Semiconductor company Intel said the shortage of chips cost the U.S. economy $240 billion in 2021.

The backlog of chips from China continues to put pressure on the market.

Congress just did something about it: It passed the CHIPS Act, which provides $39 billion over five years to fund American semiconductor manufacturing.

President Biden signed the bill yesterday, calling it “a once-in-a-generation investment in America itself.”

This will ease the backlog, positioning the U.S. as a global player in the industry.

Management consultant company Gartner analyzed the trend for semiconductor revenue.

You can see in the chart above the firm projects the global market size will reach record levels in 2022 and 2023.

Today’s Power Stock makes the equipment manufacturers need to produce more efficient semiconductors: Axcelis Technologies Inc. (Nasdaq: ACLS).

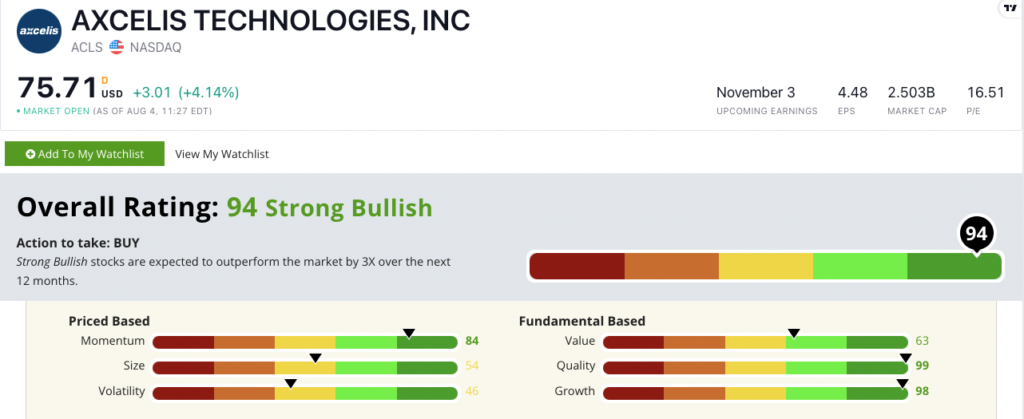

ACLS Stock Power Ratings in August 2022.

ACLS specializes in ion implanters for the semiconductor industry around the world.

These are workhorses in semiconductor manufacturing plants. They modify the silicon in the chips to allow for smaller, more powerful semiconductors.

Axcelis Tech stock scores a “Strong Bullish” 94 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

ACLS Stock: Top Quality + Growth Potential

Axcelis just announced a blockbuster quarter.

Highlights include:

- Revenue of $221.2 million — a 50% increase from the same quarter a year ago!

- Gross profit for the quarter was $99.2 million — a 55% jump from the same time last year.

That shows why ACLS earns a 98 on growth in our Stock Power Ratings system.

But it’s also an outstanding quality stock.

Its 99 rating on that metric comes from a return on equity of 23.7% and a strong gross margin of 45.1%.

This stock has shown the momentum we love to see in stocks:

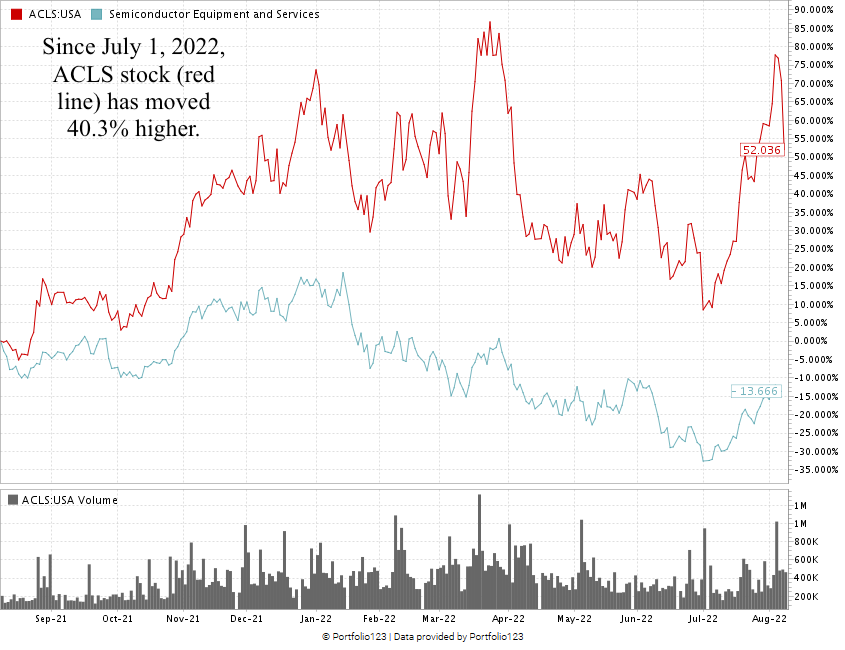

In March 2022, ACLS hit its 52-week high. Those gains pared back as headwinds hit the broader market.

Since July 1, the stock has climbed 40.3%.

Over the last 12 months, ACLS is up 52%. The semiconductor equipment and services industry, on the other hand, is down 14% during the same time.

ACLS stock shows the “maximum momentum” we love to see.

Axcelis Tech stock scores a 94 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Demand for semiconductors continues to grow. A new bill infusing incentives for American companies to produce these chips will amplify that growth.

Axcelis doesn’t produce semiconductors … it makes the components the chips need in order to work.

ACLS is a strong investment for your portfolio!

Stay Tuned: 3 High-Performance Power Stocks

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on three of the top Power Stocks I’ve covered in recent weeks.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment about Stock Power Daily? Reach out to my team and me at Feedback@MoneyandMarkets.com.