Back in the early 1980s, my father bought our first family home while mortgage rates were near 20%.

Those rates seem crazy to younger buyers today, but he was happy to do it.

After all, inflation had steadily been on the rise for years, so it was just the “norm,” the market rate everyone had grown accustomed to.

And he was eager to lock in his own slice of the American Dream — before mortgage rates rose any higher.

Rates eventually decreased, but only gradually.

Even a decade later, during the 1990s, homebuyers happily signed mortgages at nearly 10%.

So for millions of experienced homebuyers (perhaps including yourself), today’s 8% rates might not seem like such a major hurdle.

But it’s important to remember — homes are far more expensive than they used to be. So every extra percentage point can cost a fortune for less affluent buyers.

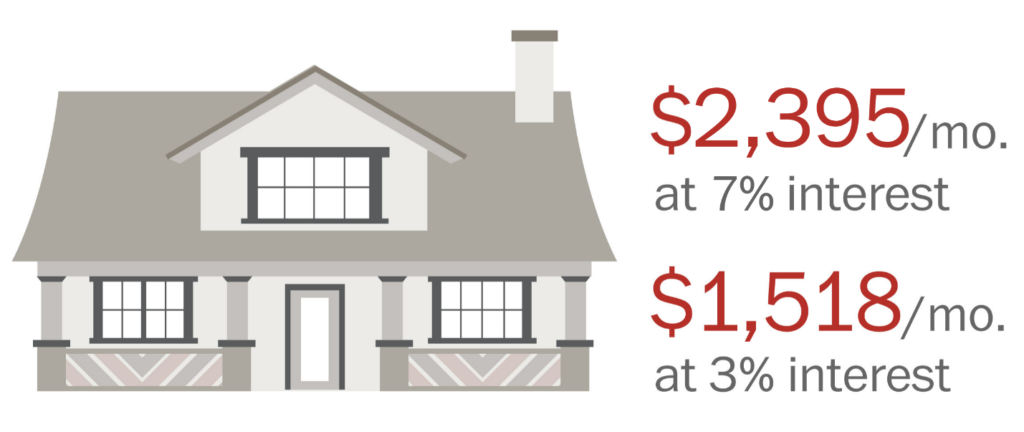

For example, if you took out a mortgage on an average-priced home at 3% just a few years ago, your monthly payment would’ve been around $1,500.

But the same home at 7% would cost nearly $2,400 per month. So you’re paying 50% more per month!

That’s a proposition many younger and first-time homebuyers simply can’t afford.

On the supply side … any potential sellers who mortgaged their home at 3% a few years ago are hesitant to move, only to pay a rate that’s at least twice as high.

It makes zero financial sense for them to sell … so they aren’t.

I’m in that camp as well — I got a 3% mortgage in 2020, and now that my family is getting bigger, we’re eyeing bigger houses … but bemoaning the higher rate we’d have to pay if we mortgage it!

All this means that home sales just aren’t happening in the volume they were just a couple years ago. In fact, existing home sales dropped to a 13-year low in September.

More recently, though, things have started to take a turn for the better.

The latest Consumer Price Index report indicated that inflation is now leveling out year over year.

That triggered a rally in stocks and bonds — which, in turn, led to 30-year mortgage rates plummeting faster than they have in 16 months.

When those mortgage rates sink back down to more affordable levels, we will see the beginning of the biggest homebuying boom in American history.

Here’s why…

Short Supply Meets Infinite Demand

When I recommended a top homebuilder stock to my Green Zone Fortunes subscribers earlier this year, I cited simple supply and demand factors that would drive long-term growth.

To recap those factors here — the average age for household formation is 33.

That lines up perfectly with the millennial generation, which is anyone born between 1981 and 1996.

(The oldest millennials — my crowd — are currently 42 years old, with the median at about 34.)

This generation of 72 million people makes up over 20% of the U.S. population.

We can also bring Gen Z into the equation here. Born between 1997 and 2012, they’re much younger (the oldest is about 26) but are just a few years shy of their own homebuying season.

They’re also not far behind millennials in terms of head count — they make up another 20% of the population, at 69.5 million.

That adds up to 140 million red-blooded Americans ready to buy a new home.

But we’re not finished, are we?

Because we also have to factor in some of the sharpest homebuyers of all. The baby boomers.

After sending the last of their kids off to college, many of these baby boomers will be looking to downsize from their grand family homes.

