The return rate on 30-year Treasury bond sank to a record low Wednesday morning while the yield curve further inverted as traders bet on low inflation and slower U.S. growth as recession fears continue to mount.

The yield on the 30-year bond dipped as low as 1.907% early Wednesday morning as futures continued to sink after another down day for the markets on Tuesday. The previous record low for the 30-year year Treasury was 1.916%, which also happened earlier this month. The yield later ticked up a bit to 1.918%, still well below the yields on short-term debt like the 3-month and 1-month bills.

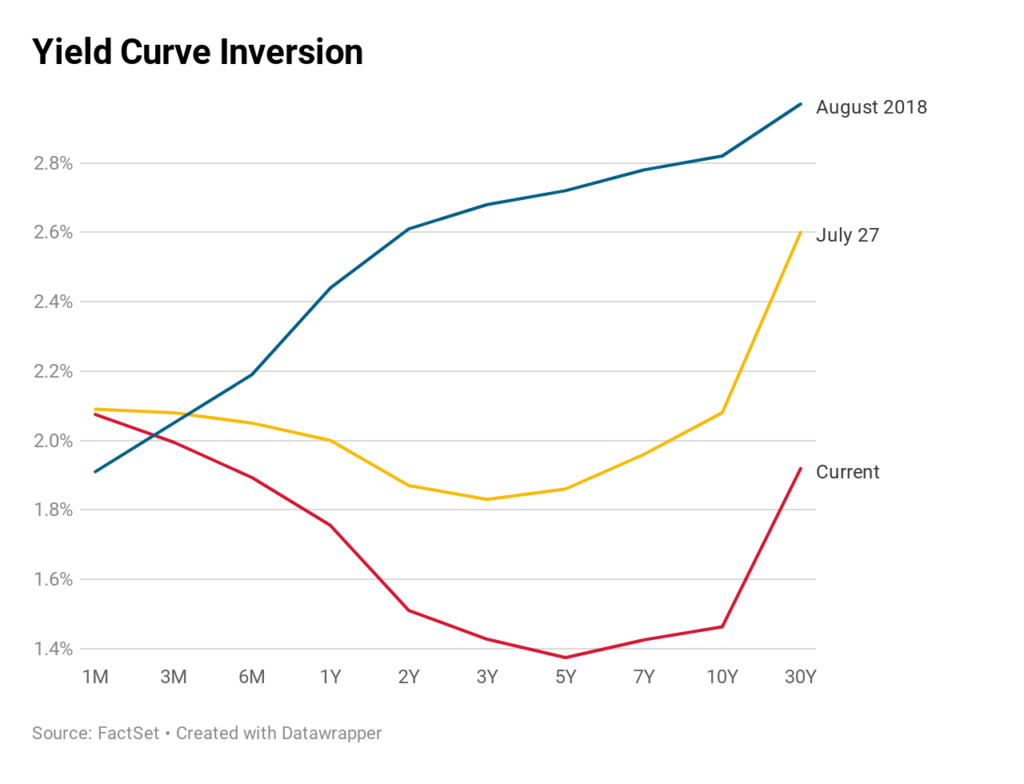

The yield curve inversion also continued to worsen as the yield on the benchmark 10-year Treasury as it dipped to 1.461%, falling below the 2-year note’s 1.508%. The yield closed the day inverted for the second day in a row Tuesday.

An inversion of the 10-year/2-year yield curve has been one of the most accurate signals of an incoming recession, and has preceded each recession of the past 50 years. Before August, the last inversion of this particular yield curve happened in December of 2005, two years before the financial crisis that preceded the Great Recession. On average, a recession begins about 22 months after this particular yield curve inversion.

The 3-month/10-year Treasury yield also sank to -53 basis points, its lowest level since March, when it the yield curve on these notes inverted last.

The record-low bond yields and inversion of the yield curves come as reports of a global slowdown continue to mount.

New UK Prime Minister Boris Johnson moved to suspend parliament until October, heightening the chances of a no-deal Brexit and causing Britain’s currency, the pound, to dip 1% below the 1.2211 by late Wednesday morning. The 10-year Italian yield also fell below 1% for the first time ever. Rates on 10-year German and French bonds also fell to record lows.