If you want a textbook example of why short selling can be wildly dangerous, take a look at AMC Entertainment Holdings’ (NYSE: AMC) stock chart.

AMC Soars 71% — and Crashes Again

Source: Yahoo Finance.

Last Monday, the shares opened 71% higher on the news that Pfizer Inc.’s (NYSE: PFE) COVID-19 vaccine was highly effective in trials.

Yes, you read that right. The shares closed the previous Friday at $2.49 and opened last Monday at $4.27, popping instantly by 71%. If you were short the stock — betting on further declines — you might have gone into full cardiac arrest.

In the days that followed, shares have drifted lower.

It seems that the hope of a quick end to the pandemic has been replaced by the cold reality that, even in a best-case scenario, we’re still looking at months of high infections and continued social distancing. By the time the world reopens in earnest, there is the real possibility that people’s habits have changed permanently.

At any rate, let’s take a closer look at AMC’s stock.

As a movie theater chain, the company has been crushed by the COVID-19 pandemic. Even in places where theaters are open with little restrictions, there’s nothing to play in them. Studios have been reluctant to produce or release much under these conditions.

Sometimes, battered sectors like these can produce fantastic investment opportunities for bargain hunters. Other times, they produce value traps that perpetually get cheaper before finally blowing up.

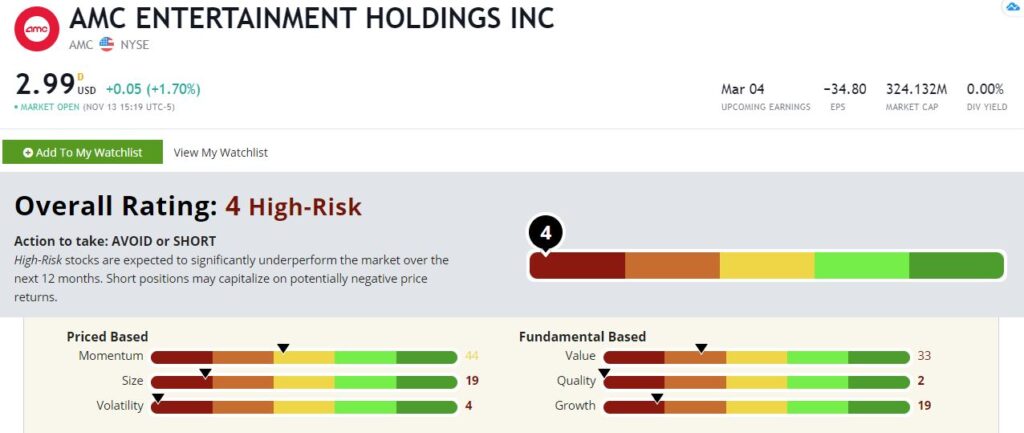

To see which scenario is more likely, let’s run AMC’s stock through Adam O’Dell’s Green Zone Ratings system.

AMC Stock Rating

At first glance … it’s bad. AMC rates a 4 out of 100, meaning that fully 96% of the stocks in our universe rate higher. Let’s see if AMC’s stock has any redeeming qualities.

AMC’s Green Zone Rating on November 13, 2020.

Momentum — Given how badly beaten up this stock is, AMC rates the highest on momentum. But don’t get too excited. With a momentum rating of 44, AMC is still in the bottom half of all companies. When AMC’s stock moves, it really moves. We saw that last week when it popped on the vaccine news. But given how sensitive to virus headlines this stock can be, it pays to be careful.

Value — AMC is down nearly 70% from its 52-week highs, so you might expect it to rate highly based on value. Well … it doesn’t at a 33. AMC’s fundamentals have collapsed even faster than its share price. We measure value with a variety of metrics, including the price-to-earnings ratio and the price-to-sales ratio. Earnings and sales have both collapsed, so shares are not remotely cheap by these metrics.

Size — From here, it just gets worse. AMC rates at a 19 on size. Despite its woes, AMC is still not small enough to really benefit from the small-cap effect. All else equal, small caps tend to outperform large caps over time as they are discovered by new investors. AMC was a mid- to large-cap stock that effectively got chopped down to a small-cap stock due to COVID-19. That’s a lot different than being an up-and-coming company just catching the eye of Wall Street.

Growth — AMC also rates at a 19 on growth. Even before the pandemic upended the world, movie theaters were struggling due to competition from larger TVs at home and a glut of high-quality content from Netflix and other streaming services. Furthermore, the format itself has gotten somewhat stale. Over the past several years, new releases have been dominated by comic book sequels and reboots of 1980s movies. That’s not AMC’s fault, of course. But the success of the theater chain, and the growth of AMC’s stock, ultimately depends on the success of the movies.

Volatility — Over time, low-volatility stocks tend to outperform high-volatility stocks. And here, the news for AMC isn’t good. AMC rates a 4 on volatility, meaning that it is more volatile than 96% of the stocks in our universe.

Quality — We measure quality primarily by balance sheet strength and profitability. AMC has neither. It’s a highly-indebted company that is bleeding losses due to the pandemic. AMC’s stock rates a 2 here.

Bottom line: Our Green Zone Ratings system suggests you should run away screaming from this stock. It is absolutely unsuitable as a long-term holding.

But, I should be clear on one point here. Any company that rises 71% in one day is a company you can trade to make a fortune. Of course, you could also lose a fortune in a stock like this. So, by all means, if you’re feeling lucky, have fun trading AMC and other COVID-19-sensitive stocks. But do not make this a part of your long-term retirement portfolio.

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.