“Hakuna Matata” is a song familiar to many. Children have sung The Lion King classic for more than 25 years.

At last week’s press conference, Federal Reserve Chairman Jerome Powell could have been singing that Fed policy “means no worries, for the rest of your days.”

In Fedspeak, he said: “The fundamental change in our framework is that we’re not going to act pre-emptively based on forecasts for the most part, and we’re going to wait to see actual data. I think it will take people time to adjust to that and to adjust to that new practice, and the only way we can really build the credibility of that is by doing it.”

In simple words, Powell’s not concerned by rising yields, and he’s willing to let the economic data show robust growth, even if inflation rises, to ensure there will be a full and sustained recovery from the shutdowns associated with fighting COVID-19.

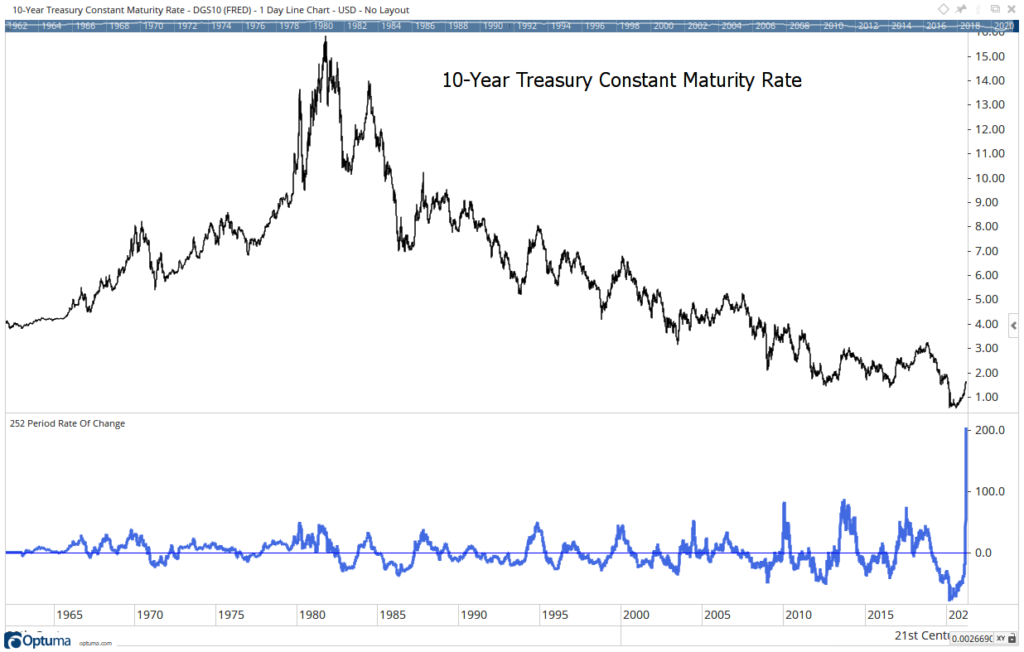

Traders in the bond market heard his message and reacted by selling. When traders sell bonds, yields rise. Higher yields should attract buyers seeking more income and slow the selling. The chart below shows sellers remain in control of the market.

10-Year Treasury Yield

Source: Optuma.

Bond Trading Fears at 60-Year High

The 1-year rate of change of yields is shown at the bottom of the chart. It’s shown as the 252-day return on capital (ROC) to reflect the number of trading days in one year.

ROC measures the level of fear in the market. When ROC spikes higher, traders are worried about inflation getting out of control.

Yield data on 10-year Treasury notes dates back to 1962. The chart shows that ROC is more than twice the previous record levels.

Fear among bond market traders is at the highest level in almost 60 years. Something unprecedented is happening to cause that fear.

Fed Chairman Powell is telling traders: “Sing it, kid! It’s our problem-free philosophy. Hakuna Matata!” Traders with money at risk are ignoring him. Now could be the time for individuals hoping for a secure retirement to worry.

I’m not quitting anything…

I’m just showing people a new way to make money in the markets.

My typical approach targets setups in individual stocks. With roughly 3,000 U.S. stocks, there’s plenty of opportunity.

But my new approach has simplified everything and boiled the markets down to one repeatable trade in the same ticker symbol.

The annual return was 132% last year. Click here to see how we did it. And most importantly, how it could benefit you.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.