In a bear market, even the big dogs lose money.

For example, take Berkshire Hathaway Inc. (NYSE: BRK.B).

Following President Donald Trump’s announcement of a travel ban from Europe to the U.S., airline stocks sped up their already rapid decline — shedding even more from their already-slumping share prices.

The International Air Transport Association said the travel ban will ground 550 flights from Europe to the U.S. and cost more than $10 billion in passenger revenue.

#US #TravelBan will ground 550 flights, 125,000 pax per day & increase the extreme financial & operational pressures the industry is facing.

One #airline has gone under, others are being pushed in the same direction. Our industry needs support. #Covid_19 https://t.co/WMfIytRzga pic.twitter.com/Lt2LAdqzxx

— IATA (@IATA) March 12, 2020

How That Impacts Berkshire Hathaway

Delta Air Lines Inc. (NYSE: DAL), United Airlines Holdings Inc. (Nasdaq: UAL), American Airlines Group Inc. (Nasdaq: AAL) and Southwest Airlines Co. (NYSE: LUV) are among Berkshire’s largest holdings.

According to CNBC’s portfolio tracker, Berkshire Hathaway holds 11.2% of Delta, 10.4% of Southwest, 10% of American and 8.8% of United at the end of December 2019.

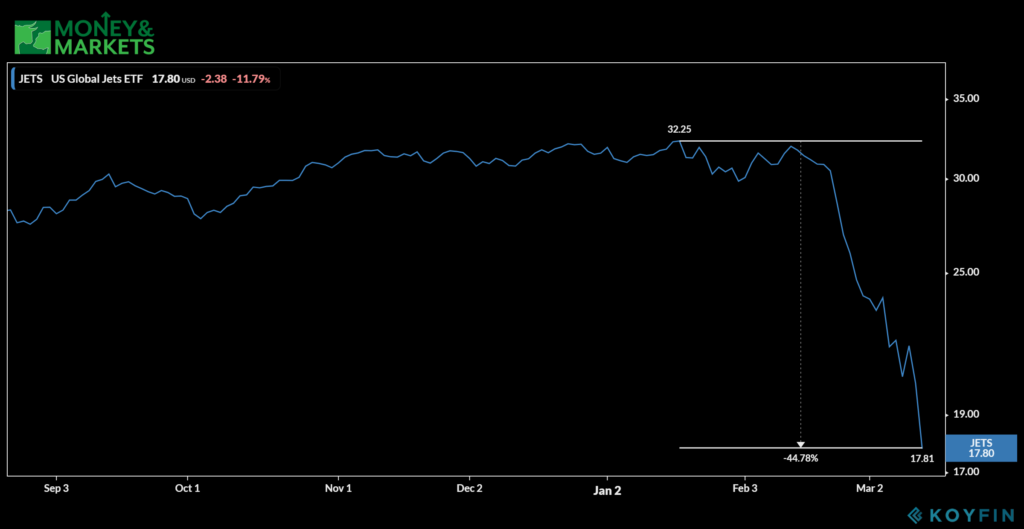

The U.S. Global Jets EFT (NYSEARCA: JETS) — which exclusively tracks U.S.-based airline industry stocks — has dropped more than 44% since reaching a high on Jan. 17, 2020.

All told, the airline shares owned by Berkshire Hathaway were worth about $10 billion at the time, according to GuruFocus.com.

Since the outbreak of the coronavirus, or COVID-19, airline stocks have nosedived. American Airlines’ shares have dropped nearly 50% while United has also nearly halved its share price. Delta is down more than 30%.

Due to the large stake held by Berkshire Hathaway in each of those companies, the stock dips translate into losses to the tune of $3 billion — or about a third of the value of the company’s holdings.

The Delta Issue

It hasn’t stopped the investing titan from putting even more money into airline stocks. In February, Berkshire Hathaway dropped another $45 million into Delta alone.

That could cause big issues for the Berkshire portfolio, according to Banyan Hill Publishing Chartered Market Technician and Pure Income Editor Chad Shoop.

“It’s important to have historical perspective and regarding Delta, it was under $4 a share in March 2009, so it can go way lower,” Shoop said. “It’s always the hard thing with buying the dip — you don’t know where the bottom is.”

That translates to even larger losses for one of the most-watched portfolios on the market.

However, an oil price war between Saudi Arabia and Russia could benefit the airline industry as companies will see dramatically lower fuel expenses, so long as the oil market continues to tank.

Trump has also vowed to help struggling cruise lines and airlines, but the details on what that assistance might be has not been announced.