Editor’s Note: Today we’re drilling down on two of the Nasdaq 100’s hottest stocks. But if you’re interested in seeing the Top 1% of what the index has to offer, I HIGHLY recommend attending Mike Carr’s upcoming event HERE. Lock in your special invitation as a Stock Power Daily reader, and make sure you’re ready for next Tuesday, November 14 at 1 p.m. Eastern time. — Chad Stone

2 of the Nasdaq 100’s Hottest Stocks: Buy or Hold?

So far this year, the Nasdaq 100 has surged 41% overall.

It’s up 9% over the last two weeks alone!

These kinds of fast-moving gains are both delightful … and a little concerning.

They’re delightful because they’re the kinds of gains we’re always on the hunt for. If I could get $400 each year for every $1,000 I put on the line, I’d be over the moon. Especially after last year’s bear market.

But it’s also concerning because this kind of rally might not be sustainable. Will the market keep marching higher into the holiday season? Or are we in for another major downturn?

Fortunately, we have an incredible tool for breaking down the index and evaluating some of its most promising stocks — with Adam O’Dell’s Green Zone Power Rating system.

In a matter of seconds, we can look past the bigger market moves. We can find the stocks within the Nasdaq 100 that are set to outperform — no matter what’s next.

Chief Research Analyst Matt Clark already showed you what’s going on within the Nasdaq 100 earlier this week. So today, I wanted to share a deeper look into two stocks that have been on my own personal watchlist.

Let’s start with one of 2023’s hottest sectors — Big Tech…

The Next NVDA?

I can’t write about the biggest of Big Tech without mentioning 2023’s No. 1 mega trend: artificial intelligence.

It’s been about one year since ChatGPT burst onto the scene and gained 100 million monthly users in what felt like a flash. And now every other major player in the tech world is playing catch-up, releasing their own generative AI tools to compete with Microsoft’s cash cow.

It’s clear that AI is an investing theme with staying power. But what should you buy?

After NVIDIA Corp.’s (Nasdaq: NVDA) massive rally this year (it’s up more than 230% this year as I write), I wanted to see how one of its biggest competitors in the chipmaker space, Advanced Micro Devices Inc. (Nasdaq: AMD), stacked up.

And looking at Green Zone Power Ratings, this stock may have to sit on my watchlist for a bit longer.

AMD rates a “Neutral” 50 out of 100 in our system.

Stocks within this category historically track the broader market’s moves. During a year like 2023, that’s not so bad with the S&P 500 up 14%! But holding a Neutral stock when markets turn lower is when it starts to get a little hairy. You don’t want to perform in line with the market when it’s in decline!

Looking closer at AMD’s Green Zone Power Ratings, I want to point out a theme you’ll run into with a lot of Nasdaq 100 stocks: low ratings on Size and Value paired with high ratings on Momentum and Growth.

These are some of the largest companies by market cap (AMD is at $185 billion). And investors are betting big on growth, bidding up their share prices well beyond a reasonable valuation.

AMD rates a 0 on Size and a 4 on Value, but its stellar Momentum (94) and Growth (100) ratings have been enough to carry it to outperformance this year. And now Green Zone Power Ratings says its set for a slower pace from here.

THIS Is a Nasdaq 100 Stock?!

When someone says “Nasdaq,” I always think of flashy, high-tech stocks and fast-moving innovators. After all, those Big Tech names grab all the headlines.

But the Nasdaq 100 is so much more than that. The index contains companies across almost any sector you can think of — even the more mundane market segments like utilities or consumer staples.

With the holidays fast-approaching, I wanted to know how one retailer bracing for massive foot traffic through its hallowed warehouse halls looked as an investment opportunity.

I’m talking about Costco Wholesale Corp. (Nasdaq: COST), of course!

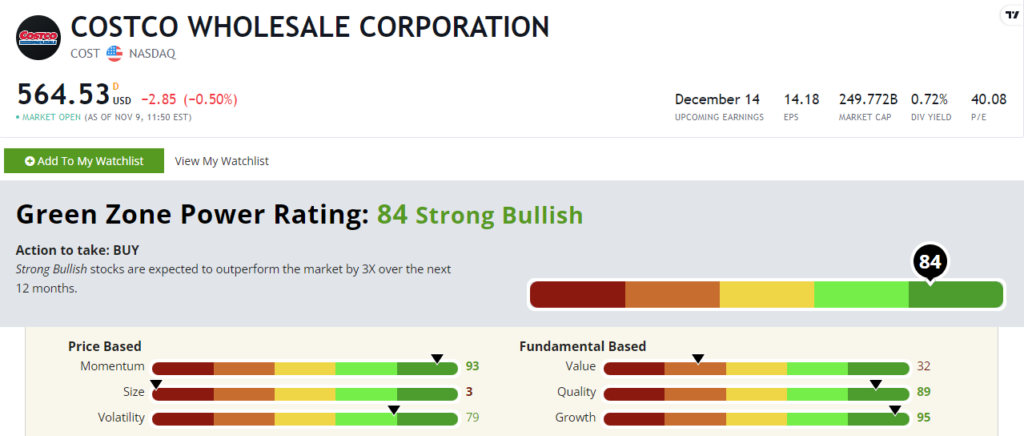

COST rates a “Strong Bullish” 84 out of 100 in Green Zone Power Ratings. That means its set to crush the market by 3X over the next 12 months.

Like AMD, it scores a lowly 3 on Size and a slightly better (but still bearish) 32 on Value.

But COST stock looks like it’s in a great spot otherwise. It reported 9.5% year over year revenue growth in its most recent earnings report.

Paired with $2.1 billion in net income — a 15% increase from the same quarter a year ago — and you can see why it rates a 95 on Growth. And with a healthy balance sheet, including positive returns on equity, assets and investments, it boasts an 89 on Quality.

Green Zone Power Ratings shows COST is one to add as 2023 wraps up.

Now if I could just figure out how to walk out of my local Costco without spending $200 every time…

Buy the Stock (Not the Index)

So as you can see, there’s plenty of diversity even within the larger stocks of an index like the Nasdaq 100.

One of the stocks seems to be relatively overpriced at the moment, while the other looks quite strong headed into 2024. They’re both part of the same index — but after a quick look at their Green Zone Power Ratings, I know which one I’d buy right now (and you probably do too).

But what if you could pinpoint the very best stock from the index every month?

That’s what Chief Market Technician Mike Carr’s “Top 1%” event is all about. During his 2023 backtest alone, he pinpointed multiple double- and triple-digit winning trades — and they all happened in 30 days or less.

On Tuesday, he’s going to show you how he did it and give you a chance to join him as he finds the best of the best Nasdaq 100 trades going forward. He’ll tell you more at 1 p.m. Eastern time that Tuesday, so click here to add your name to his guest list.

Until next time,

Chad Stone

Managing Editor, Money & Markets