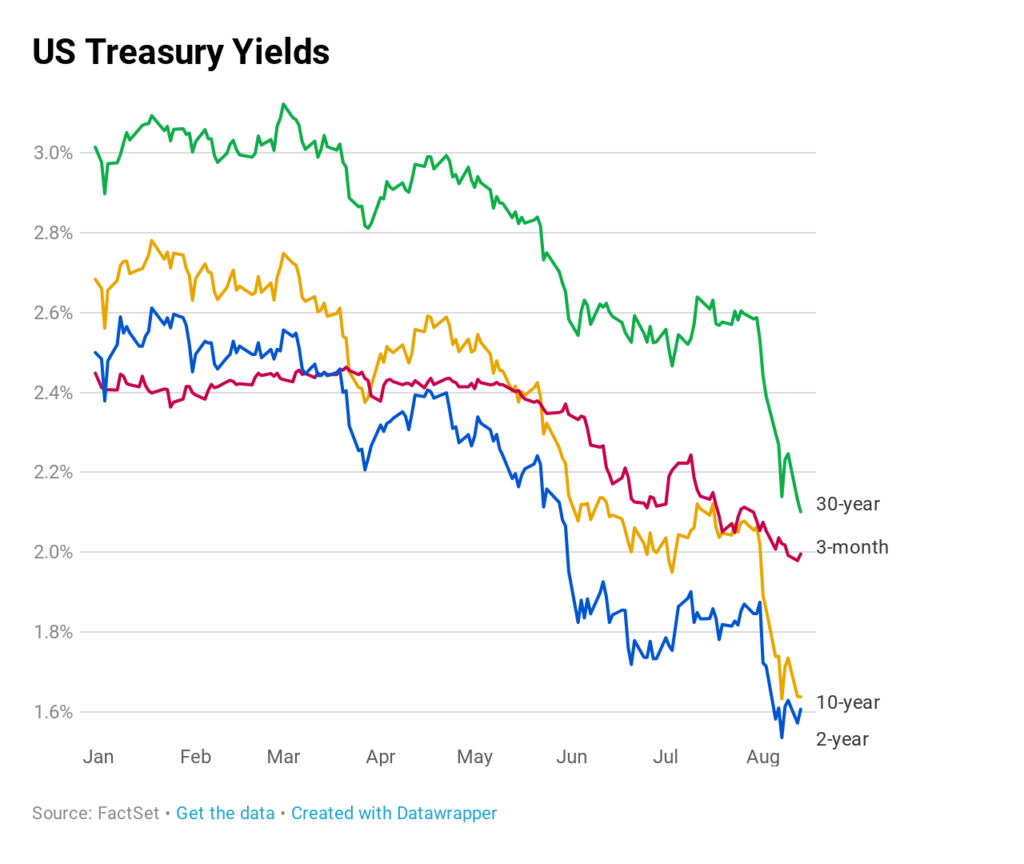

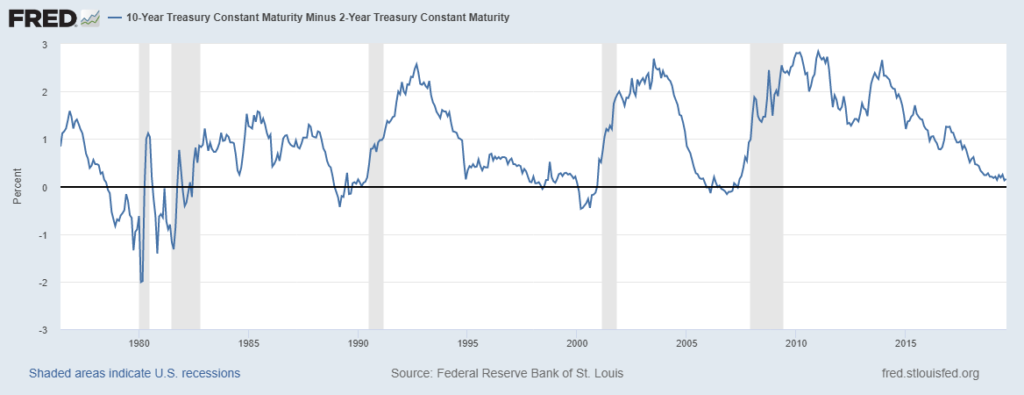

Yield curve warning lights are flashing again as the 10-year Treasury note nearly dipped below the 2-year U.S. note on Tuesday in a key recession indicator.

An “inverted yield curve” happens when the 10-year Treasury curve dips below the 2-year, and it means that investors are demanding higher interest rates on short-term debt instead of longer-term debt. The curve is monitored closely because an inversion has preceded every recession that has happened in the last 50 years, even if it doesn’t hit until months later.

Uncertainties about global economic growth and the trade war between the United States and China has driven many investors away from stocks and into the bond market, which has led to greater fluctuations in yields lately.

On Tuesday, the yield on the benchmark 10-year Treasury note had risen to 1.691% by around 2:30 EDT, with the 2-year note at just 1.673.

But it had come within just one basis point of inversion earlier in the day, according to CNBC. The yield between the 10-year Treasury and the 3-month note did invert last week after the U.S. stock market suffered its worst day of 2019.

One basis point is 0.01%.

The yield on the 30-year treasury bond was struggling Tuesday as well, trading barely above its all-time low of 2.14%, according to CNBC. Yields drop as bond prices rise.

August has been a rough month for long-term yields as investors grow more worried about GDP growth and trade developments. Central banks around the world are becoming more aggressive, too, as they fight to keep the economic expansion going while also worrying about too-low inflation rates. The 10-year Treasury note, which is used by banks to set mortgage rates and other forms of lending, has plummeted 35 basis points in August alone.

And the theme may continue on as GDP growth and inflation estimates have softened over the last year, according to CNBC.