White walls surround me in my home office.

We might take it for granted, but creating the color white is no easy task.

It takes one critical element: titanium dioxide.

We use the metal element as a white pigment in paints, plastics, sunscreen and more.

We import it to the U.S. from Japan, China and Russia. However, supply chain issues are pushing American companies to find a local source.

This chart shows how much titanium dioxide Americans use. It dropped from 2019 to 2020 because the COVID pandemic shut down thousands of U.S. manufacturers.

In 2021, production started back up, and the use of titanium dioxide rebounded.

I’m confident this rebound will continue, and consumption of this metal will exceed 2019 levels in short order.

Today’s Power Stock is one of the largest domestic producers of titanium dioxide: Kronos Worldwide Inc. (NYSE: KRO).

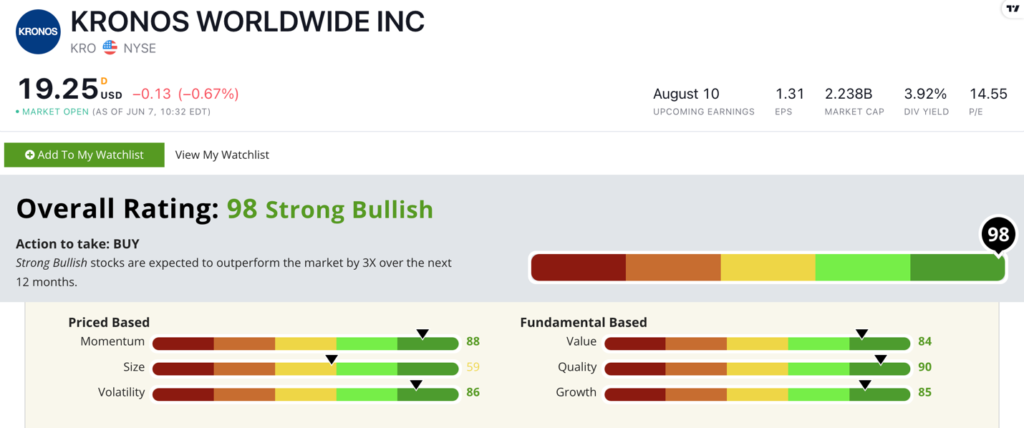

KRO Stock Power Ratings in June 2022.

Kronos’ titanium dioxide is in paint, coatings, plastics and more.

Kronos Worldwide stock scores a “Strong Bullish” 98 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

KRO Stock: Top Quality and Momentum

Kronos had an outstanding first quarter this year. Highlights include:

- KRO reported net income of $57.5 million in its most recent quarter, compared to $19.6 million in the same quarter a year ago — a 193% increase!

- Its net sales were 21% higher in the first quarter of 2022 than in first-quarter 2021.

KRO’s fundamentals are about as sound as they come!

Its returns on assets, equity and investment are all positive, while the specialty and performance chemical industry averages are all negative.

After a slight dip during the March market sell-off, KRO has rebounded 43%, as you can see in its stock chart.

That’s the “maximum momentum” we look for in stocks!

For the last 12 months, KRO is up 29.4% and has gained 10 times its industry peers thanks to its recent run.

Kronos Worldwide stock scores a 98 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

We’ve always imported titanium dioxide into the U.S., but recent supply chain issues are moving companies to find more local sources.

That points to more solid growth for Kronos Worldwide Inc.

Bonus: KRO’s forward dividend yield of 3.9% means the company pays shareholders $0.76 per share, per year to own the stock!

Stay Tuned: Strong Bullish Commercial Vehicles Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify.

Stay tuned for the next issue, where I’ll share all the details on a top vehicle stock to buy.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment about Stock Power Daily? Reach out to Feedback@MoneyandMarkets.com — my team and I would love to hear from you!