“AI” is the buzzword of 2023.

I don’t think I’ve gone a day this year without reading about, talking about or even using artificial intelligence technology throughout my work and home life.

And companies are tapped into this buzz.

According to Insider, four of the Big Tech behemoths (Meta, Amazon, Microsoft and Google) mentioned AI a total of 168 times in their earnings calls last week.

And we can safely assume Microsoft’s multiyear, multibillion-dollar deal with OpenAI, the developer behind the popular ChatGPT AI bot, won’t be the last we’ll see as this innovative technology develops.

When a mega trend like AI comes along, we as investors want to know the best stocks to buy. We want to buy the next Apple, Amazon or Google — but that’s easier said than done.

So many companies are trying to tap into this market … some higher quality than others. Slapping “AI” on the end of your company name is en vogue, but we all remember what happened to internet companies that tried to same tactic with “.com” in the late ‘90s…

Luckily, here at Money & Markets, we have a tool that can do a lot of the heavy lifting and screen tickers for their investing potential: the Green Zone Power Ratings system.

This ratings system is completely free to use. And starting today, in a brand-new feature you can expect every Friday, I want to show you how easy it is to use it in your own investing journey.

And there’s no better place than to start with AI stocks, the buzziest segment of the market this year.

My Process (and Yours Too!)

Before we get started, there’s something you should know about me…

I have a solid knowledge base of the economy and how the stock market works, but I am nowhere near the same level of expertise as Adam, Matt or Mike. That’s why I work mostly behind the scenes making their essays and other content shine.

But the beauty of Adam’s Green Zone Power Ratings system is that anyone can use it, even those who aren’t financial experts.

If you’re curious about a stock and want to see if it’s worth buying, it’s the perfect place to start.

Want to know how I built a watchlist of AI stocks in five minutes?

I started by Googling “AI stocks” … and then plugging tickers into our search bar at www.MoneyandMarkets.com. It looks like this in the upper-right corner of the homepage:

In a matter of minutes, I had an initial impression of a handful of companies that are innovating within the AI space.

Go ahead and try it yourself! And feel free to email us at Feedback@MoneyandMarkets.com with what you find or any questions regarding the ratings system.

If you need to know what each level of the system means, here’s a quick breakdown of how each rating category is expected to perform over the next 12 months:

- Strong Bullish (81 to 100): Expected to outperform the market by 3X.

- Bullish (61 to 80): Expected to outperform the market by 2X.

- Neutral (41 to 60): Expected to perform in line with the market.

- Bearish (21 to 40): Expected to underperform the market.

- High-Risk (0 to 20): Expected to significantly underperform the market.

Now, let’s get into what I found…

2 AI Stock Blue Chips

Since ChatGPT burst onto the scene in November 2022, it’s become synonymous with AI. By January, 100 million people were using the software every month.

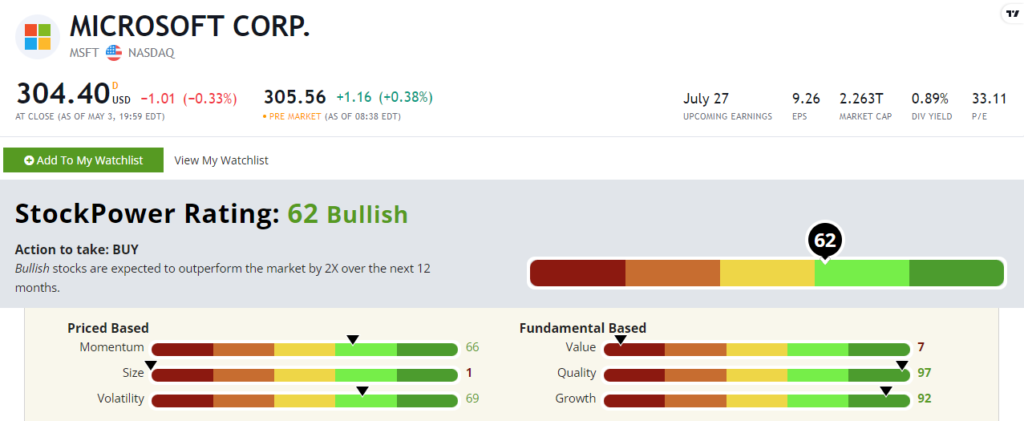

With that in mind, we almost have to start with Microsoft Corp. (Nasdaq: MSFT) since it landed that multibillion-dollar deal with OpenAI earlier this year.

Of course, Microsoft is not a pure AI stock play. It’s an established leader in the software and cloud computing industries, as well.

But looking at its Green Zone Power Ratings, that may be a strength.

MSFT scores a “Bullish” 62 out of 100, with strong scores on quality (97) and growth (92). It does get dinged on value and size, being a massive $2.2 trillion tech company that investors have not been shy about bidding up.

I almost see MSFT as an AI blue-chip company. Its established cloud computing and software businesses are a strong moat, allowing it to continue funding AI innovation. Right now, the ratings system flags Microsoft as a Buy.

