Eric Montross is a big man.

He stands 7 feet tall and is best known for leading the North Carolina Tar Heels to the 1993 NCAA basketball national championship.

After college, he was a first-round pick of the Boston Celtics and spent eight years in the NBA.

He was quite the imposing figure on the basketball court.

Now, he is a radio analyst for his alma mater and helps raise money for the university’s athletic department.

Last week Montross’ family announced that he is battling cancer.

The announcement put cancer back in the headlines, albeit for a short time.

While COVID-19 and other new viruses and illnesses were the biggest topics in the medical world over the last couple of years, researchers remain focused on innovations to treat cancer.

And that’s for good reason…

The American Cancer Society expects 1.6 million new cases of cancer in the U.S. this year:

Despite advances in the treatment of cancer, that’s a 33.8% increase from 2009.

This tells me that cancer is still affecting our society in a huge way.

Several pharmaceutical companies are racing for a cure, so I dug through our Stock Power Ratings system and found one making tremendous headway.

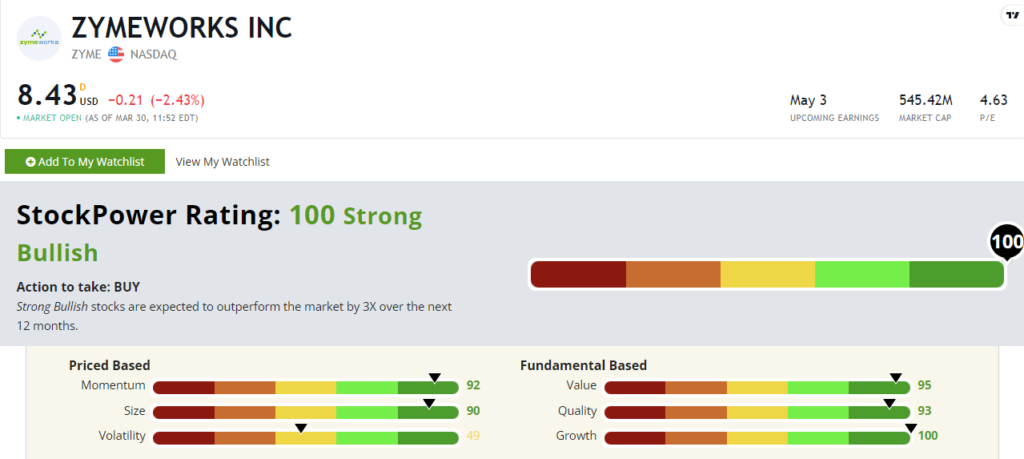

Zymeworks Inc. (Nasdaq: ZYME) scores a “Strong Bullish” 100 out of 100 in our proprietary Stock Power Ratings system.

That means we expect it to beat the broader market by 3X in the next 12 months.

The company, in partnership with Jazz Pharmaceuticals PLC (Nasdaq: JAZZ), has developed zanidatamab — a medicine that when coupled with chemotherapy has been incredibly effective in battling HER2 breast cancer, one of the most prevalent tumor types worldwide.

In January, the two companies announced the 18-month overall survival rate during phase 2 testing reached 84%.

And that’s helped boost ZYME’s financial prospects.

Zymeworks Stock: Outstanding Fundamentals With Solid Momentum

Zymeworks recently reported a strong close to 2022.

Here are two high points:

- Reported total revenue of $412.5 million for the year — that’s a 1,446% jump from its revenue reported in 2021!

- It signed a licensing agreement with Jazz Pharmaceuticals to distribute zanidatamab globally.

That massive increase in revenue shows why ZYME stock scores a 100 on our growth factor of Stock Power Ratings.

ZYME is also a strong value and quality stock — it scores a 95 on our value factor and a 93 on quality.

The average price-to-earnings ratio for the miscellaneous health care industry is 28.7. Zymeworks stock trades at a ratio that’s just 15% of that. Remember, lower is better.

Its returns on assets, equity and investments are all positive while its peers average in the red.

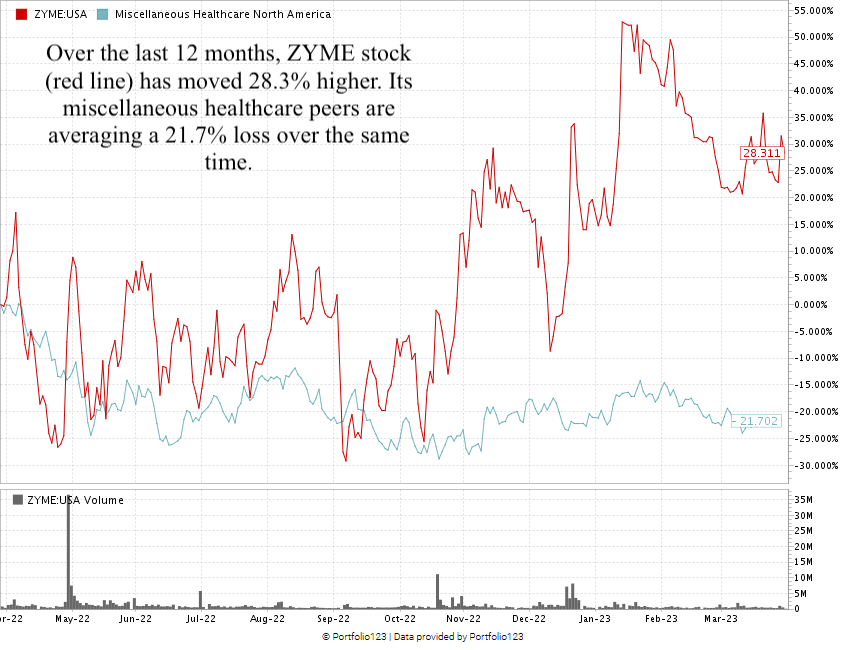

Let’s look at ZYME’s momentum — it scores a 92 on that factor:

Created in March 2023.

From its September 2022 bottom to now, ZYME stock has climbed 81.3%.

Over the last 12 months, the stock is up 28.3% compared to its peers which have averaged a 21.7% decline.

ZYME stock scores 100 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least 3X in the next 12 months.

Cancer was the second-leading cause of death in the U.S. in 2021 and the numbers show new cases on the rise.

While it doesn’t command mainstream news coverage, companies continue to race for a cure.

With strong initial clinical studies for its breast cancer treatment, Zymeworks stock is a smart addition to your portfolio.

Stay Tuned: Is Buy Now, Pay Later the Next Mega Trend?

Apple is throwing its weight into the buy now, pay later game. But does that mean this is a market segment worth investing in amid growing strain in the financial system?

I’ll dig into the story a bit more in Monday’s Stock Power Daily, and show you how some of the biggest names in the industry stack up within our proprietary system.

Stay tuned.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets