There’s only two reasons stock prices move. Either supply or demand change — that’s really all there is.

Supply changes slowly. Companies infrequently issue new shares. That should push prices down. More commonly, companies buy back their own shares. That decreases supply and helps increase prices.

Demand, on the other hand, changes frequently. It changes when investors change their opinions about the market. If they become bullish, they increase demand for shares. If they become bearish, demand decreases.

Of course, changes in opinion only theoretically affect demand. Actual price changes only occur when investors act on their opinions.

When demand decreases, investors sell and the amount of cash they hold increases. Increased demand results in less cash as investors convert dollars to shares.

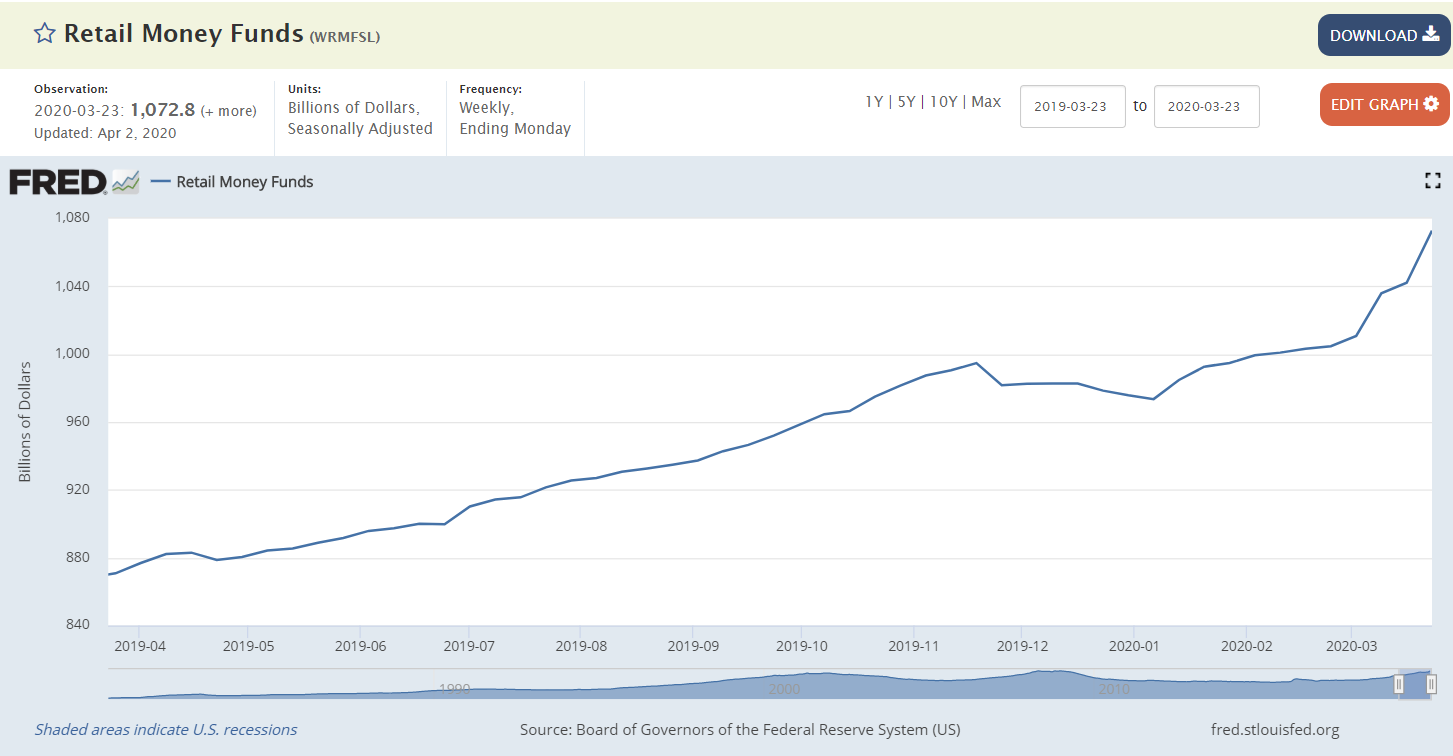

We can monitor how much cash investors have by watching the amount of assets in money market funds.

