Congress recently approved $1.9 trillion in new stimulus spending to help individuals and businesses adversely affected by economic shutdowns. Data suggests the spending might not be needed.

As a group, households are doing fairly well despite what the headlines suggest. That’s confirmed by new research from economists with the Federal Reserve Bank of St. Louis.

In “Measuring Household Distress and Potential Policy Impacts,” the economists noted:

“Anecdotal evidence suggests many households are struggling to meet their financial obligations (e.g., making loan payments). Yet housing markets and consumer spending have been strong, and personal bankruptcies and mortgage foreclosures are at multiyear lows.”

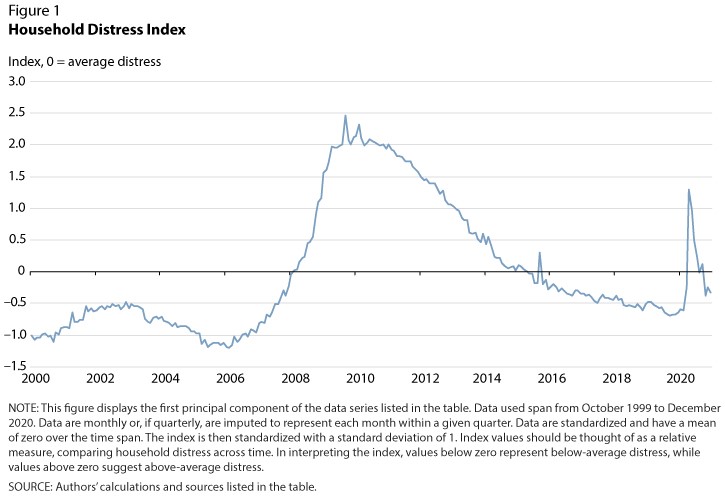

To reconcile these two seemingly contradictory statements, a team of researchers created the Household Stress Index. The Index combines 13 pieces of data into one. It closely tracked the experience of many families in the last recession, rising as unemployment increased and falling back to low levels only after an extended economic expansion.

Data from this Index allowed them to conclude: “the current level of household distress is below average compared with the past 21 years, which includes the Great Recession and its protracted effects.”

Household Distress Index Shows K-Shaped Recovery

Source: Federal Reserve.

Stimulus Uncertainty May Trigger Market Stress

This data shows that there is a K-shaped recovery underway, with households in the upper half of the K doing well while those in the lower half continue to struggle.

It’s a recovery The New York Times says is one in which: “Bread lines grew longer, Birkin bags got hotter.”

Economists are less certain about the situation.

It’s possible that the stimulus programs, including cash payments and extended unemployment benefits, may have reduced financial stress on families. The Index indicates those measures may have even eliminated stress, on average.

Or these policies may have only delayed the day of reckoning. Distress may be just around the corner.

Time will tell, but the uncertainty created by headlines could trigger concerns among investors no matter what the data says.

While I didn’t exactly design the internet, I can take full credit for this.

I’ve created a first-of-its-kind innovation in the financial markets. It allows everyday traders to get ahead making one simple trade per week.

Click here to see how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.