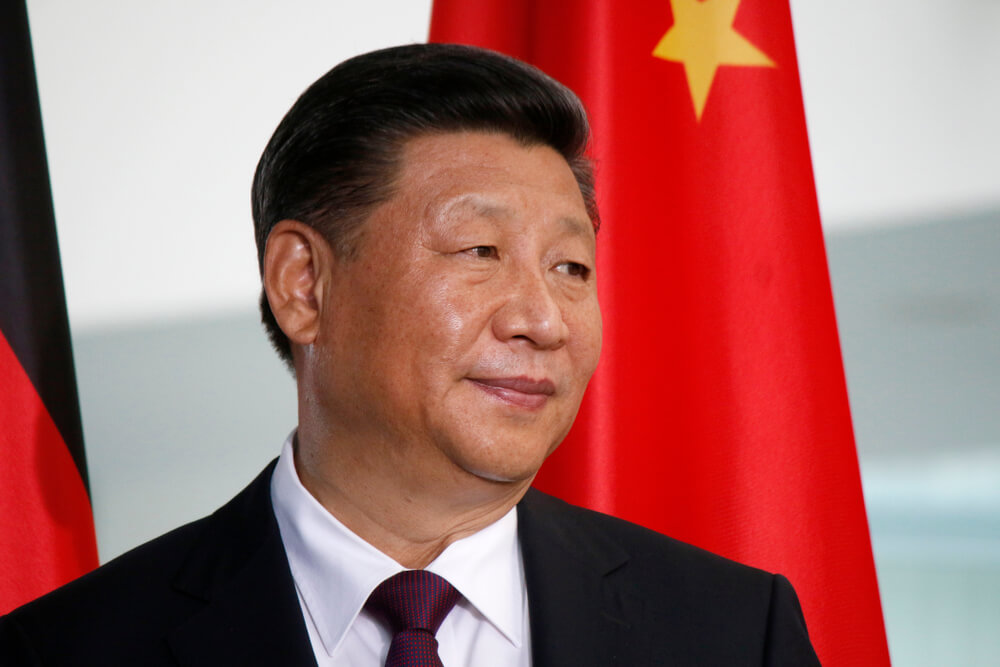

With trade tensions between the U.S. and China escalating the past two weeks, China reportedly sold $20.5 billion worth of U.S. Treasury holdings in March, and its president, Xi Jinping, slammed “foolish” efforts by the Trump administration to try and force other countries into new trade agreements.

“To think that one’s own race and civilization are superior to others, and to insist on transforming or even replacing other civilizations, is foolish in understanding and disastrous in practice,” Xi said Wednesday during a speech in Beijing, his first address since the recent escalation.

“Exchanges and mutual learning among civilizations should be reciprocal and equal,” he continued with thinly veiled shots at the Trump administration. “They should be diversified and multidirectional, rather than compulsory or coercive. They should not be one way.”

The sell-off brings China’s bond holdings down to $1.12 trillion, the lowest level it’s been in two years — though Beijing is still the No. 1 foreign holder of U.S. debt.

The worry of course is that China could use its position as the world’s top holder of U.S. debt as leverage in the ongoing trade negotiations.

In the latest 12-month period ending in March, China’s holdings of U.S. government notes, bonds and bills fell by $67.2 billion, or 5.6%. The holdings have shrunk by about $200 billion since its peak in 2012, now representing 7% of total outstanding U.S. debt, compared to 12% previously.

“The Chinese people’s beliefs are united and their determination as strong as a rock to safeguard national unity and territorial integrity, and defend national interests and dignity,” Xi said Tuesday.

China not buying more U.S. debt and outright selling some of it off is a major threat to the U.S. bond market.

Beijing ultimately could escalate things further by slashing more bonds. According to UBS, if the bond reduction is gradual, it could result in a 0.4% rise in the benchmark 10-year Treasury.

“To the extent that China’s Treasury sales could be either the cause or the effect of a more risk-averse global environment, the positive impact on Treasury yields could be smaller than estimated if private investors step up their Treasury purchases,” UBS strategists said in a note to clients.

However, selling U.S. Treasurys will ultimately hurt China, the U.S. and the world by suppressing the value of the dollar and strengthening the yuan, making Chinese exports more expensive — and harder to sell — in a dangerous game of currency manipulation.

Japan is the second-largest holder of U.S. debt, with about $1.08 trillion, and the U.K. is third with about $317.1 billion.

Foreign ownership of U.S. debt is currently $6.47 trillion, up 4% from a year ago as the national debt continues to grow above $22 trillion.