Did you buy this “monkeypox stock” when I first wrote about it?

When we started Stock Power Daily, our mission was simple: Find opportunities to profit, regardless of what the market was doing.

Since April, the market has been anything but stable:

The chart above shows the total daily return of the S&P 500 Index since April 18, 2022 — the day we launched Stock Power Daily.

The index was in the green for three days before dropping as low as 16% in June.

It’s off by 5.6% as I write this.

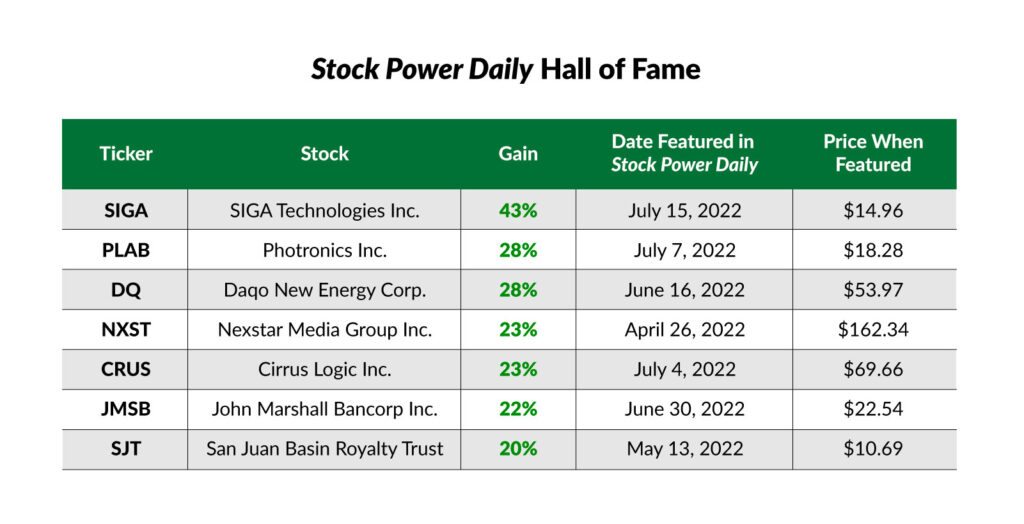

Despite that, several of my recent selections look like “maximum momentum” plays as market volatility continues:

One stock I told you about on July 15 has gained 43% since I shared it with you … and it still earns a “Strong Bullish” Stock Power Rating, so I have high conviction this run is just the beginning.

Monkeypox Power Stock

Just when we thought we were getting past the infectious disease madness, along came monkeypox.

According to the Centers for Disease Control and Prevention, 49 states and the District of Columbia have all reported cases of monkeypox.

It’s spread so far and fast that the U.S. government and World Health Organization declared the outbreak a health emergency.

Power Stock SIGA Technologies Inc. (Nasdaq: SIGA) was ahead of the outbreak.

SIGA Stock Power Ratings in August 2022.

SIGA develops drugs to combat infectious diseases in the U.S. Its lead product, TPOXX, is an antiviral drug that treats smallpox. TPOXX’s use is expanding to treat monkeypox.

The company partnered with Cipla Therapeutics to develop and produce drugs used against various biothreats.

In May, the U.S. Department of Defense awarded SIGA $7.5 million for TPOXX to combat monkeypox.

SIGA Technologies stock scores a “Strong Bullish” 89 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

SIGA’s growth potential is one reason I like this stock.

In the first quarter of 2022, SIGA reported total revenue of $10.5 billion — a 118.8% increase in revenue over the same period a year ago!

The stock’s quality is another strong point. SIGA knows how to turn a profit!

The company’s operating margin — the profit on $1 of sales after taking out production and wage costs — is a massive 62.9%.

Its industry peers average negative 1,213.8%. That’s not a typo, folks!

SIGA Shows “Maximum Momentum”

Since I told you about SIGA last month, the stock has rocketed up another 43%!

Over the last 12 months, SIGA is up 301.3%, while its industry peers are averaging down 29.8%.

The S&P 500 is up just 7.2% since I featured SIGA in Stock Power Daily.

That shows the “maximum momentum” we look for in stocks.

If you bought in when I told you about SIGA, well done! I’d love to hear from you. Write to my team and me anytime to let us know if you’ve bought any Power Stocks and how they’re performing!

I have high conviction more gains are on the horizon for SIGA.

Here’s why…

With monkeypox considered a global health emergency, countries are requesting vaccines now.

Because SIGA’s monkeypox vaccine is already in the pipeline, its future growth looks promising.

But SIGA isn’t the only recent winner we’ve had with Stock Power Daily:

- Photronics Inc. (Nasdaq: PLAB) — The manufacturer of key components used in semiconductors is up 28% since I featured it on July 7. The stock earns a “Strong Bullish” 97 overall Stock Power Rating today.

- San Juan Basin Royalty Trust (NYSE: SJT) — This company holds royalties on property used to mine oil and natural gas. It’s gained 20% since I told you about it in May, and its 90 overall Stock Power Rating tells us it’s still a smart buy.

This is while the broader market continues to struggle after a drop early in the year.

Make sure to open our Stock Power Daily email when it arrives in your inbox each weekday at 7 a.m. Eastern for more market-crushing stocks.

Stay Tuned: Book Publisher Power Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a top-rated American multinational publishing, education and media company.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Remember, if you’ve bought any of the stocks I’ve featured in Stock Power Daily, we’d love to hear how you did … because knowing we’re helping real folks make money is why we do what we do here at Money & Markets! Reach out to Feedback@MoneyandMarkets.com anytime.