Before COVID, you could shop online for groceries. But it wasn’t the first choice for most shoppers.

Post-COVID, the habit has set in after lockdowns and fear of contracting the virus changed the way we shop.

Now more people are shopping for groceries online than going to the store:

Research firm eMarketer reports the percent of online grocery shoppers in the U.S. in 2019 was only 33.8%.

By 2025, that number is expected to reach 55.8%.

This leads me to today’s Power Stock: a grocery store chain in the Northeastern U.S. with a strong online grocery presence: Weis Markets Inc. (NYSE: WMK).

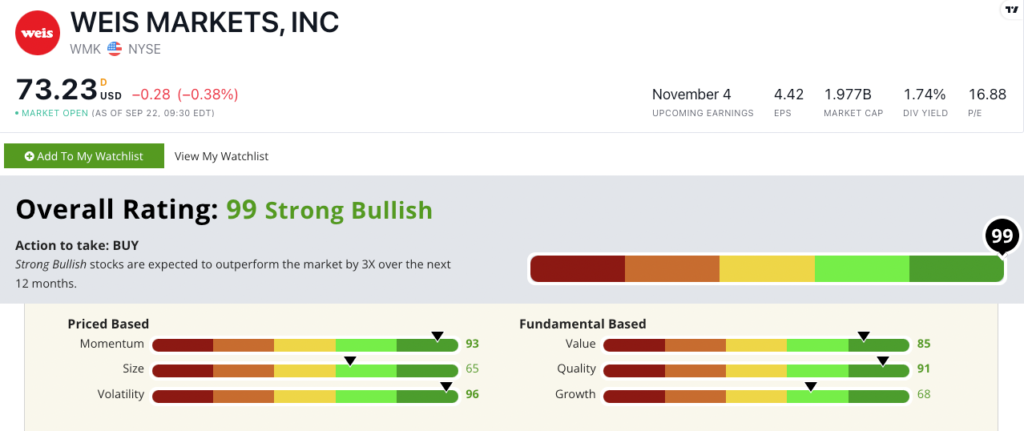

WMK's Stock Power Ratings in September 2022.

Weis Markets operates more than 100 grocery stores and an e-commerce platform.

Fun fact: Weis offered online grocery shopping in 2005. Grocery giant Walmart didn’t start e-commerce until a year later.

WMK scores a “Strong Bullish” 99 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

WMK Stock: Strong Quality and Value With Great Momentum

Here’s what I found interesting about WMK:

- In the first six months of 2022, net income increased by 17% to $67 million compared to the first half of 2021.

- WMK registered $952.4 million in grocery sales for the second quarter — 6% higher than the same quarter a year ago.

These are strong sales numbers. And that’s during a period of high inflation — when groceries are more expensive than they were six months ago.

It rates a 91 on our quality metric, with positive returns on assets, equity and investment. For comparison, its food and beverage retail peers all average negative return-ons.

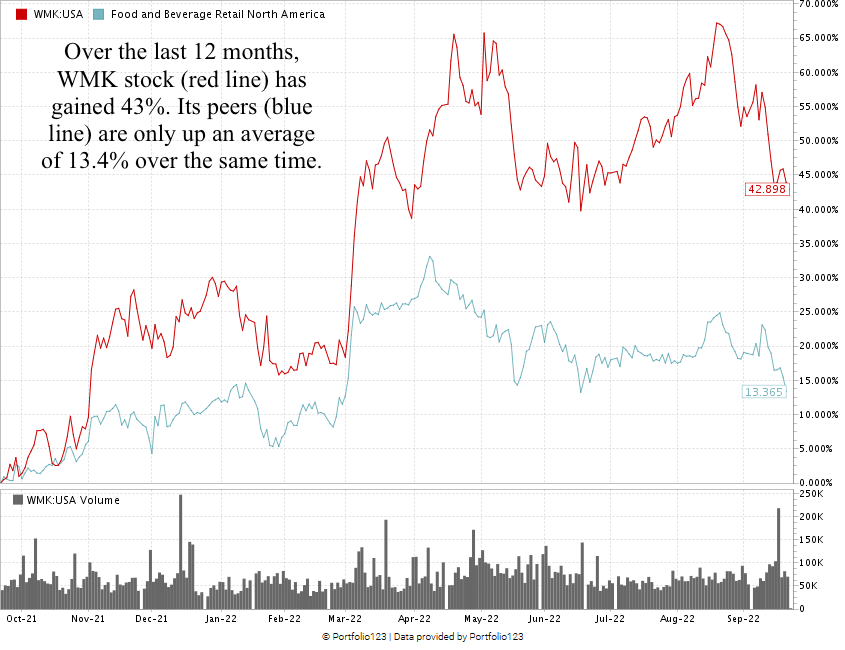

Created in September 2022.

WMK stock excels most on momentum, where it rates a 93:

WMK hit its 52-week high at the end of August 2022 after gaining 20.6% from a dip in April.

Over the last 12 months, the stock is up 43% — more than three times its peers!

Weis Markets stock scores a 99 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Despite high inflation, people across the U.S. need groceries. And they’re buying them online.

Weis Markets was ahead of the big grocery players in adopting online grocery sales.

This early entry into online grocery shopping is one reason to add WMK to your portfolio.

Bonus: WMK’s 1.74% forward dividend yield pays shareholders $1.28 per share per year — just to own the stock.

Stay Tuned: Midstream Oil Company Rates 97 Overall

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a midstream oil and gas company up over 150% in the last year.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.