Before Jerome Powell became Chairman of the Federal Reserve, the goal of Fed policy was clear.

In 1955, Chairman William McChesney Martin explained: “The Federal Reserve … is in the position of the chaperone who has ordered the punch bowl removed just when the party was really warming up.”

This philosophy drove interest rate hikes before the economy heated up. It led to rate cuts when slowdowns appeared imminent. This policy was proactive.

Last week, Powell announced the Fed would become reactive. In a press conference after the Fed’s policy meeting, Powell changed the 65-year-old tradition of proactive policy.

The Chairman said: “…We’ve said that we would continue [current policy] until we see substantial further progress. And that’s actual progress, not forecast progress. And that’s a difference from our past approach.”

The 3.5% Unemployment Fantasy

Powell stressed that he meant what he said:

And what we mean by that is pretty straightforward. It is we want to see that the labor markets have moved — labor market conditions have moved, you know, have made substantial progress toward maximum employment, and inflation has made substantial progress toward the 2% goal.

Later, he mentioned 3.5% unemployment. That’s where policy moved to fantasy.

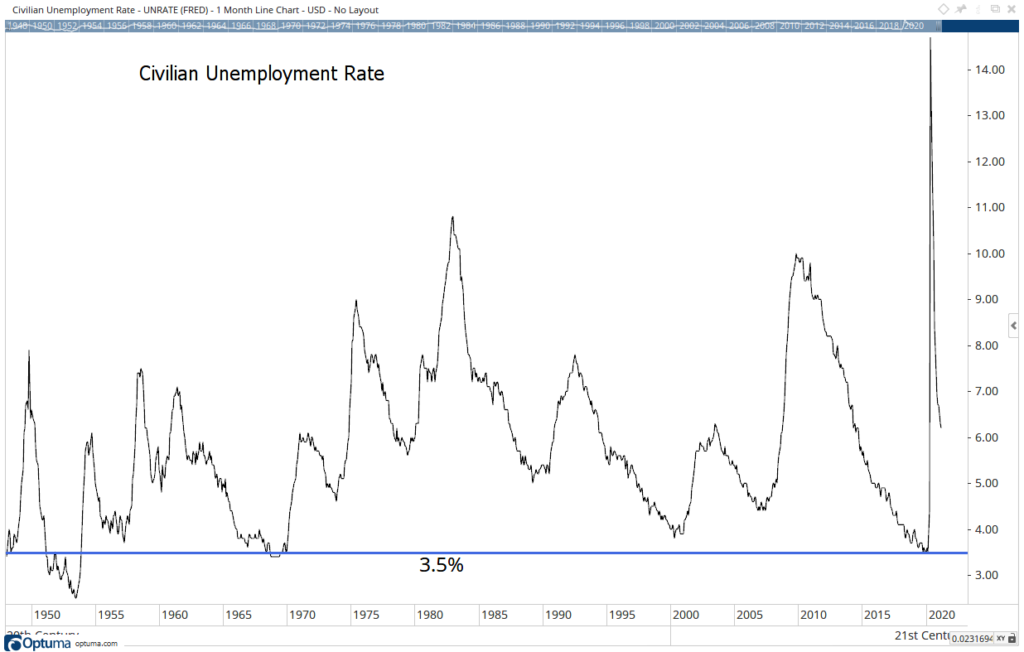

As you can see in the chart below, 3.5% unemployment is rare.

Unemployment Over 70 Years

Inflation Could End the Stock Bull Market

Powell’s goal of 3.5% unemployment has been reached three times before.

Unemployment plummeted in the late 1950s, as the world rebuilt after the destruction of the second world war. It fell again in the late 1960s, as spending on the Vietnam War boosted manufacturing. The third time was in late 2019 after a 10-year economic boom.

It will take time for unemployment to fall that low. In the meantime, inflation could take hold as it did in the 1960s. Powell says he’s OK with the risk of inflation. He knows inflation is coming and wants to comfort investors.

Within months, we will know if investors are joining the Fed on Fantasy Island. More likely, they will panic and push interest rates up. This will force the Fed to confront reality, and that could end the bull market in stocks.

P.S. I don’t like working more than I have to.

That’s why I found a way to beat the market by making one simple trade per week.

Last year, this trade helped me beat the market eight times over.

It’s a great way to accelerate your gains. Click here, and I’ll show you how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.