Money & Markets Week Ahead for the week of December 13, 2020: Online shopping giant Wish IPOs this week.

We’re looking at an active week on Wall Street.

In today’s Week Ahead, I dive into a big initial public offering and the earnings of a company that has fallen from grace.

Here are some things investors should watch on Wall Street this week:

Wish IPO

Following a week with two big initial public offerings (IPO), another substantial IPO plans to launch this week.

Last week, DoorDash Inc. (NYSE: DASH) and Airbnb Inc. (Nasdaq: ABNB) both debuted on the market. DoorDash opened at $180 per share but was down almost 4% by midday Friday.

Airbnb, on the other hand, priced its IPO at $68 per share but opened much higher, at $146 on Friday.

Next Thursday, e-commerce company ContextLogic, which does business as the website Wish, will launch its IPO.

It will trade on the Nasdaq under the ticker WISH.

The Business: In simple terms, Wish is an online shopping website. However, a broader look shows it to be more of a social platform that matches merchants with prospective buyers.

Wish serves customers in the United States and India. Most of the manufacturers of products listed on Wish are in China.

For the first nine months of the year, Wish notched a net loss of $176 million on revenue of $1.75 billion. In the same period a year ago, the company had a loss of $12 million on revenue of $1.33 billion.

So, both losses and revenue are up over the last year.

Following a recent round of private funding, Wish was valued at around $11.2 billion.

Wish IPO Terms: WISH plans to offer 46 million shares of stock at a price between $22 and $24 per share, according to its regulatory filing with the Securities and Exchange Commission.

The company intends to raise $1.1 billion if the stock sells at the top of the price range. It could also bring a valuation for the company of $14.07 billion.

Goldman Sachs, JPMorgan Chase and Bank of America Securities are the lead bookrunning managers for the Wish IPO. Citigroup, Deutsche Bank Securities, UBS Investment Bank, RBC Capital Markets and Credit Suisse are also bookrunning managers.

Cowen, Oppenheimer & Co., Stifel, William Blair, Academy Securities, Loop Capital and R. Seelaus & Co. are co-managers for the offering.

What to Expect: This is a lucrative time for IPOs as investors have a high interest in new companies coming to market.

The Renaissance IPO ETF (NYSE: IPO) — an exchange-traded fund that tracks IPOs — is up 83.6% in 2020 compared to the S&P 500 Index, which has only gained around 11%.

BlackBerry Earnings

This week in earnings will start a little slow but ramp up toward the end.

One company that caught my eye reporting earnings this week is BlackBerry Ltd. (NYSE: BB).

I remember when BlackBerry phones were all the rage. I had to have one.

I don’t even know what they look like anymore.

I looked at the data to see how the company has performed this year.

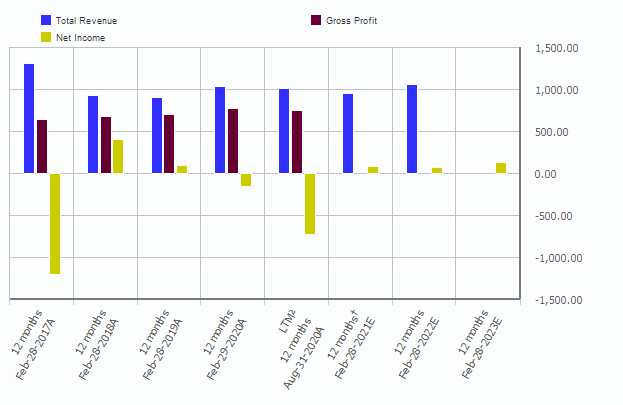

BlackBerry had its best 12 months of revenue back in 2017 when it recorded $1.3 billion.

Since then, it has struggled to crack the $1 billion mark for total revenue.

BlackBerry Ltd. (NYSE: BB) Loses Revenue but Increases Income

Its trailing 12-month revenue ending Aug. 31, 2020, was right at the $1 billion mark.

