To combat high inflation, the Federal Reserve has one massive tool: interest rates.

When the Fed raises rates, it encourages banks to raise rates on loans.

The intent is to reduce the monetary supply and inflation.

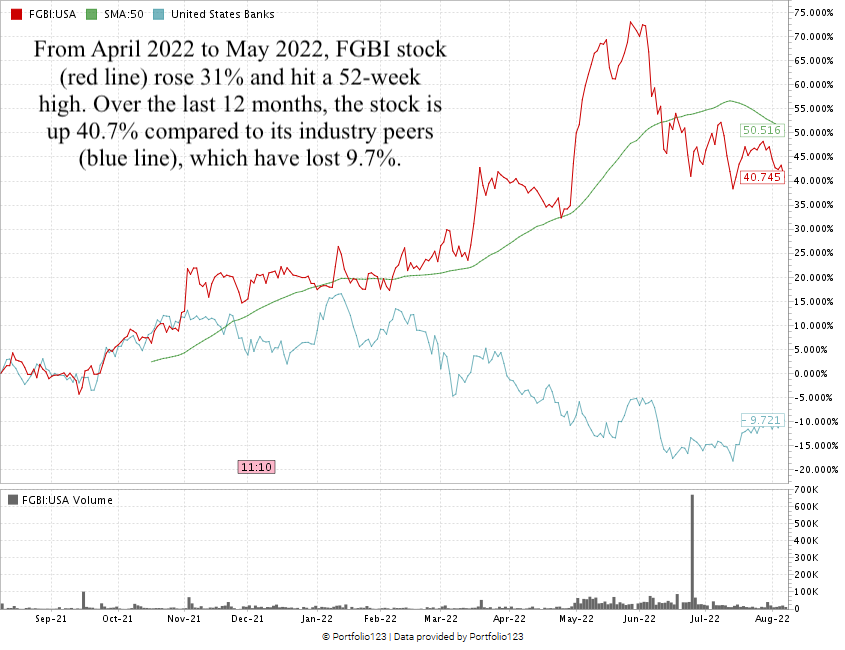

The chart above shows the S&P U.S. Banks Broad Market Index in July.

After hitting a bottom mid-month, bank stocks rallied on news of a rate hike.

The index posted a 7.9% jump in share price for the month thanks to the central bank.

It was the best month of 2022 for bank stocks. I have high conviction that this strong performance will continue.

Today’s Power Stock is a regional bank in the South: First Guaranty Bancshares Inc. (Nasdaq: FGBI).

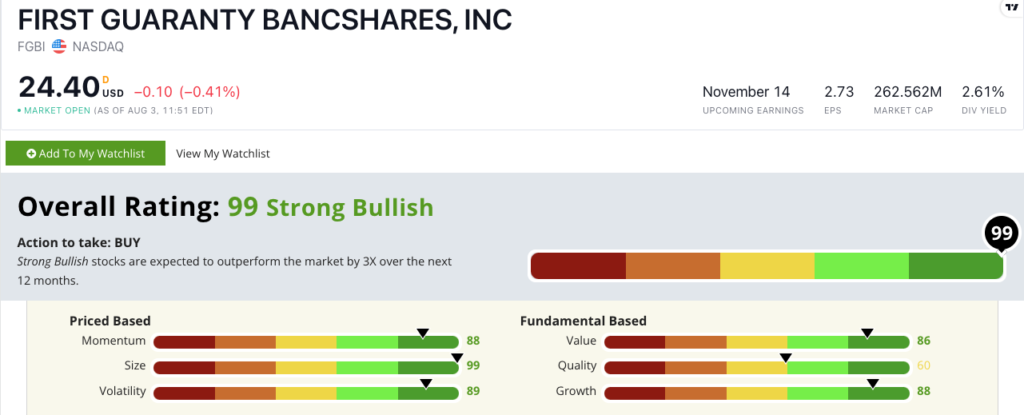

FGBI Stock Power Ratings in August 2022.

FGBI has 36 locations in Louisiana and Texas, as well as branches in Kentucky and West Virginia. It’s been around since 1934.

First Guaranty Banck stock scores a “Strong Bullish” 99 out of 100 on our Stock Power Ratings system.

We expect it to beat the broader market by 3X in the next 12 months.

FGBI Stock: “Strong Bullish” Value + Growth

FGBI released its quarterly numbers, and I was impressed:

- Revenue of $35 million — the best quarterly performance since the fourth quarter of 2020!

- Earnings per share of $0.70 — the highest it’s been in the last 16 quarters.

FGBI stock scores an 88 on our Stock Power Ratings system’s growth metric.

That’s based on an impressive one-year earnings-per-share growth rate of 27.5%. Its quarterly sales growth rate is solid as well, at 14.7%.

It’s also an excellent value stock, with a price-to-earnings ratio of 8.9. The U.S. bank industry average is 10.5, so FGBI is undervalued compared to its peers.

FGBI scores an 88 on our momentum factor:

FGBI had its biggest run from April to May, gaining 31% to reach a 52-week high.

While its industry peers have lost 9.7% over the last 12 months, FGBI has gained 40.7%.

First Guaranty Bank stock scores a 99 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Bank stocks had their best month of the year in July. Higher interest rates will further boost profit margins for banks … and for investors.

You can see why FGBI is a strong investment for your portfolio!

Stay Tuned: Semiconductor Industry Manufacturer

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on an excellent, innovative company that employs a unique tech and just crushed earnings expectations.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.