As stock prices fell, investors reduced their demand for stocks and cash in money market funds topped $1 trillion.

Source: Federal Reserve

That cash can now be used to buy stocks. But investors only have $1 trillion in cash. That’s not much compared to the amount of cash the Federal Reserve manages.

Adjustments to Federal Reserve Policy

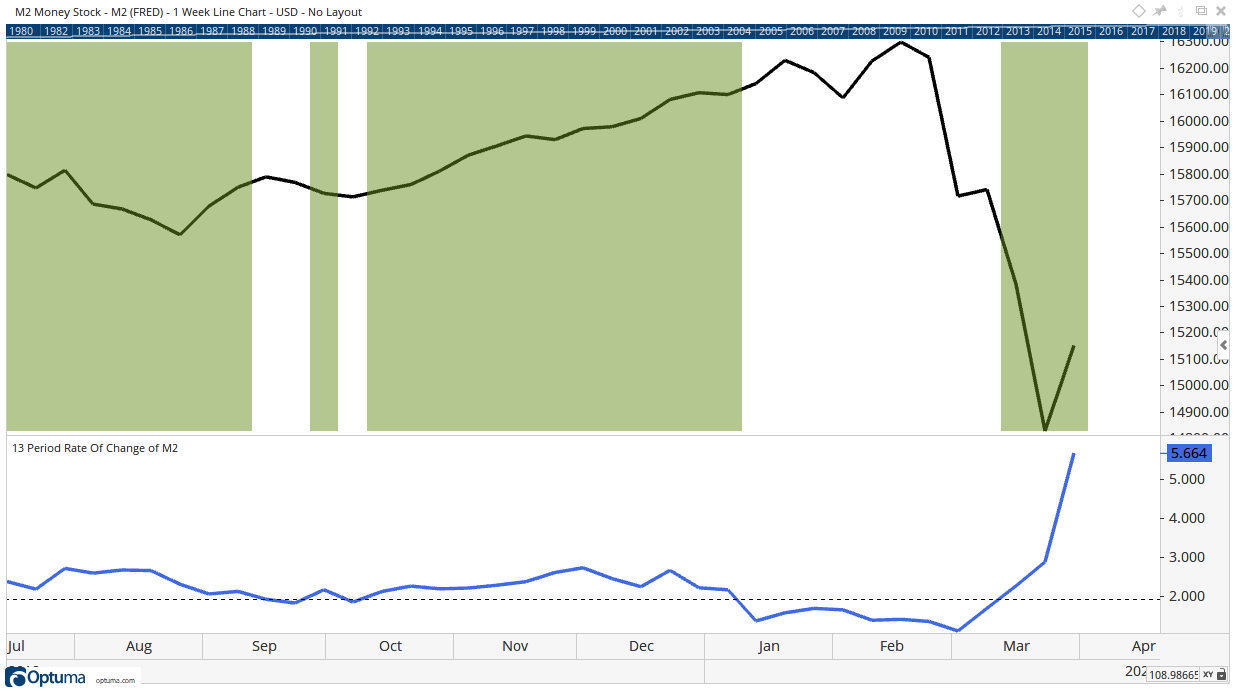

The Fed controls a $16.3 trillion pile of cash. This changes weekly and small adjustments to Fed policy can trigger major market moves.

When the Fed adds cash to the system, stock prices tend to go up. When the Fed reverses course and begins reducing the money supply, stock prices tend to fall.

The chart below shows the S&P 500‘s quarter-over-quarter growth in the money supply. The S&P 500 is at the top. Changes in money supply at the bottom.

Green shading shows when money supply is increasing at least 2%. The 2% level of growth is consistent with the Fed’s inflation target and tends to support both economic growth and gains in the stock market.

Money supply fell under than important 2% level in January. Then stocks plummeted.

Now the Fed realized the economy, and the strong market, weren’t strong enough to withstand the decrease in cash. So they are flooding the economy with cash and some of it will find its way into the stock market.

This will give the stock market a short-term sugar rush. Sustained gains will take more than cash from the Fed. To keep going higher, stocks will need even more money. The Fed has to pull back or risk inflation.

That makes this a tradable bounce for short-term traders. Long-term investors should use the rally to raise cash. They’ll be able to use it later.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the editor of Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Michael also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru