I’ve had a lifelong dream of being a pilot.

Not one of those jumbo jet pilots, but something much smaller — a turbo prop plane, for instance.

The problem is the cost.

Not just the cost of a license, but fuel, recertification, buying a plane and … above all else … maintenance.

A study by risk-data firm Oliver Wyman breaks down the cost of maintenance performed while an aircraft is still operational.

You can see in the chart above that the firm projects the global market size will increase in value by 62.7% in the next decade.

Today’s Power Stock is one of the world’s largest aircraft maintenance providers: AAR Corp. (NYSE: AIR).

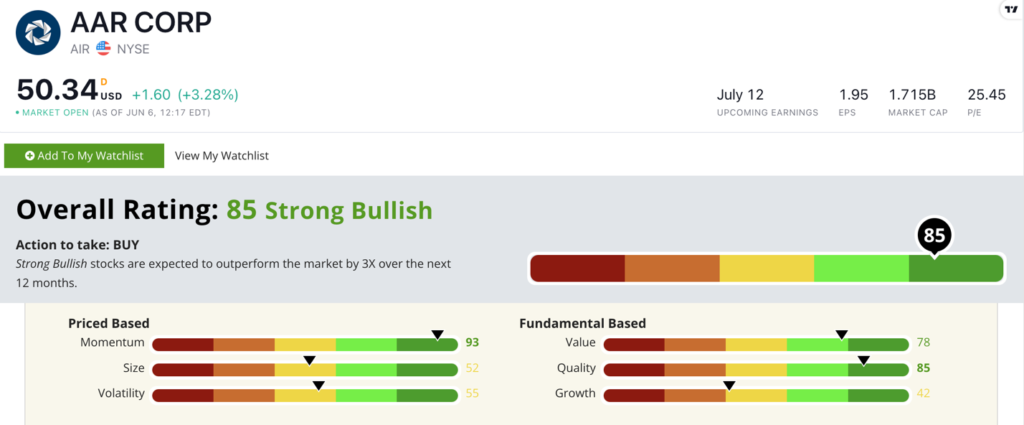

AIR Stock Power Ratings in June 2022.

AIR provides products and services to the worldwide commercial, government and defense aviation industries.

It offers aftermarket support and services. This includes selling and leasing repaired engines and other parts.

AAR Corp. stock scores a “Strong Bullish” 85 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

AIR Stock: Strong Quality + Maximum Momentum

After a closer look at AIR, here’s what caught my eye:

- In its fiscal year 2021, AIR reported operating income of $85.2 million — a 106% increase from 2020!

- Last year, the company earned the Military Friendly® Employer designation for its support of military programs and employees.

AIR is a terrific quality stock, according to our Stock Power Ratings.

Its 85 rating on that metric comes from a return on equity of 7.1% and a strong gross margin of 18.7%.

This stock shines with its strong momentum:

In November 2021, AIR stock dropped 19%.

After hitting that low, it mounted a serious rally and jumped up 58% — touching higher highs and higher lows along the way.

AIR stock shows the “maximum momentum” we love to see.

AAR Corp. stock scores an 85 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

The aircraft maintenance market is poised to double by 2032, putting AIR in an ideal position to grab a massive slice of those gains.

Its staunch support of our military and its missions around the world is a bonus.

AIR is a strong potential investment for your portfolio!

Stay Tuned: Chemicals Stock With Promise

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a promising “Strong Bullish” chemicals stock.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment about Stock Power Daily? Reach out to my team and me at Feedback@MoneyandMarkets.com.