Last month was the second-hottest July in the U.S. in two decades.

On the flip side, January’s average temperature was the lowest since 2014.

We’re facing hotter summers and colder winters.

Reliable heating and air conditioning in our homes and offices is more important than ever.

The chart above shows that the revenue from HVAC equipment sales in the U.S. will increase 23.8% from 2020 to 2024.

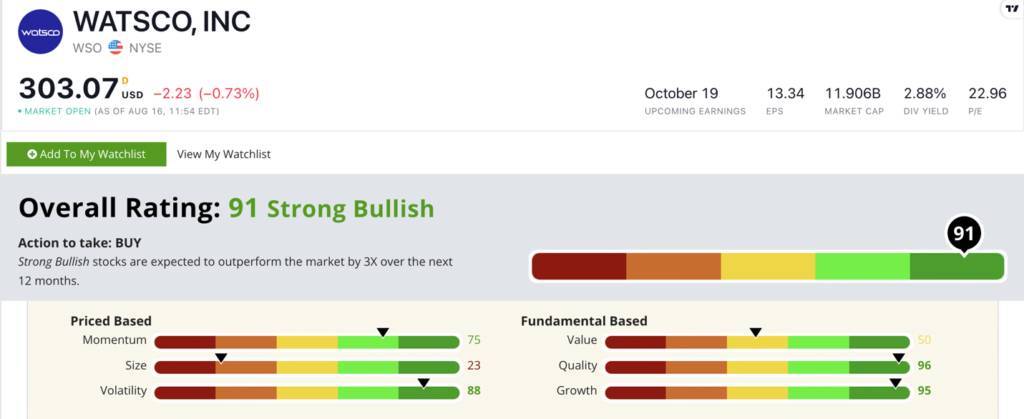

Today’s Power Stock distributes HVAC equipment in the U.S. and other parts of North America: Watsco Inc. (NYSE: WSO).

WSO Stock Power Ratings in August 2022.

WSO sells heating and air conditioning units and the parts and supplies needed to keep those units running.

Florida-based Watsco’s stock scores a “Strong Bullish” 91 out of 100 on our Stock Power Ratings system. We expect it to beat the broader market by 3X in the next 12 months.

WSO Stock: Low Volatility + Strong Quality and Growth

Watsco crushed the second quarter:

- Recorded $287 million in operating income — that’s 32% higher than the same quarter a year ago!

- Its gross profit was $596 million — a new high mark for WSO and a 25% jump from last year.

And that’s after WSO set sales, profit and net income records last year.

Those numbers are why WSO earns a 95 on our growth metric.

It scores an even-higher 96 on the quality factor in Stock Power Ratings.

The company’s return on investment is 22.3% — almost double its industry peers, which average 12.9%.

Its margins (gross, net and operating) are also all stronger than its peers’.

These numbers tell us WSO is a terrific growth and quality stock compared to the rest of the diversified industrials distribution industry.

WSO has jumped more than 35% higher since July, as you can see above.

It’s now trading around $47 above its 50-day simple moving average (green line in the chart above) — a bullish indicator.

WSO is up 12% for the year. Its industry peers, on the other hand, are down 2.2% over the same time.

Watsco Inc. stock scores a 91 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Bottom line: Summers are getting hotter, and winters are getting colder.

We’ll need better heating and A/C units in our homes and offices as that trend continues.

A leader in the field, WSO is a top candidate for your portfolio.

Stay Tuned: "High-Risk" Stock to Avoid

I’m switching it up in tomorrow’s Stock Power Daily. Instead of a top-rated company, I’ll analyze a stock to avoid right now.

Stay tuned for the next issue, where I’ll share all the details on a “High-Risk” sports team stock to dump.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.