A recent National Review article caught my eye the other day. Western governments are throwing money at the electric vehicle (EV) market.

EV investment in the U.S. alone is substantial.

There’s $5 billion for a national charging network … millions in taxpayer dollars to fund EV-battery manufacturing plants in the U.S. … and thousands in tax credits for EV purchases.

Zooming out, data firm Mordor Intelligence calculates that the global EV market will grow more than 238% from 2021 to 2027.

While this is a booming industry, our Stock Power Ratings system shows that not all EV manufacturers make great investments.

This is the case with XPeng Inc. (NYSE: XPEV).

XPEV Struggles in the World’s Largest EV Market

The Chinese company started in 2015 but didn’t begin trading on the American market until 2020.

XPEV soared 240.1% from its initial public offering launch in August 2020 to November of that year.

But it has struggled since then.

You see, its EV line is still mostly limited to the Chinese market, which has since become saturated with nearly 300 companies producing these vehicles in China.

That has put enormous pressure on smaller companies like XPEV.

And a quick look at our Stock Power Ratings system helps you see the real picture of a company.

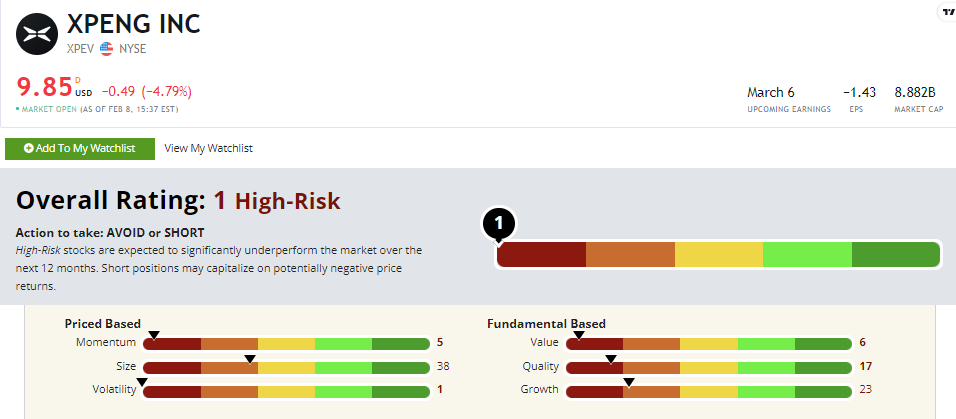

XPeng stock scores a “High-Risk” 1 out of 100 on our Stock Power Ratings system, and we expect it to underperform the broader market over the next 12 months.

XPeng Stock: Fundamentals and Technicals in the Red

Here is where I usually tell you about impressive company milestones.

Not so much for XPEV:

- In its recent quarterly report, the company saw a 1% decline in vehicle sales from the previous quarter!

- Its year-over-year net loss expanded by 49%.

That shows why XPEV scores a 23 on growth.

It also scores in the red on our other five factors.

XPEV’s negative price-to-earnings ratio means it can’t keep its financials afloat. It scores a horrible 6 on value.

The company has returns on assets, equity and investment that are deeper in the red than its industry peers. Hence the 17 rating on our quality factor.

This stock is wildly overvalued, and its financial bottom line is far from being in good shape.

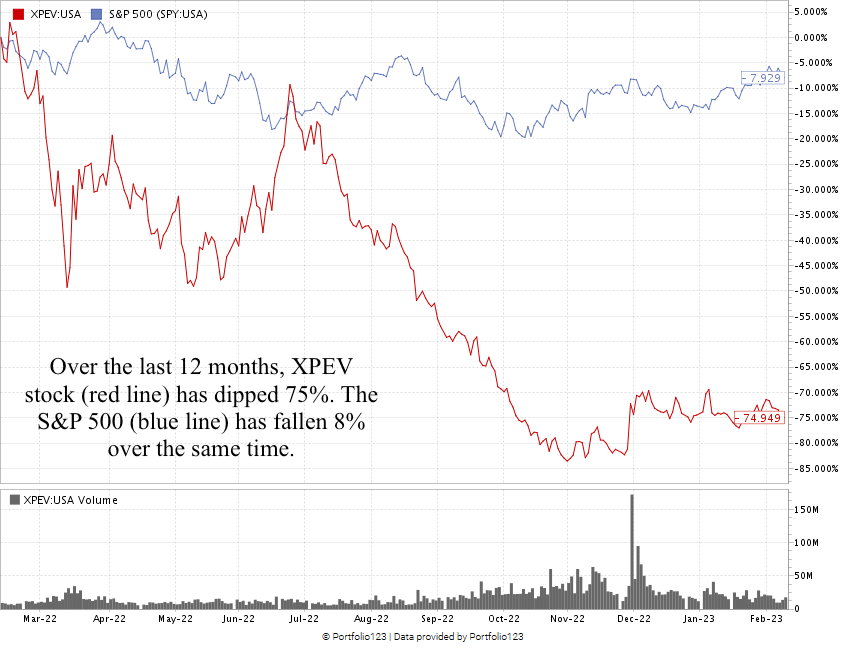

The last 12 months have not been kind to XPeng stock.

It’s fallen 75% over the last year, while the broader S&P 500 has only dropped 8%. That’s shown in the chart below.

Created in February 2023.

XPEV stock scores a horrendous 1 overall on our proprietary Stock Power Ratings system.

That means we consider it “High-Risk” and expect it to underperform the broader market.

The EV market is booming, and governments are putting a truckload of money behind EV infrastructure.

But competition in the market is tight, meaning a lot of smaller companies won’t survive.

A quick look at our Stock Power Ratings system shows that the massive red ink in its ledger makes XPeng stock one to avoid.

Stay Tuned: A Safe Way to Go “Short”

Tomorrow’s going to look a little different in Stock Power Daily.

Adam O’Dell is going to stop to show you why 2023’s rally will reverse and how you can take advantage of it with one stock.

And on that front, Adam is going live later today to reveal his No. 1 stock for what he’s calling “The Next Big Short.”

This is your last chance to sign up for the premiere of this event that’s going live at 1 p.m. Eastern today.

You don’t want to miss it!

Until next time…

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. I’d love to hear what you thought about my “Stock to Avoid” article today. Was it valuable? Would you like us to continue sharing high-risk stocks on occasion, so you know what to stay away from?

Would you prefer that we only share “Bullish” and “Strong Bullish” stocks?