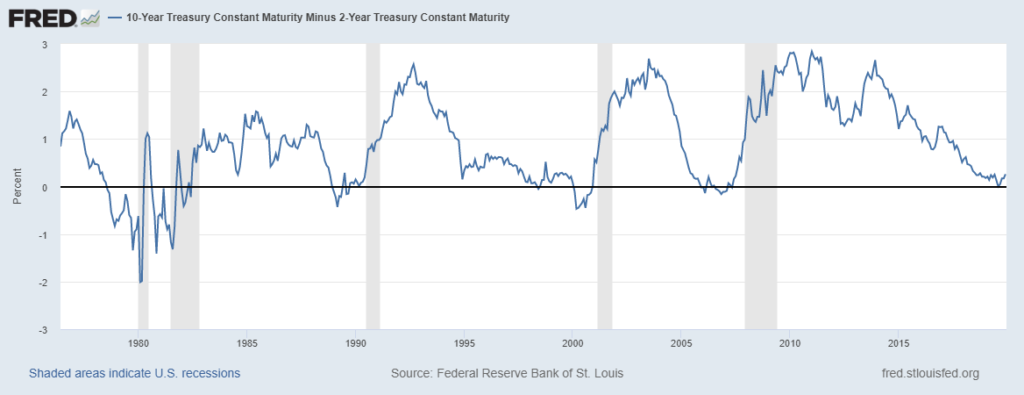

Flashback to this summer when 2-year Treasury yields surpassed those of 10-year Treasurys — the dreaded yield curve inversion, a long-time recession indicator.

The market when into an absolute panic. The Dow dropped 800 points in a day.

It was market pandemonium.

Four months later and that yield curve inversion — a trusted benchmark for an impending recession — has reversed itself as the distance between the 2-year Treasury yield and the 10-year yield ballooned to 28.7 basis points. That’s the largest gap since November 2018.

“The Fed is on hold, the economy is doing well, and trade tensions aren’t increasing. In such a world, a steeper curve follows intuitively,” BMO head of U.S. rates Ian Lyngen said in a note Wednesday, according to CNBC.

There is justification for Wall Street paranoia with a yield curve inversion. The inversion has accurately predicted each of the last five recessions dating back to 1980.

The yield curve inversion reversal should mean investors holding a ticker-tape parade up and down Wall Street, but not so fast.

We have to keep in mind that a recession doesn’t happen immediately after a yield-curve inversion. In fact, historically, the yield curve will right itself just before a recession hits.

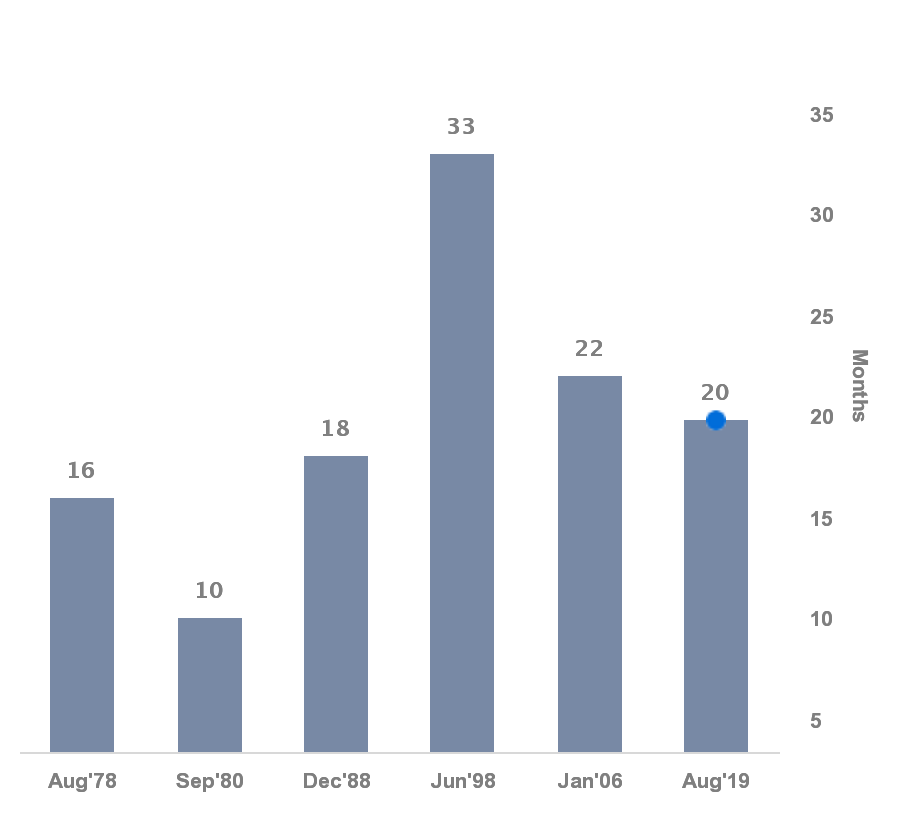

Consider it was 22 months from the time the yield curve inverted in January 2006 to when we actually hit a recession.

