When you think oil, gasoline and engines come to mind.

We equate oil with making our cars go.

But oil is in much more: Manufacturers use tons of oil to keep their machines and instruments lubricated and running at peak performance levels.

This chart shows the growth of the global industrial oil market.

From 2021 to 2030, the market’s value will grow 58.4% to $150 billion.

That’s ideal for today’s Power Stock, Canadian oil and gas producer Enerplus Corp. (NYSE: ERF).

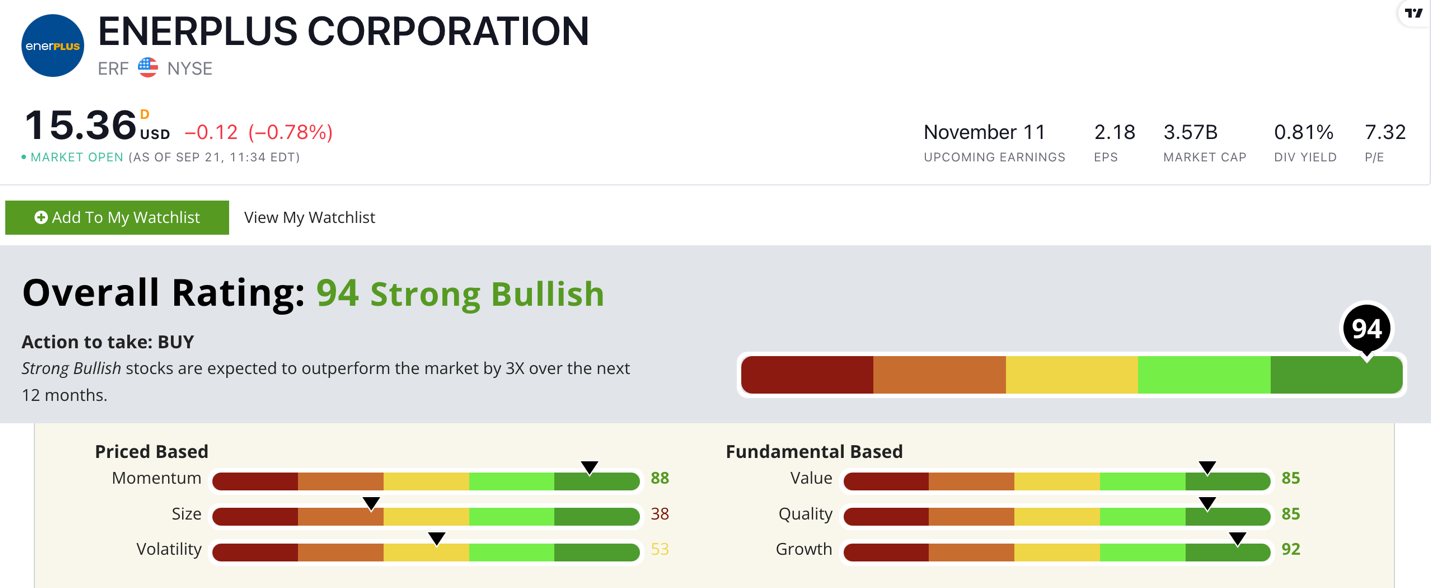

ERF Stock Ratings in September 2022.

ERF explores oil and natural gas prospects in Canada and holds interests in the U.S.

Enerplus scores a “Strong Bullish” 94 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

ERF Stock: “Strong Bullish” Fundamentals + “Maximum Momentum”

While deep-diving into ERF, I discovered two compelling items:

- In the second quarter of 2022, ERF generated $244.4 million in net income — a 508.2% increase from a year ago.

- The company increased its production guidance for 2022, expecting to produce even more oil to match increasing demand.

The increase in quarterly income is a big reason ERF earns a 92 on our growth factor.

While the company scores in the green on all our fundamental metrics, I want to focus on quality.

ERF has an impressive return on equity of 89.9%, while its industry peers average just 21.2%.

This tells us that not only is ERF more profitable than its peers, but it generates those profits more efficiently.

ERF’s return on assets is nearly five times greater than its peers’, meaning its assets turn an above-average profit.

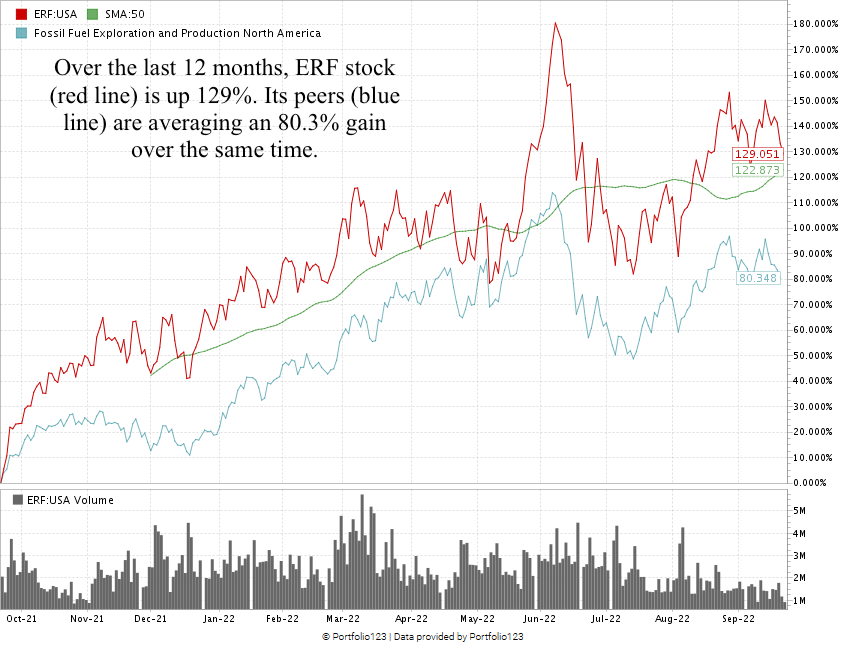

Created in September 2022.

The stock is up 129% over the last 12 months, beating the broader fossil fuel exploration industry, which is up 80.3%.

It shows the “maximum momentum” we love to see in stocks.

Enerplus Corp. stock scores a 94 overall on our proprietary Stock Power Ratings system.

That means we consider it “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Global oil demand isn’t going away anytime soon.

Enerplus has a proven track record of growing profits and getting the most out of its oil-producing assets.

Oil and gas producer ERF is a strong contender for your portfolio.

Bonus: The company’s 1.3% forward dividend yield pays shareholders $0.20 per share, per year to own the stock.

Stay Tuned: Top-Notch Grocer to Buy

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a mid-Atlantic food retailer that rates a 99 on our system.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.