I’m a cautious optimist. In the long run, I’m confident the economy and markets will weather even this storm.

But I’m also a trader. So I know that if the broad-based rally in stocks since the March 23 low turns out to be nothing more than a bear-market rally, we should prepare to see a retest of those lows … and to watch prices make new lower lows, if even just by a bit.

And since many stocks are now trading back up toward either their 50-day or 200-day moving averages, I’m expecting to see resistance (aka selling pressure) that could stall or reverse the sharp advance many stocks have made over just the past three weeks.

In short, if you’re looking to add a short-stock play to your portfolio … I think now’s a great time to do it.

That’s what I told my Cycle 9 Alert readers to do this week (which you’ll be able to sign up for here on Money & Markets very soon).

Real-estate technology firm, Zillow Group (NYSE: Z) last reported earnings on Feb. 19.

In hindsight, we now know that was precisely the date of the peak in the broader stock market. But as it was happening, no one really knew.

Zillow reported numbers that investors were apparently encouraged by … shares of the stock jumped higher on Feb. 20 and 21, as most other stocks began to slip lower.

Ultimately though, Zillow has been unable to escape the wrath of the sell-off. From high to low, shares fell 66% between Feb. 21 and March 18!

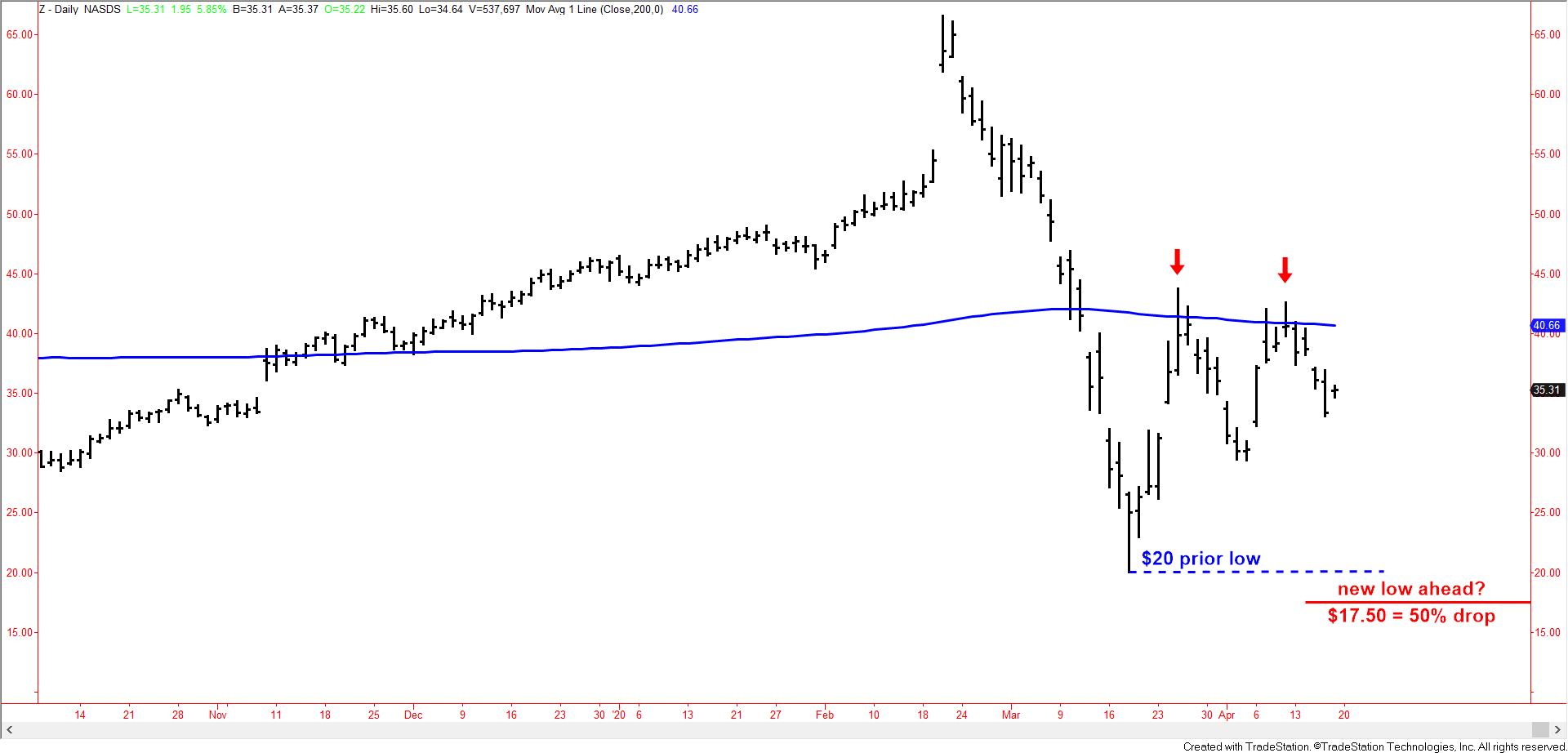

Then following that late-March low, the stock bounced higher along with the rest of the market’s (bear-market?) rally. Shares bounced more than 100% higher — from a low of $20 to as high as $40 by April 9.

That $40 level is roughly where the stock’s 200-day moving average currently sits. And so far, two of the stock’s recent advances have failed to break above this resistance zone — once during the last week of March, and then again the week before last week including April 9.

Have a look…

When the Music Stops, Is Zillow Caught Holding the Bag?

The concern over Zillow’s business isn’t a secret. The company relies heavily on advertising revenue, which stands to be choked off by the broadly contracting economy.

There are already reports of significant decreases in the number of new homes listed for sale, yet current inventory levels are creeping higher, suggesting that interest on the buyers’ side is also weakening.

And then there’s the possibility of Zillow getting stuck holding a big bag of properties it never truly wanted to own in the first place.

Aimed at increasing revenue, Zillow began buying homes directly from sellers in 2018. Their intention has always been to quickly turn them around and sell on the open market — aka “flip” them. They ramped up this program throughout 2018 and added several new markets in 2019.

Now, Zillow owns nearly 2,000 properties … and it remains to be seen how quickly they’ll be able to unload that unwanted inventory, and at what prices.

By the way, Zillow was already losing as much as $80 million a quarter on its “home-flipping” business, well before the COVID crisis.

And while their Feb. 19 earnings report showed a dramatic increase in advertising revenue, the entire business is still not turning a profit — earnings per share came in at a loss of $0.26.

As I led with, I’m a cautious optimist and I’m sure the economy and U.S. property market will, in the end, weather even this most unusual storm. But in the near term, Zillow’s business is under significant threat from a slowdown.

If investors don’t have the appetite to buy or hold Zillow shares at $40 or above, the stock could easily tumble down to retest its March 18, $20 low.

A drop to $17.50 would mean a 50% loss from its current price of $35.

Adam O’Dell

• Adam O’Dell is the Chief Investment Strategist for Money & Markets and editor of Green Zone Stocks, Cycle 9 Alert and 10X Profits.