We’re halfway through 2023, and … I’d say things are looking pretty good!

While many expected stocks to turn lower as the Federal Reserve marched interest rates higher, it hasn’t played out like that.

Big Tech and artificial intelligence hype are leading a broader market charge, even as Fed Chair Jerome Powell hints at more rate hikes in the near future.

U.S. homebuilders are raving about increased demand for new homes, and auto sales rose almost 20% in May. That’s with the highest interest rates we’ve seen in years!

Considering all this, I’m left wondering if the recession everyone’s been screaming about for the last year will even happen…

Of course, most previous recessions didn’t seem like they would happen … and we never clearly understood how bad things would get until long after they were done.

I don’t think we’re in the clear either. Interest rates are going to remain elevated for longer than many likely expect, and that’s going to create more pressure as time goes on.

But this week, I want to explore the idea that things won’t be as bad as originally expected.

And if that winds up being the case, we have to look at the consumer discretionary sector…

Why Consumer Stocks?

Consumer discretionary companies make “the things we want, but don’t need” — fancy cars, new home gadgets, decadent food, an expensive trip to Europe … that kind of stuff.

If we manage to dodge a recession, consumers won’t be shy about opening their wallet for these luxuries. And that means big profits for the sector.

So, how to find the best stocks within this potentially hot sector? You already know…

Adam’s Green Zone Power Ratings system.

By starting with the Consumer Discretionary Select Sector SPDR Fund (NYSE: XLY), the broader exchange-traded fund (ETF) tracking these stocks in the S&P 500, I have a list of around 50 stocks to start with. That’s a lot easier to poke through than the more than 6,000 stocks our system rates!

And you can do the same with any of the other popular S&P 500 ETFs. Curious about energy? Look into XLE… What about companies providing goods to people need no matter what? Start with XLP… Or, if you’re looking for a new utilities stock paying out a solid dividend, check out XLU…

By starting with XLY, I was able to quickly scan a handful of stocks. Here’s what I found.

A 4-Star Hotel Stock

Another benefit of starting with a broad ETF like XLY is it’s full of recognizable companies. That’s how I landed on Marriott International (Nasdaq: MAR).

Fun fact: My mother traveled a lot for work when I was a kid, and one of the perks is that I got to join her quite often in various Marriott establishments … the highlight being a weekend at the Ritz Carlton in San Francisco.

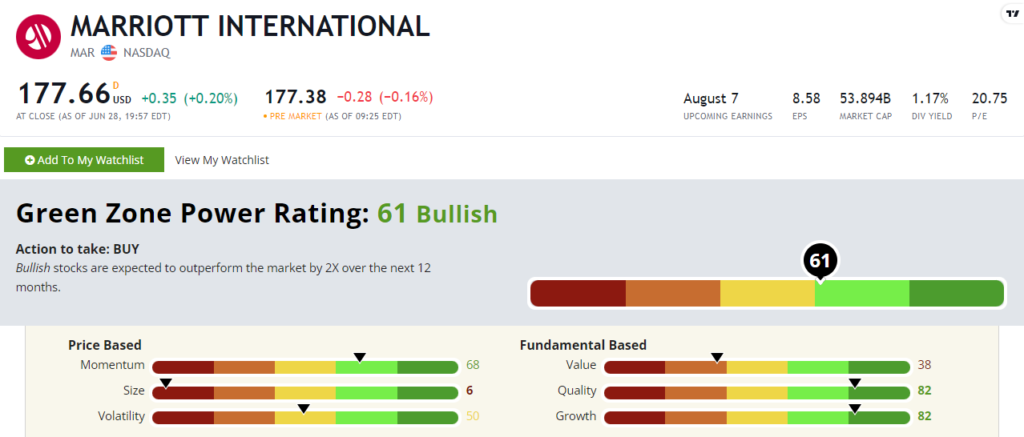

Going by Green Zone Power Ratings, MAR is a consumer discretionary stock worth considering:

Marriott International stock rates a “Bullish” 61 out of 100, which means we expect it to beat the broader market by 2X over the next 12 months.

It boasts an impressive 82 rating on Growth. In its first-quarter earnings call, MAR executives reported earnings per share of $2.09, crushing Wall Street expectations of $1.86. It also brought in $5.6 billion in revenue, higher than expectations by more than $150 million.

That’s helped MAR’s momentum in 2023. The stock is up 20% year to date, which shows why it rates a 68 on the Momentum factor.

Overall, Green Zone Power Ratings show MAR is one to think about.

A Middling Fast Food Co.