According to experts from the Maxwell School of Citizenship and Public Affairs at Syracuse University, some 4 million baby boomers will be entering the market each year for the next decade.

Many will be hoping to cash out some home equity to boost their retirement funds.

And they’ve got a good bit more experience than younger generations when it comes to buying a home.

So in other words, virtually every American who’s capable of buying a home will want to buy a home at some point over the next few years.

The real question is — from whom will they be buying?

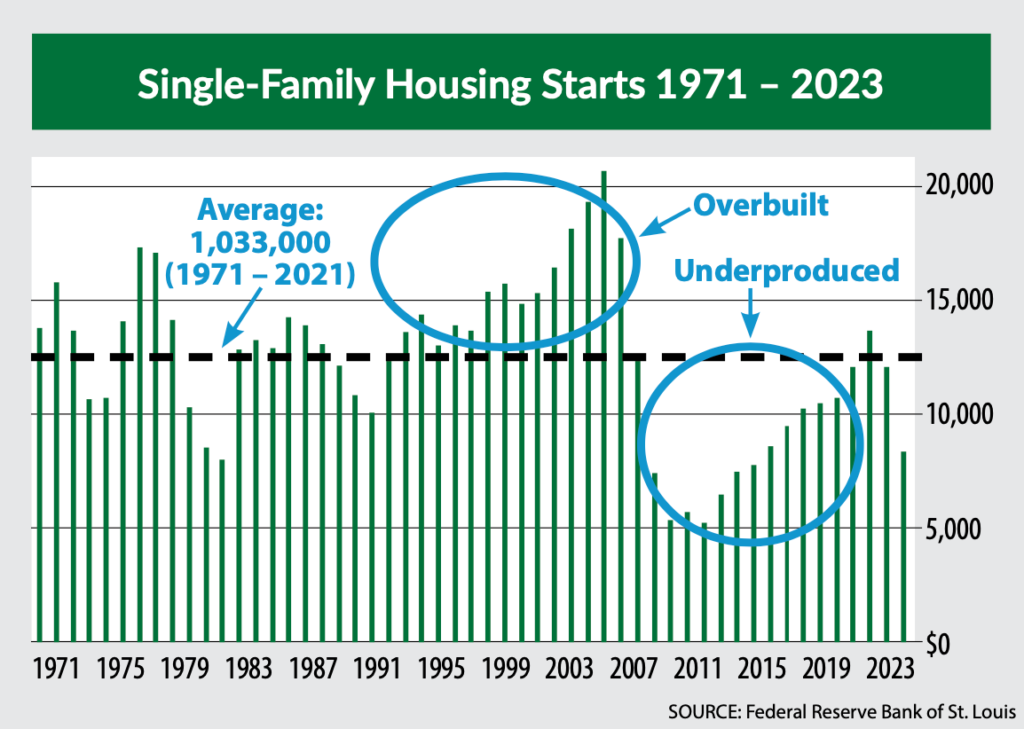

Sellers will be hesitant to enter the market at negative interest rates, and new housing is in short supply:

Fortunately, to quote John Maynard Keynes: “Demand creates its own supply.”

With demand off the charts, home prices are set to rise.

And that’s a tremendous tailwind for homebuilding stocks — with Goldman Sachs recently upgrading the sector to outperform.

Homebuilders will inevitably ramp up, helping supply eventually meet demand while making a fortune along the way.

Already Picking up Momentum

Homebuilder stocks have also started showing up in my Infinite Momentum Alert portfolio.

Infinite Momentum Alert is my newest service — where I combine the Green Zone Power Ratings system with artificial intelligence analysis to recommend the top 10 stocks for each month of the year.

Every month, the system recommends the 10 stocks with the highest momentum and some of the strongest earning potential, from a universe of over 8,000 different securities.

I engineered the system based on over a decade of research and experience … and now it automatically assembles our portfolio each month.

During its most recent rebalance, the system recommended not one but two homebuilder stocks. And as I write, they’re both up double digits — one +24%, the other +36%.

This confirms what we’re seeing — the sector is definitely looking strong and now is a great time to invest.

(If you’d like to know more about the Infinite Momentum Alert system and how it’s beaten the S&P 500 300-to-1 over the long run, you can get the full story here.)

To good profits,

Adam O’Dell

Chief Investment Strategist