One good sign for the company is that it has increased its net income.

In 2017, Blackberry’s net income was minus-$1.2 billion. However, that loss was just $732 million for the 12 months ending in August 2020.

Its trailing 12-month gross profit has also improved.

In 2017, profit was $642 million. In the 12 months ending in August 2020, that profit rose to $755 million.

Though its phones aren’t as widely marketed or sold, the company has still managed to increase its profits.

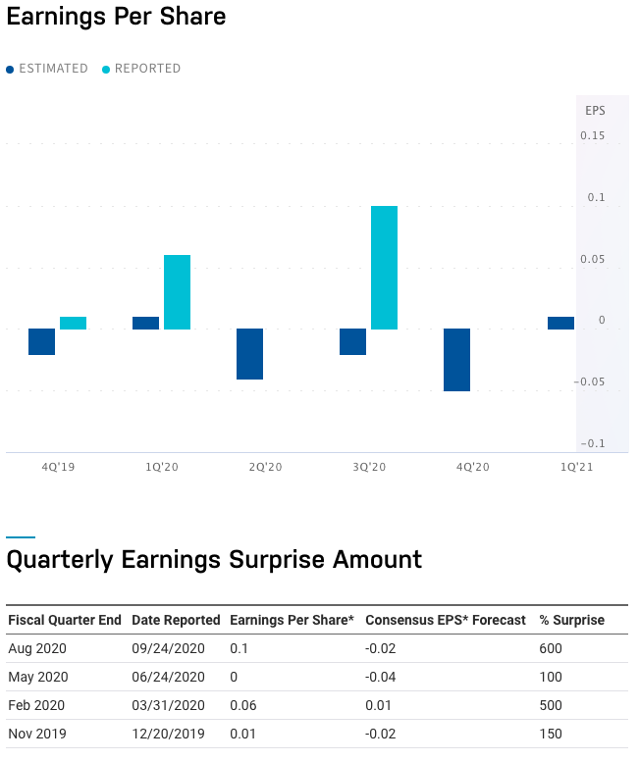

As for its quarterly earnings due out on Friday, I would suspect those earnings to be $0.00 per share. That would be a drop from the plus-$0.01 per share the company earned in the four quarter of 2019.

The company has surprised Wall Street in each of the last four quarters — reporting slightly positive earnings per share despite negative expectations.

BlackBerry Surprised Analysts in Last 4 Quarters

But the issue is that the company has struggled to turn a profit as its products have not kept up with the times … or big smartphone manufacturers like Apple Inc. (Nasdaq: AAPL) and Samsung.

This trend is likely to continue for the immediate future.

Money & Markets Week Ahead: Data Dump

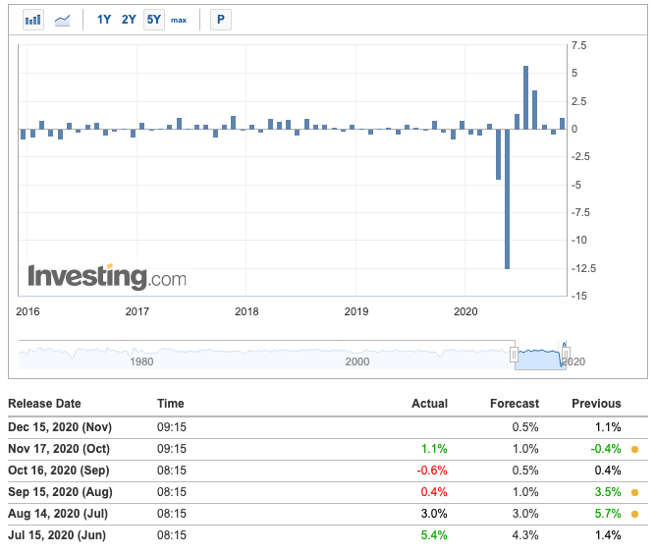

On Tuesday, the Federal Reserve will give insights into national industrial and manufacturing production.

