Elon Musk was back in the headlines again this weekend, making a special trip to Beijing as his company, Tesla, nears approval to roll out Full Self-Driving (FSD) in China.

Reports seem cautiously optimistic, with Bloomberg announcing that Chinese authorities have “tentatively approved” the program.

As a result, it seems like optimism is tilting back in Tesla’s favor — even after the epic disaster of its Cybertruck launch.

At the time of writing, Tesla Inc. (Nasdaq: TSLA) shares are up more than 30% over the last week.

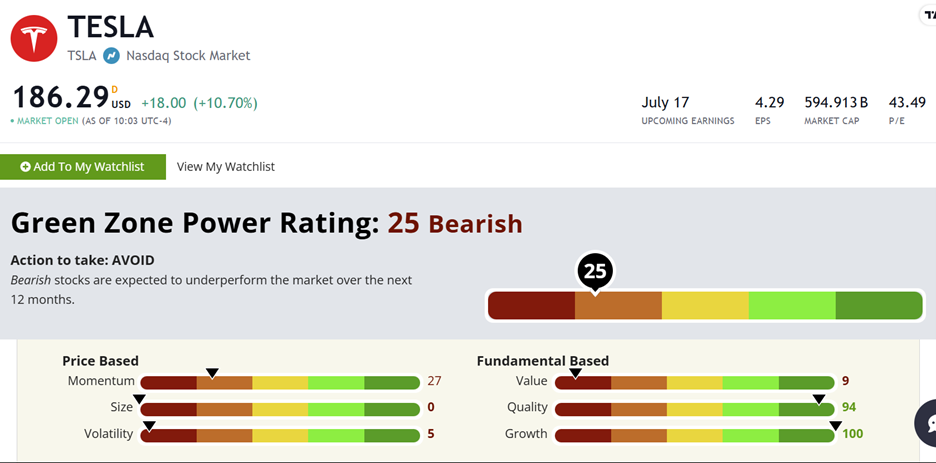

However, even with these recent gains, Tesla is still the sixth worst-performing stock in the S&P 500. And its Green Zone Power Ratings are a “Bearish” 25 out of 100, which should give any investor reason to reconsider:

There are also three “Big Picture” reasons why Tesla’s rally will likely be short-lived…

First, ask yourself: Why isn’t Tesla rolling out this new tech in America?

Because American authorities would never allow it.

The National Highway Traffic Safety Administration (NHTSA) recently reported on the hundreds of crashes and dozens of fatalities already linked to Tesla’s autopilot features.

The report details how Tesla’s autopilot is technically capable of self-driving in ideal conditions.

But it also gives the driver a false sense of security. Drivers often react too slowly, failing to interrupt and avoid an accident.

In other words … Tesla’s autopilot is only capable of self-driving when it has a driver at the wheel who’s ready to take over within a moment’s notice.

It’s basically at the same level of sophistication as a student driver.

This is why Tesla cars sold in America come with such extensive warning labels and documentation.

And why our government would never greenlight the rollout of FSD Teslas using the company’s current technology.

Second Question: Why Did Tesla Choose China?

At first, China seems like a slam-dunk location for Tesla to roll out its FSD cars.

It’s one of the biggest countries in the world, with a growing middle class and a more “relaxed” regulatory environment than you’d find here in the States.

None of that’s really news, though.

Tesla has been trying for years to crack the Chinese EV market. It’s had some limited success.

Then, over the last year, China’s domestic manufacturers have been absolutely pummeling Tesla’s production capacity.

One of the companies taking Musk to the cleaners is BYD.

This Chinese EV maker was once a choice investment of Warren Buffett, and it currently holds a commanding 31% market share in its home country.

By comparison, Tesla had carved out 10.5% of the Chinese EV market in the first quarter of 2023. But by the fourth quarter, that number had dwindled to just 6.7%.

That means that in 2023 alone, Tesla lost 40% of its Chinese market share.

So you can see why Musk is desperate for good publicity…

Finally: Is Elon Even Telling the Truth?

For more than a decade, Musk has been promising that FSD cars, autopilot and robotaxis were “just around the corner.”

That’s not an exaggeration, either.

One YouTuber went so far as to make a compilation of “Elon Musk’s Broken Promises,” including clips from interviews going as far back as 2014. You can see it for yourself here.

Just like his promises about hyperloops, Martian colonies and revolutionary Cybertrucks, Musk has yet to deliver on truly autonomous vehicles.

Now, I like to think of myself as a cautious optimist, even when it comes to an eccentric CEO like Musk.

I believe it’s possible that Tesla could be on the verge of a massive self-driving breakthrough.

However, I also believe Musk may be responding to a tough situation in the only way he knows how.

Tesla’s Chinese market share is plummeting, U.S. sales are sagging and the Cybertruck is quickly becoming one of the most disastrous new vehicle launches in automotive history.

Musk needs a win, even if that means breaking another one of his many promises.

Does that mean it’s time to short Tesla? Not exactly. As John Keynes once said: “Markets can remain irrational longer than you can remain solvent.”

Instead, I’m recommending my readers look into a different company — one that’s actually making real-world progress on a usable self-driving system.

No, I’m not talking about Ford, Chevrolet, Amazon or Google. I’m talking about a tiny tech startup that’s still early in its development — so early that it hasn’t even had its official IPO yet.

But for the next 36 hours, you can make a special “pre-IPO” investment, with gains projected to reach over 5,700%.

To good profits,

Adam O’Dell

Chief Investment Strategist, Money & Markets