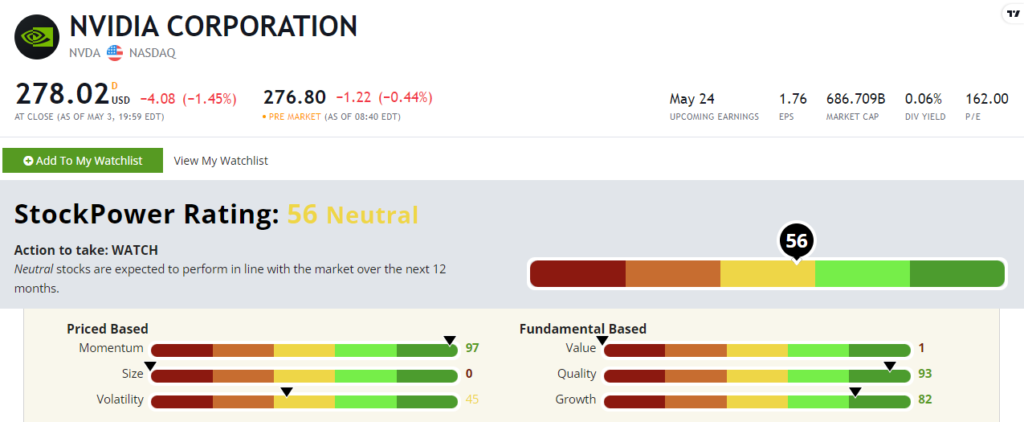

Keeping in the same vein of AI as a side business, I also looked into NVIDIA Corp. (Nasdaq: NVDA).

NVIDIA’s role in the AI mega trend is mostly on the hardware side. It develops physical computer chips that are powerful enough to allow AI programs like ChatGPT to communicate with users.

As for its Green Zone Power Ratings? It scores a respectable 56 out of 100, putting it on the higher side of the “Neutral” scale.

NVDA looks a lot like MSFT, and that makes sense given these are two of the biggest tech companies around.

I do want to highlight NVDA’s momentum score of 97. It has gained 35% over the last 12 months, which is fantastic considering the broader Nasdaq Index has lost 7% over that same time.

However, also note that the ratings system flags NVDA as just a Watch, for now. A neutral rating means we should expect it to track the market in the next 12 months.

Now let’s look at the other side of the coin … with a popular AI stock that the system says is too risky to buy now.

Avoid 1 AI Stock — for Now

With AI being such a new technology, it’s going to take time to realize its true potential. And a lot of companies are going to do their best to make themselves known within the industry.

Trying to pick which companies are actually going to succeed at these early stages is tough. But our system can at least give some guidance on what the next year might be like as an investor.

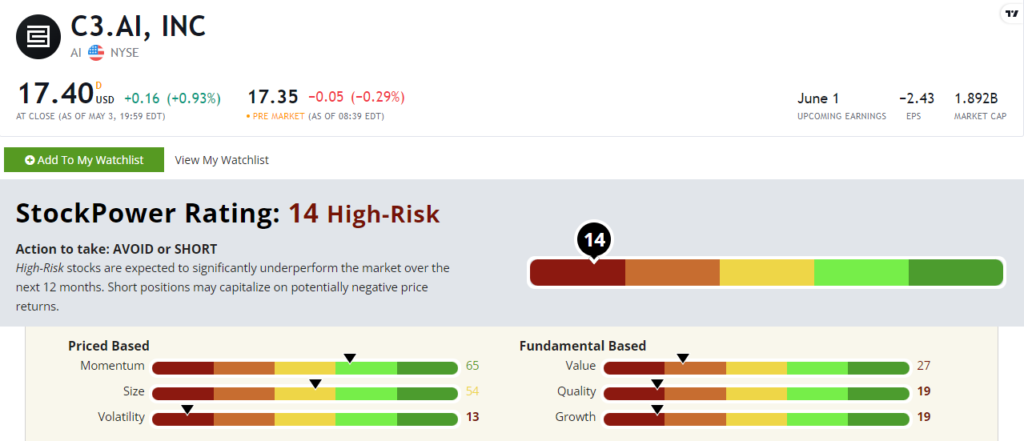

Here’s what Green Zone Power Ratings says about C3.ai Inc. (NYSE: AI).

C3.ai is an enterprise AI platform with over 40 applications for businesses and global enterprises across a wide range of industries (manufacturing, financial services, oil and gas, etc.).

I can see the future potential for this small-cap company. It has landed some contracts with some massive establishments including Shell, Koch and even the U.S. Air Force.

But our system shows there is a lot of risk that comes with buying shares of this AI stock right now. It scores a 14 out of 100 overall, and its 13 score on volatility means its stock price is more volatile than all but 13% of more than 6,000 stocks we rate.

I would definitely keep an eye on C3.ai though. I would not be shocked to see its overall score improve as the AI mega trend continues.

The Common Factor: Momentum

You’ll notice that all three of the AI stocks I featured today have good to great momentum.

Momentum is an important factor. Stocks that are moving faster than the overall trend deserve any investor’s attention.

But as Adam noted earlier this week, the stocks set to outperform in a huge way over the next year have more than that.

Momentum is a great place to start. But when you see a stock with strong momentum, in addition to the other five factors our system tracks? That’s a recipe for a can’t-miss investment.

Here’s why I bring this up…

Adam’s about to close the door on a chance to invest in a small handful of stocks trading for less than $5 right now.

Stocks that he believes are set to gain 500% or more over the next year.

While none of these are AI stocks, they are solid companies with incredible potential. And all of them are involved in other major mega trends on our radar.

Click here to see how you can gain access to these recommendations…

Until next time,

Chad Stone

Managing Editor, Money & Markets