The Fed’s industrial production report measures the change in the total inflation-adjusted value of output produced by manufacturers, mines and utilities.

In October, industrial production rose 1.1% — recovering much of its 16.5% drop from February to April.

Industrial Production: Rose 1.1% in October

However, industrial production was still 5.6% lower than pre-pandemic levels from before February.

Utilities’ output increased 3.9% while mine output dropped 0.6% during the month.

The total index was at of its 2012 average.

For November, analysts are projecting a month-over-month increase of 0.5% — significantly lower than the 1.1% rise in October.

Manufacturing production levels were up 1% on a month-over-month basis in October, but analysts project a slowdown in November. They gauged production to be up just 0.5% last month.

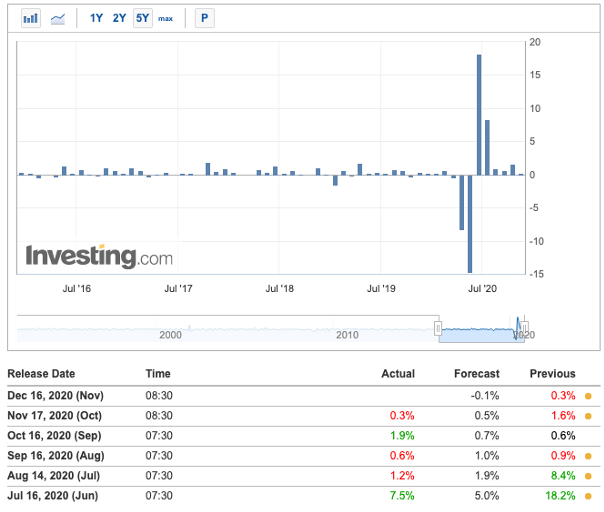

On Wednesday, the Census Bureau will release its monthly retail sales report for November.

The report examines the change in the total value of sales at the retail level. It helps us gauge consumer confidence.

In October, monthly sales ticked up slightly — a 0.3% increase from the previous month. This was far less than the 1.6% gain in retail sales reported for September.

Retail Sales: Slight Increase in October

Analysts have forecast a minus-0.1% drop in sales for November on a month-over-month basis, despite the holiday shopping season that started after Thanksgiving.

Later on Wednesday, the Federal Open Markets Committee (FOMC) will conclude its two-day December meeting, and Federal Reserve Chair Jerome Powell will discuss the Fed’s interest rate policy — which is expected to remain unchanged, holding interest rates between 0.00% and 0.25%.

Finally, on Thursday, the Federal Reserve Bank of Kansas City will release its manufacturing activity survey.

This tracks manufacturing activity in the 10th Federal District, which includes Kansas, Colorado, Nebraska, Oklahoma, Wyoming and parts of Missouri and New Mexico.

In November, the composite index was at 11, slightly lower than 13 reported in October. This indicated a slight slowdown but modest growth in activity.

Money & Markets Week Ahead: Earnings Reports

To finish off the Money & Markets Week Ahead, here’s a look at some of the key earnings reports due out next week:

Monday

Hexo Corp. (NYSE: HEXO)

Vince Holding Corp. (NYSE: VNCE)

Tuesday

Nordson Corp. (Nasdaq: NDSN)

Aspen Group Inc. (Nasdaq: ASPU)

Wednesday

Lennar Corp. (NYSE: LEN)

Winnebago Industries Inc. (NYSE: WGO)

Blue Bird Corp. (Nasdaq: BLBD)

Thursday

FedEx Corp. (NYSE: FDX)

Cintas Corp. (Nasdaq: CTAS)

General Mills Inc. (NYSE: GIS)

BlackBerry Ltd. (NYSE: BB)

Rite Aid Corp. (NYSE: RAD)

Friday

Nike Inc. (NYSE: NKE)

Carnival Corp. (NYSE: CCL)

That’s all for this week.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.