We still have a few weeks left in 2021, but it’s time to look ahead to the new year and to the investment themes that should carry us through 2022.

Many investment themes have a short shelf life. But I believe that several mega trends are firmly in place for the rest of this decade.

Here are some of the market mega trends that have the potential to create life-changing wealth in 2022 — and even decades down the line.

2022 Market Mega Trend No. 1: Genomics

When historians look back at 2020 years from now, they’ll identify it as the year that genomics jumped front and center.

I identified the genomics mega trend — DNA-based medicine — back in 2019, and it has been a recurring theme in Green Zone Fortunes since. We’ve enjoyed some initial gains, but it’s still very much the “early innings.” I expect to capture some of our greatest returns in my career following this trend.

Genomics took a major leap forward this year in the successful rollout of the mRNA COVID-19 vaccines. These were the proof of concept. The technology works, and we may soon have mRNA treatments for HIV, cancer and even seasonal flu.

This may be the single biggest leap forward in medicine since the discovery of penicillin nearly a century ago.

As I’ve said for years, I believe this trend will be bigger than the internet in its potential for disruption and wealth creation. So, you can bet that I’ll be looking for opportunities here well into 2022 and beyond.

You may get tired of hearing the word “genomics” from me, but you won’t get tired of the profits.

Trend No. 2: Infrastructure

After months of wrangling, we finally have an infrastructure bill … and at $1.2 trillion, it was the biggest commitment to infrastructure spending in decades.

Anticipating this, we started investing in infrastructure and construction-related stocks starting late in 2020. Given the sheer size of the outlays and the multi-year timelines in implementing them, I’ll be on the lookout for new ways to profit.

This mega trend goes beyond Biden’s bill.

Next year will see the rise of the connected smart city, smart home, smart office and essentially “smart everything” as technology makes our cities function more efficiently. And there will be fortunes to be made by the companies turning that futuristic vision into reality.

Trend No. 3: Green Energy

But perhaps no market mega trend is as unstoppable today as the rise of green energy. And I’m not just talking about your neighbor’s Tesla. I’m talking about the modernization and transformation of America’s energy grid.

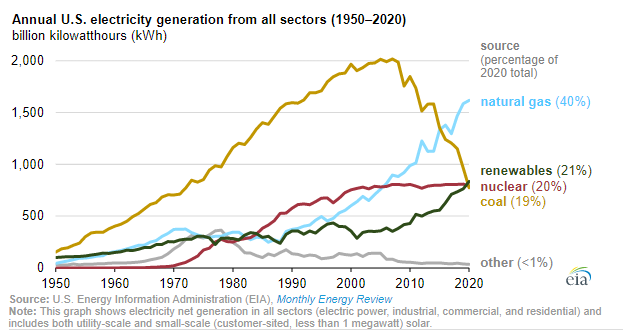

As of last year, renewable energy (green line in the chart below) — which includes wind, solar, hydroelectric and even biomass — already accounted for 21% of all utility power generated in the United States, according to the U.S. Energy Information Administration.

By 2025, that figure is projected to reach 31%. And between 2040 and 2045, we’re expected to reach the tipping point in which renewables make up a majority of all energy produced. And it just goes up from there.

And that’s just in the U.S. The runway is even longer overseas. Think about China, which burns nearly nine times as much coal per year as the U.S.

Politicians love to talk about sustainability and carbon reduction. But this transformation has almost nothing to do with politics.

It’s all about economics.

In 2018, the cost of generating new wind and solar energy dropped below the cost of generating power from existing coal plants for the first time. That was three years ago, and prices haven’t stopped dropping. Renewable energy will crowd out fossil fuels in the years ahead because it’s cheaper.

But for renewable energy to be viable, you have to be able to store it. Wind turbines don’t do much good when the wind stops blowing. And solar panels are useless at night.

This has created the opportunity of a lifetime for makers of industrial-sized batteries, which is the subject of my next issue of Green Zone Fortunes.

I recommend a cutting-edge industrial battery maker poised to change the world. My research has led me to believe it could make its investors a bundle of profits along the way.

And you can be one of the first to learn about my newest stock research and recommendation by joining Green Zone Fortunes for what comes out to less than $4 per month today! December’s issue of the newsletter will hit subscribers’ inboxes next week.

Click here to see how you can join us today. You’ll learn even more about the genomics mega trend, including the technology behind my No. 1 genomics stock.

And once you join, you’ll gain access to our model portfolio where you’ll find our highest-conviction stocks following mega trends like infrastructure, green energy and electric vehicles.

I can’t wait to show you how we’re going to capitalize on these market mega trends in 2022 and beyond.

To good profits,

Adam O’Dell

Chief Investment Strategist