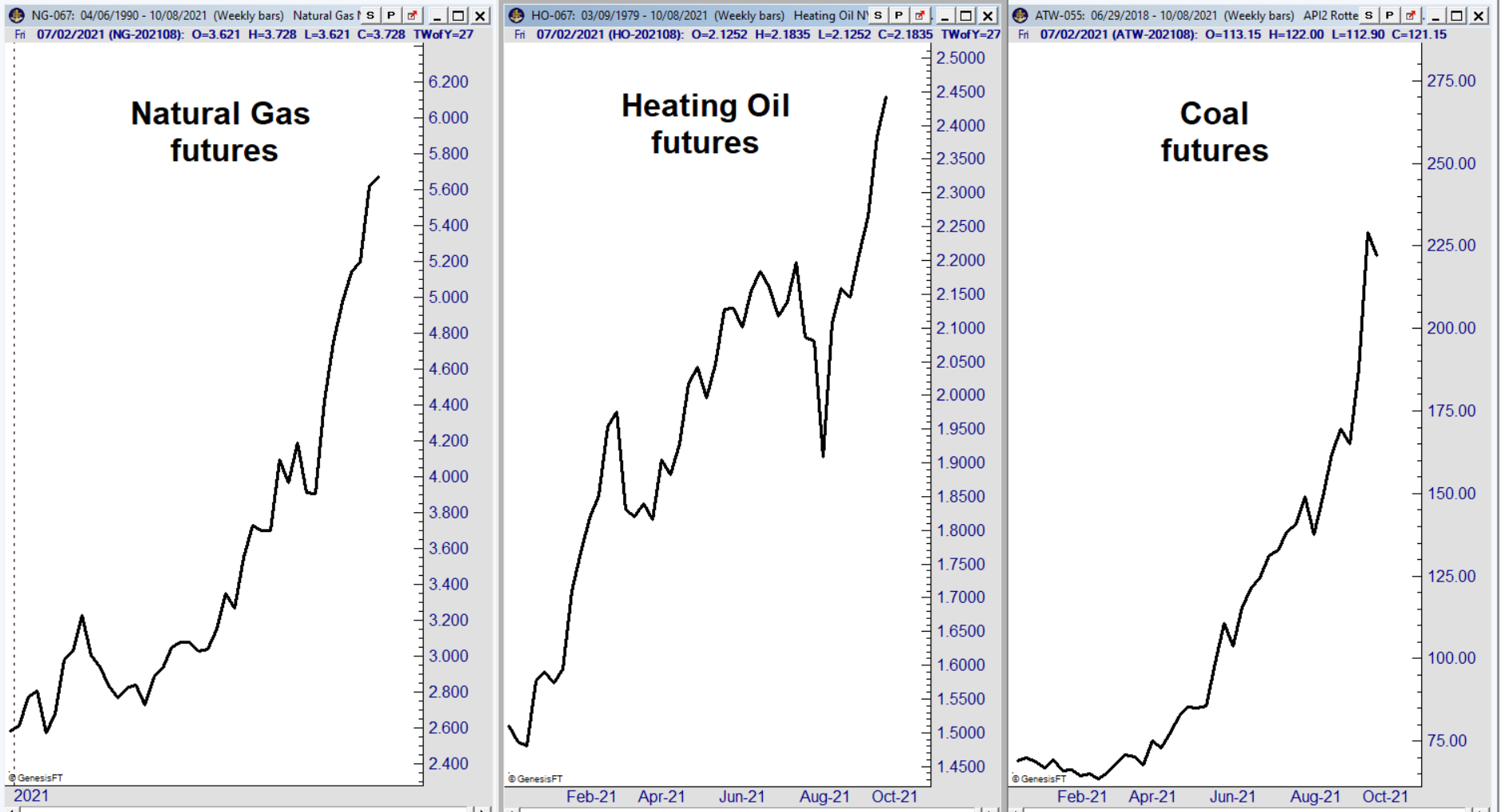

Energy Prices Continue to Rise in 2021

Since the beginning of the year, natural gas prices are up more than 120%. Heating oil gained more than 60% in that time, while coal soared more than 220%.

Energy Prices Are Spiking Worldwide

The Wall Street Journal recently highlighted the reasons for the spike in coal prices:

Global production of coal, which generates around 40% of the world’s electricity, is about 5% below pre-pandemic levels.

In Europe, the rising prices for coal and other energy resources have hit factory output and driven household energy bills higher. Major coal importers in Asia, including Japan and South Korea, are jostling to secure supplies.

In China, dwindling supplies and surging costs have resulted in electricity shortfalls on a scale unseen in more than a decade, hitting industry and prompting some cities to turn off traffic lights to conserve power.

Supply cannot expand quickly. And demand is likely to rise even more as winter arrives and homes that use coal for heat require more of the commodity.

Increased demand for heating will also affect natural gas and heating oil. This points to an expensive winter for consumers and another temporary factor for Powell to cite as a reason to allow inflation to rise.

I’m not quitting anything…

I’m just showing people a new way to make money in the markets.

My typical approach targets setups in individual stocks. With roughly 3,000 U.S. stocks, there’s plenty of opportunity.

But my new approach has simplified everything and boiled the markets down to one repeatable trade in the same ticker symbol.

The annual return was 132% last year. Click here to see how we did it. And most importantly, how it could benefit you.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.

Click here to join True Options Masters.