Zoom has become part of our everyday vocabulary during the lockdown.

The videoconferencing tool was already used in offices. But Zoom became ubiquitous as schools shut down and education moved online. And social interactions like Zoom happy hours are now commonplace.

Not surprisingly, Zoom Information Systems (Nasdaq: ZM) became one of the best performers in the stock market. The stock soared as much as 615% since the beginning of the year.

However, ZM sold off earlier this week after an analyst questioned the stock’s valuation. Morgan Stanley is “beginning to lean more cautious as valuation prices perfection.”

Valuation is measured with tools like the price-to-earnings (P/E) ratio. Value stocks often have P/E ratios below 20. Even after the sell-off, ZM has a P/E ratio of more than 190. Morgan Stanley seems to believe a P/E ratio of 140 is more appropriate for the stock.

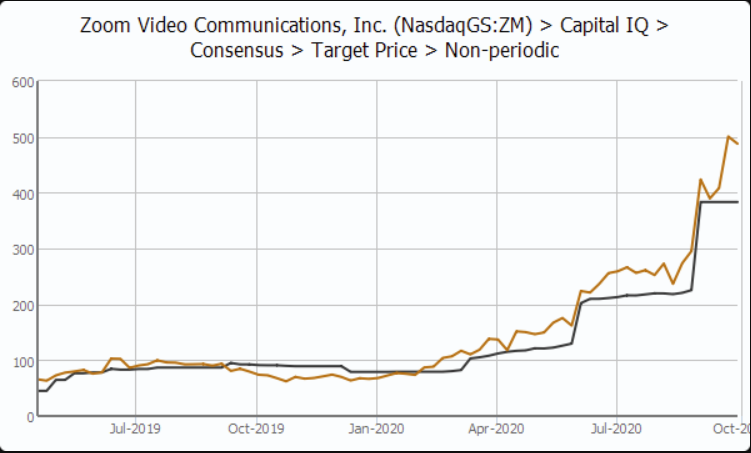

Most analysts agree that ZM is overvalued. The chart below shows that analysts’ target prices for the stock (the black line) have consistently been below the share price (the gold line).

ZM’s Stock Price Consistently Beats Analyst Targets

Source: Standard & Poor’s

While ZM is likely to decline, the speed of that decline is among the most important economic indicators to watch.

Zoom Stock May Signal a Return to Normalcy

As Zoom became popular, offices became less popular.

Stocks of companies associated with leasing office space declined. Boston Properties, Inc. (NYSE: BXP) is the largest publicly traded developer and owner of Class A office properties in the United States. Shares of BXP dropped more than 50% during the coronavirus crash in March and remain well below from their February high.

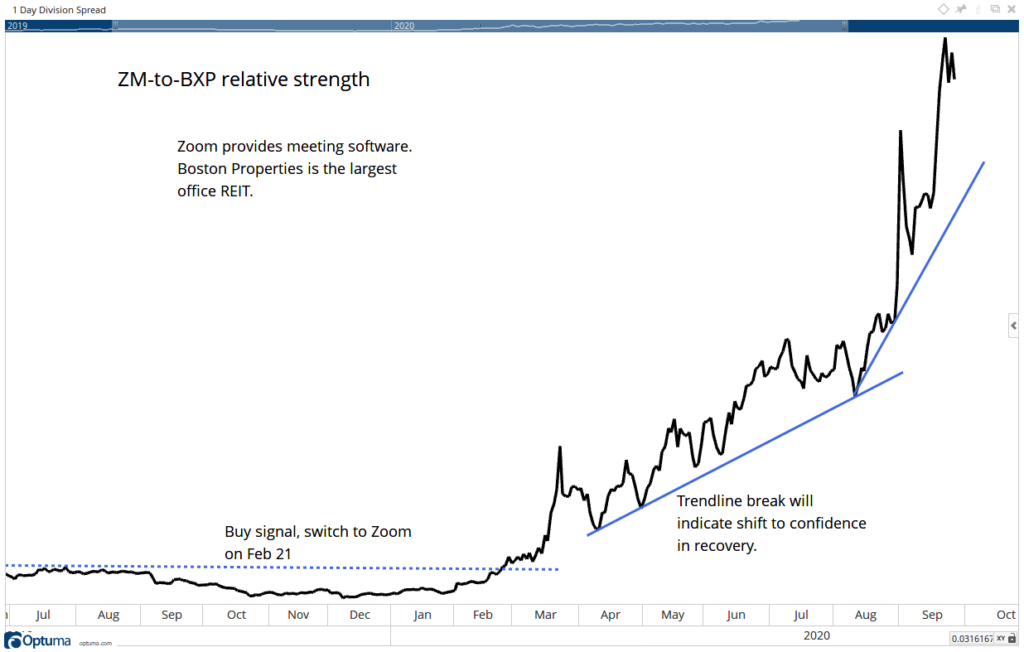

Comparing the performance of ZM and BXP provides insight into the economy. The chart below shows the ratio.

ZM-to-BXP: The Shift From Office Space to Online

Source: Optuma

When the relative strength line in the chart above is rising, Zoom conferences are more popular than office spaces. A reversal in this ratio will signal a return to normalcy.

For now, there is no sign that the economy is on track to recovery. When that changes, Zoom’s stock will let us know.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.