Sticking with recognizable consumer discretionary stocks, let’s see how McDonald’s Corp. (NYSE: MCD) rates…

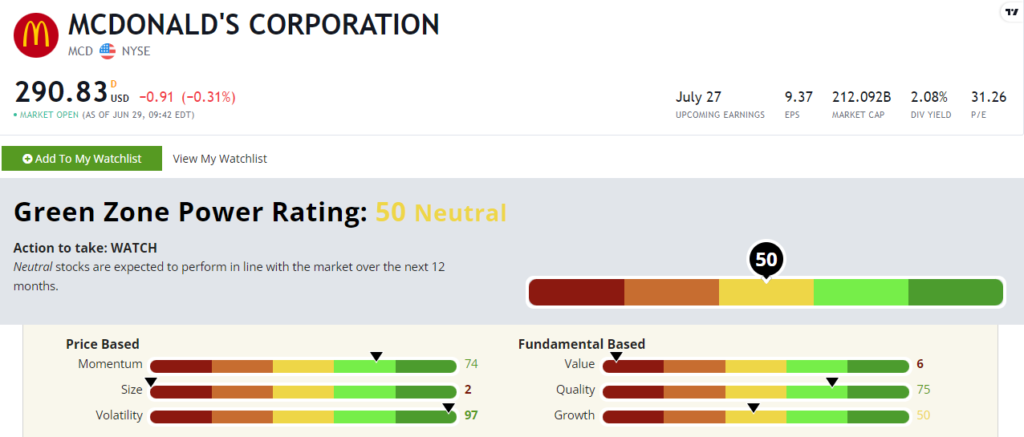

MCD rates a “Neutral” 50 out of 100, which means it’s expected to perform in line with the rest of the market from here.

McDonald’s stock has solid Momentum and Volatility. The stock is up more than 10% this year, and it’s been a steady climb higher.

But its Value and Size drag the stock down a bit. McDonald’s market cap is now north of $213 billion, which shows why it scores a 2 on the Size factor.

And MCD doesn’t trade at a cheap valuation, which explains its 6 rating on Value. Its current price-to-earnings (P/E) ratio is 31! The broader XLY trades at an average P/E of 26 (keep in mind this fund holds tech giants like AMZN and TSLA). Comparable fast food companies like Jack in the Box Inc. (Nasdaq: JACK) trade at almost one-third of MCD’s ratio!

McDonald’s might be one to watch as the economic situation unfolds.

Down the Drain

Let’s have a little fun with this last stock. Nothing screams discretionary like a new hot tub!

But instead of investing the money in Whirlpool Corp. (NYSE: WHR), you might be better off just spending it on the actual hot tub. Here’s why…

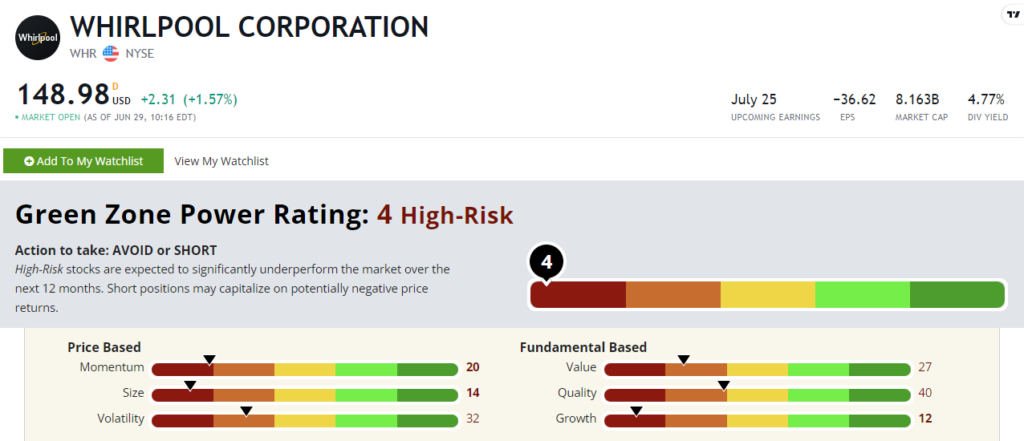

WHR rates a “High-Risk” 4 out of 100 in Green Zone Power Ratings. That means it’s expected to significantly underperform the market over the next 12 months.

It doesn’t score above 40 on any of the six factors within Adam’s system.

Digging into its 12 rating on Growth, you can see why it’s not one to buy now. In the first quarter of 2023, Whirlpool:

- Posted $4.6 billion in revenue, down 5.5% year over year.

- Net income was -$179 million, down 157% from the same quarter a year ago.

- And operating income fell 43% from a year ago to $270 million.

With weak growth numbers like that, you can see why investors have fallen out of favor with WHR stock.

If you want to start digging into consumer discretionary stocks, or any other stocks on your mind using Green Zone Power Ratings, click here to go to our homepage. And then just look for the search bar, or click this button to get started:

You may be surprised by what you find.

Of course, Adam takes Green Zone Power Ratings to another level in Green Zone Fortunes, his premium research service.

He uses his system to find his highest-conviction recommendations and tells you exactly when is the right time to buy and sell.

On top of that, he’s created a weekly “Blacklist” of stocks that don’t deserve a spot in your portfolio.

Just click here to find out how to gain access.

Until next time,

Chad Stone

Managing Editor, Money & Markets