Apple (Nasdaq: AAPL) creates new markets.

The iPhone is the best example. Nothing similar existed before it. We could say the same for the iPad and the iPod.

Even Apple’s computers broke new ground with capabilities users didn’t even know they wanted.

The App Store was another disruptive business development. Apple created the universe of apps to make its hardware even more useful.

Apple Pay was groundbreaking as well. When introducing it in 2014, CEO Tim Cook described the magnetic-stripe card payment process as “broken” for its reliance on plastic cards. He expressed it was an “outdated and vulnerable magnetic interface” with “exposed numbers” and insecure “security codes.”

Given the company’s history of innovation, traders like us need to consider Apple’s recent announcement that it’s entering the “buy now, pay later” (BNPL) business via the addition of Apple Pay Later in its Wallet app.

New Wallet Option: Apple Pay Later

The Wall Street Journal noted: “The market for such services has exploded in recent years.”

According to Apple’s press release:

Apple Pay Later provides users in the US with a seamless and secure way to split the cost of an Apple Pay purchase into four equal payments spread over six weeks, with zero interest and no fees of any kind … Apple Pay Later is available wherever Apple Pay is accepted online or in-app, using the Mastercard network.

Affirm Holdings Inc. (Nasdaq: AFRM) and other large players in the sector offer the same terms. Investors are questioning how profitable the business is.

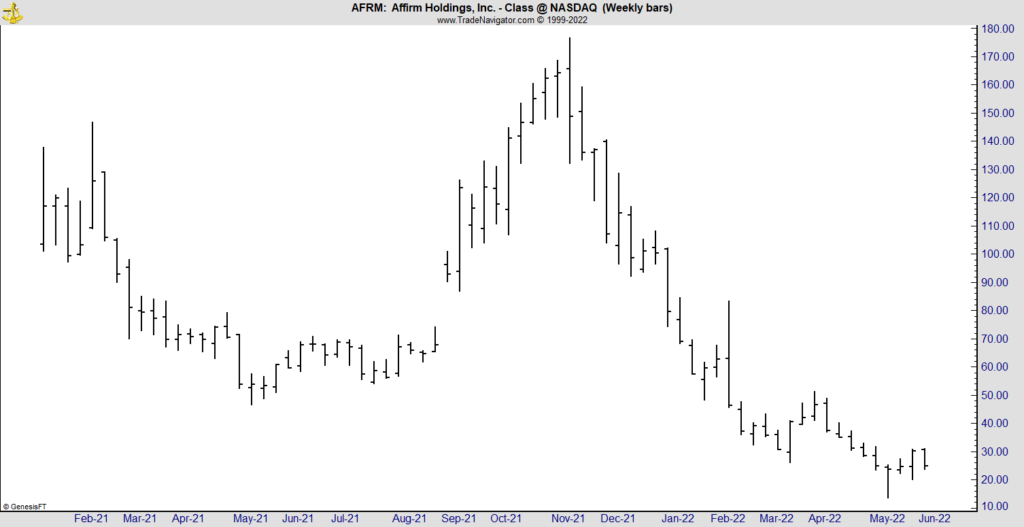

Shares of AFRM are about 85% below their high, as you can see:

Affirm Holdings Inc. Shares — January 2021 to Present

Created in June 2022.

Apple may plan to displace companies in the industry. This is bearish for AFRM and other stocks.

This raises questions about how beneficial these plans are for consumers.

CNBC found:

Now some consumers are realizing this type of credit could be a risky way to take on debt. And, unlike credit cards, BNPL can make it tough to get a handle on your credit outlook. BNPL companies generally don’t report to the credit-scoring companies when consumers use these loans. That makes it a challenge for a lender to know how many loans a consumer has outstanding.

Bottom line: Regulators are looking into the industry.

Overall, this is an unusual move for Apple. Even though AFRM is down 85%, we could see much more downside.

P.S. My new indicator find ways to capitalize when investors get greedy during this current down market. To find out how, click here to watch my “Greed Gauge Revealed” presentation now.

In this brand-new presentation, I show you how I use my latest indicator to watch every stock in the S&P 500 to see where investors are getting greedy at any moment.

It’s a strategy that has beaten the S&P 500 3-to-1 since 2000 through my extensive backtesting.

This system has found winning trades in 253 of the last 256 months even!

To find out how I’ll use my Greed Gauge to find more opportunities for you, click here to watch my new presentation now.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.