Source: Treflis

Yield Curve Inversion Reversal Doesn’t Translate to No Recession

DoubleLine Capital CEO and “Bond King,” Jeffrey Gundlach said in September that despite the reversal, there’s still a strong chance of a recession before the 2020 presidential election.

“What happens before recession every time in a very convincing pattern is that first consumers start to feel bad about the future,” he said. “They say ‘the future looks worse than how I feel about the present.’ And that started a while ago now, where the view of the future was much grimmer than the view of today.”

The numbers seem to suggest Gundlach may be on to something.

The Consumer Confidence Index dropped 0.6 points in November — the fourth consecutive month of decline. The Present Situation Index also fell in November.

“The way history has kind of proved to work … is the curve inverts well before a recession,” Gundlach said. “What people don’t understand is that when the recession is getting to be close to your doorstep, the curve actually steepens out because the Fed gets the jokes, finally, that they’re behind the curve and they need to cut interest rates more.”

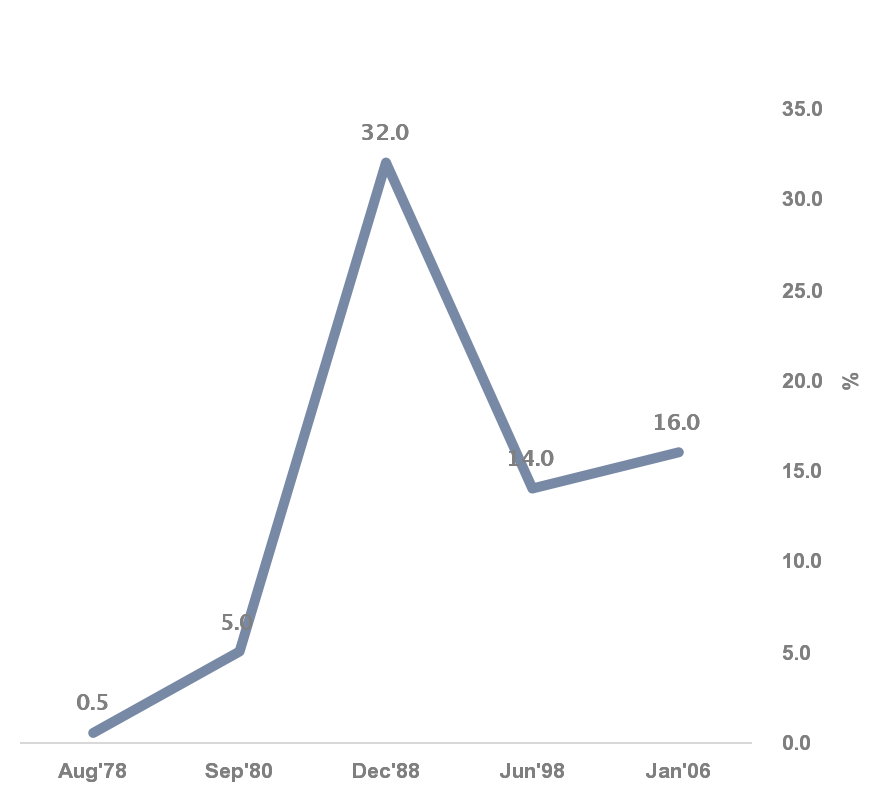

S&P 500 Performance and Yield Curve Inversion

What’s even more interesting is the fact that, historically, the S&P 500 has performed well in between the time of the yield curve inversion and when a recession actually hits.

Source: Treflis

In 1988, the S&P 500 rose more than 32%. It jumped by 16% between the 2006 yield curve inversion and the 2008 recession.

Since the Aug. 14 low of 2,840.6 to Dec. 18’s close of 3,191.14, the S&P 500 has gained 12.3%.

Source: Macrotrends.net

So while the yield curve inversion reversal may be taken as a sign that markets will be solid into 2020, we have to take into account the time factor.

Because the average time between a yield curve inversion and a recession is around 20 months, we are nowhere near out of the woods. Come late 2020 and early 2021 those recession trends may become more prevalent and should not be ignored.