At the height of the coronavirus pandemic, discretionary consumer spending screeched to a halt.

Sales of televisions, computers and other big-ticket items dropped as Americans focused their spending on staples … things like toilet paper and other household essentials.

As a result, several industries were hurt. Not the least of which was the trucking industry and, hence, trucking stocks.

In April 2020, trucking companies reported a 10% decline in activity compared to early February.

But May figures indicate a resurgence in the trucking industry and Money & Markets Chief Investment Strategist Adam O’Dell’s stock rating system is highlighting two companies that are leading the charge on trucking stocks.

On the Road to Profits: Trucking Stocks

When you think of trucking, you likely think of large 18-wheelers carrying massive containers filled with products.

Many trucking companies use what is called the less-than-load benchmark to show their activity. This is the transportation of relatively small freight — not cars, but smaller packages.

Think of it as transporting Amazon.com Inc. (Nasdaq: AMZN) packages, not Tesla Inc. (Nasdaq: TSLA) cars.

On a June 1 call with clients, Deutsche Bank AG (NYSE: DB) analyst Amit Mehrotra told investors the demand for LTL freight had begun picking up in May thanks to lower gas prices, an increase in auto parts shipping and an uptick in the weight of the shipments.

Bottom line is that Americans are ordering more, so trucking companies are getting back on the road and trucking stocks are making nice gains.

Low Volatility, High Growth Spells Profits

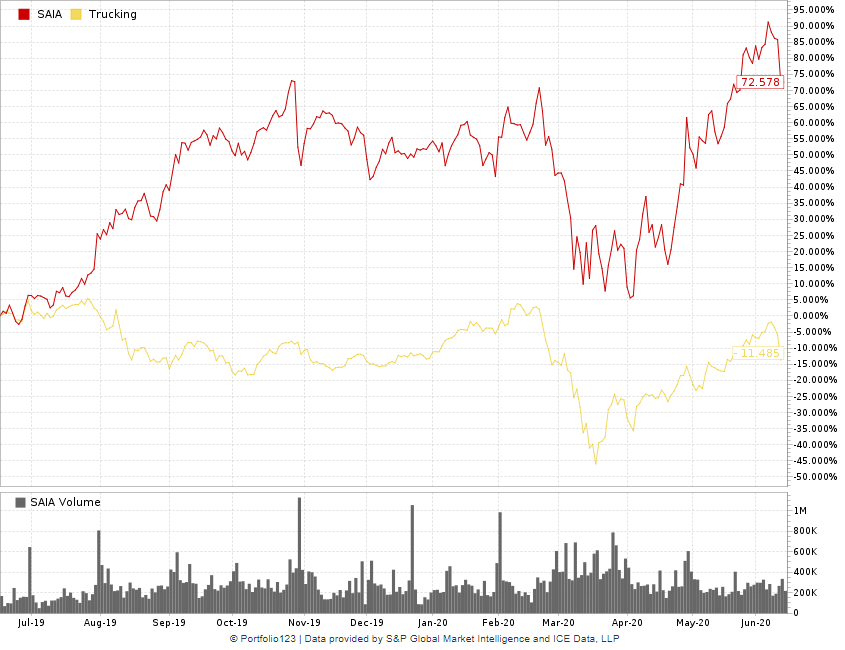

One of the trucking stocks benefitting from the industry’s recovery is Saia Inc. (Nasdaq: SAIA).

May’s shipments were down just 9.2%, a marked improvement over the prior month’s 16.2%, which likely marked the bottom.

O’Dell’s proprietary ranking system shows me Saia is a great buy now for two main reasons.

His indicators show this is a strong growth stock with attractively low volatility.

- Growth: Saia’s sales have been strong — growing 12.6% in the last three years. Its quarterly sales beat Wall Street expectations in each of the last five quarters. Annually, Saia has provided earnings per share growth of 32% over the last three years. From 2018 to 2019, Saia’s earnings have jumped from $3.99 to $4.30 per share. And this is translating into strong price action. Shares of Saia have jumped more than 72% in the last year, compared to an 11% decline for the trucking industry.

- Volatility — Adam’s system shows SAIA is a much less volatile stock compared to both the trucking industry and the overall market.

These are two big reasons Saia Inc. is a strong trucking stock buy.

Quality Leads to Gains With This Trucking Stock

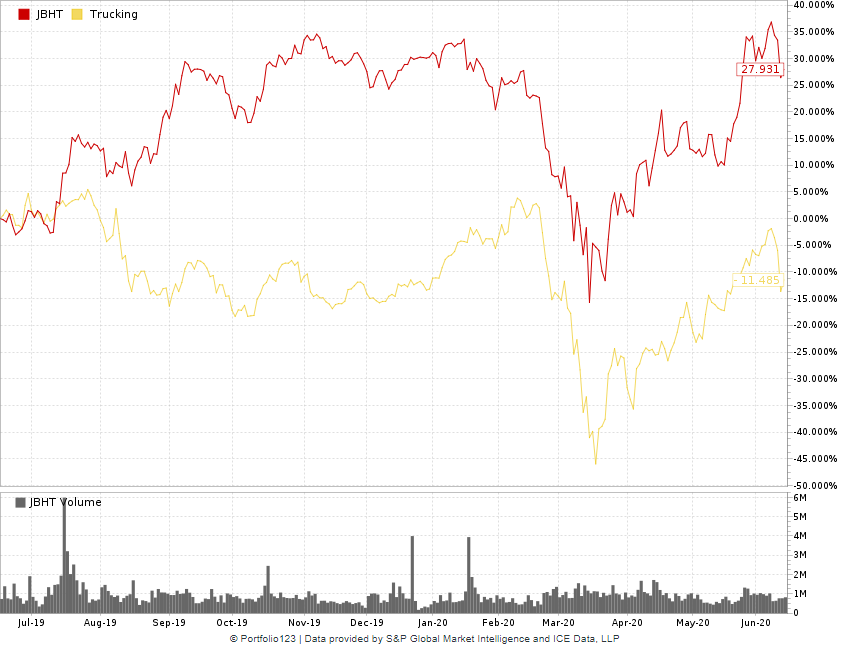

Another of two trucking stocks on our buy list this week is JB Hunt Transport Services Inc. (Nasdaq: JBHT).

The company provides transportation and delivery services across all of North America.

- Quality — JB Hunt’s returns are blowing away the rest of the transportation industry. Its return on investment is 14.8%, compared to just 4.5% for the rest of the industry. Return on equity is 22.3% versus 7.2%. And its return on assets is 9.3% versus 2.2%. These are positive standouts for JBHT.

- Volatility — As with SAIA, O’Dell’s system indicates JBHT is a much less volatile stock to own compared with industry peers. And despite what some investors think, low-volatility stocks outperform high-volatility stocks in the long run.

The Takeaway

While both SAIA and JB Hunt suffered along with the rest of the market the coronavirus crash, they have proven to have the resiliency to bounce back in a strong way.

Both are solid quality stocks and have much lower volatility compared to the rest of the transportation sector.

As more and more Americans continue to shift to online buying — and with fuel prices remaining low — these trucking stocks are going to continue to make headway, leading to solid long-term profits for investors.